Walking down Wall Street in a sharp gray suit once symbolized success. Banks used to be the top choice for graduates, but today the American banking sector has found itself in a talent pickle.

According to KornFerry’s recent Global Talent Crunch report, the financial and business services are industries that will have the largest shortfall of workers by 2030. There will be a shortage of 10.7 million workers in the financial and business services sector, a number that is more than 45 times the size of its global workforce.

2030 is still some time away but according to Forbes, just in the US itself, 54% are already experiencing a turnover of skilled workers, the highest in over a decade.

But why is this happening? Is it because baby boomers are now retiring? Is it the environment within banks? Or is it because new emerging markets like Fintech offer better flexibility packages?

Whatever it is, it does not look good. Imagine losing a top executive and being unable to replace them at a certain time. How will that impact a company’s advancement path?

The Emerging Signs of an “Existential Crisis”

The talent crunch is beginning to take its toll on the US banking industry, but what really happened? What does it mean for employers who are used to having their pick of the litter?

Increased demand in emerging markets

“Strict rules are changing how financial institutions do business” – Edmund Parker and Mayank Gupta of the Financial Times.

The financial meltdown on Wall Street in 2008 instilled skepticism among consumers, resulting in new regulations for financial institutions.

Before the 2008 Wall Street chaos, the banking industry’s focus was on making long-term loans and funding them with short-term deposits. This is broadly understood as “borrowing short and lending long.” The mortgages were bought by financial firms, who bundled them and sold them to investors as “mortgage-backed securities.” But when the mortgage defaults started going up, the last purchasers were left holding fiat money.

Due to the lack of transparency, the traditional role of banks as an “intermediary” has been undermined. Deposits and profitability of traditional banking activities such as business lending have declined in recent years.

The Wall Street meltdown’s conclusions on the causes of bank insolvency, illiquidity, and systemic risk have influenced bank regulation reforms today. As a result, banks have increasingly turned to new and nontraditional financial activities to maintain their position as financial intermediaries and reduce the likelihood of similar episodes in the future.

Today, how we do things, from payments and investment advice to regulatory practices, is being revolutionized by new innovative startups. These startups aimed to enhance transparency by instituting reporting standards for loan origination data, portfolio performance, and loan visibility in mortgage backed securities.

With the rise of FinTech, banks find themselves competing not just from outside industries but also within their walls. As more talent questions whether working long hours for minimal paychecks is worth it—in light of rising regulation and curtailed profits—many professionals at all levels are exploring other career options.

Many banking professionals are handing in their resignations and making the leap into the FinTech sector, even if it sometimes means taking pay cuts for equity shares.

Taking the entrepreneur route

The banking industry job market is getting tight, and it’s not just because of the baby boomers. Heidrick & Struggles found nearly 75% left their previous jobs to start a new company, which reflects how talent is willing to trade security for experimentation in an emerging market like cryptocurrencies.

For instance, the former head of commodities and ex-CFO at JPMorgan Chase, Blythe Masters, recently took on an advisory role with Digital Asset Holdings to investigate new ways blockchain can provide utility for society.

The FinTech industry has drawn talented people from all backgrounds. The theme now is to seek better-fitting roles. Executives value flexibility and want to work when and where they want, which fits with startups’ nontraditional schedules.

Minding the Gap: The Solutions US Banks are Trying To Deploy

As the war for talent rages on, US banks are pulling out all stops to retain top talent. They have been embracing new solutions, such as skyhigh wages, flexible work arrangements, and expedited digital transformation initiatives.

Rising wages and compensation packages

One of the most noticeable effects of the talent crunch is that it is becoming increasingly difficult for banks to find qualified workers, leading to higher wages for those who can make it. It is also causing some banks to reconsider their business models as they cannot rely on talented workers to fill all of their needs.

Rising wages have tampered Wall Street’s optimistic outlook. The Wall Street Journal reported this year that Goldman Sachs Group Inc’s payroll expenses rose by 33% to $8.1 billion in 2021, with the additional 4th quarter profit decline costing them an estimated total of 4.5 billion dollars—or almost half their entire net income from just three quarters.

JPMorgan Chase also spent over 3 billion more than they generated last time, leading directly into another erosion event for Q4 revenues.

Wage inflation is just part of the growing concern. US financial giants are competing against blockchain and cryptocurrency companies that offer their solutions but also attract experienced professionals by offering better wages or more opportunities than traditional finance.

Breaking down traditional banking hierarchies

The financial sector is going through a major shake-up with the rapid growth of FinTech..

Traditional employment models now seem excessively rigid to a new generation of savvy professionals, especially in light of changing work preferences.

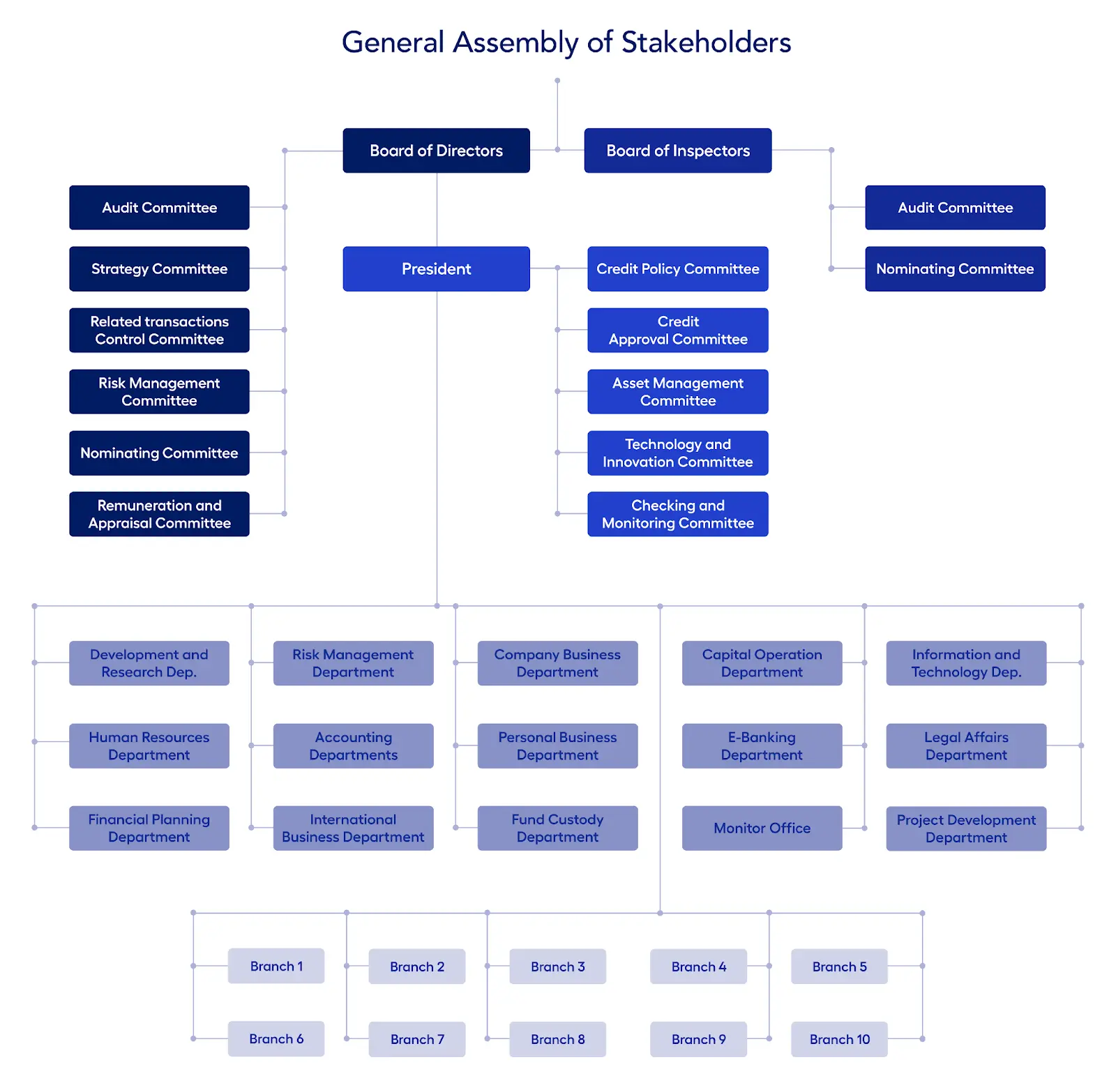

The good news is that the traditional bank employment model (as shown below) is slowly fading away.

Today, banks are moving to a less centralized model based on two primary factors—geography and information. First, geography is irrelevant today since most customers bank online and by phone. Second, digital data can be accessed and shared immediately by any employee who requires it.

These two trends, when combined, indicate that banks no longer require a rigid structure with information and responsibility contained within divisional silos. Action teams, on the other hand, can be formed and reformed as needed.

Turning to the hidden workforce

A hidden workforce is a group of people, which has (or could learn) skills in demand, and is often overlooked by employers.

As it gets tougher to find the right people, more and more companies are slowly dropping job requirements like college degrees and a certain number of years of experience and are also starting to look for talent in places that aren’t typical, hence, turning to the hidden workforce.

According to Accenture and Harvard Business School’s Project on Managing the Future of Work, middle-market banks are struggling to fill the gaps left by retiring employees working with mainframes for years. At the same time, these banks are competing for people skilled in new technologies like cloud, agile, and packaged platform solutions. A solution to this dilemma that many leaders are overlooking is the hidden worker phenomenon.

But why are they often overlooked? This can be because they lack traditional qualifications, have gaps in their employment, come from disadvantaged backgrounds, or need flexible arrangements to care for kids or aging parents.

Hidden workers are a source of untapped talent in banking, and their presence can help a bank’s model by making the workplace more welcoming and open to different points of view. What matters now is how quickly a person can learn and how adaptable they are to changing market needs.

Different Places; Different People

The opportunities for big banks are everywhere, but the talent is not. If this continues, the financial and business services sectors will hit a deep rut.

The question now is, is recruitment the root issue? Or is it on how to improve attracting and retaining the talent required to propel their organizations forward?

Borderless hiring is here

Today’s work is remote and hybrid. The pandemic forced many organizations to transition from being rooted in offices to jumping on a zoom call to conduct meetings.

Businesses have used technology to provide viable alternatives for communication, collaboration, and services. Companies are no longer limited by the office walls, and businesses can go borderless as well when it comes to hiring.

Borderless hiring refers to the act of acquiring talent globally without geographical constraints. Yes, you can hire anyone, from anywhere in the world, without needing to be present in a physical office.

In the case of the US banking industry, one of the countries they can tap into is India. According to the same KornFerry report, India is expected to have a 1.1 Million surplus of financial and business service talent by 2030. India could be a boon to the United States’ talent shortage. The country can give the United States access to new perspectives, which can help the industry adapt and innovate faster.

When you can hire people from anywhere in the world, finding people with specific skills that may not be available locally becomes much more manageable. This is especially true in a global talent pool where you can easily find someone who has experience working on projects similar to yours.

The future of work is not just remote anymore, it’s now borderless hiring. You need to take advantage and embrace a global workforce before it becomes too late.