Your quick guide on talent and labor compliance norms in Bhutan

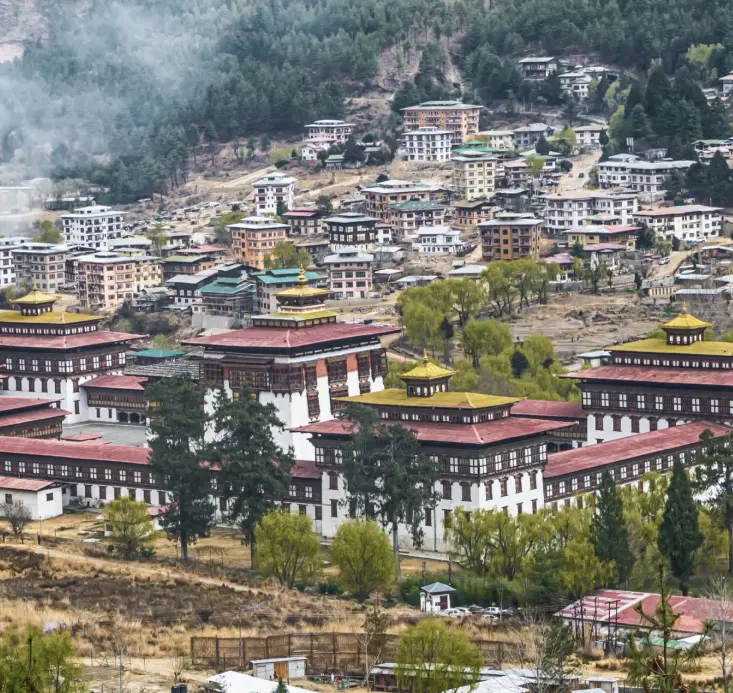

Capital

Thimphu

Currency

Bhutanese Ngultrum (BTN)

Languages

Nepali, Dzongkha, Lepcha, Tshangla

Payroll Frequency

Monthly

GDP per Capita

$3,662.70

Employer Tax

5%

Talent Overview

Bhutan is one of the least developed countries in the world with a freedom score of 59.3. Over 60% of its population depends on agriculture and animal husbandry making up 50% of its GDP. Its close trade relations with India assist them through monetary and trade exceptions. It had a downturn in GDP growth sliding to -10.1% in 2020. Bhutan largely protects its culture hence its apprehension toward progressive modernization.

Major economic hubs:

Thimphu, Phuntsholing

Skills in demand:

Construction and Trade Professionals, Information and Communications Technology Professionals, Tourism Professionals

Local Universities

The top local universities in Bhutan are as follows:

Local: 1

World : 5481

Local: 2

World : 15669

Local: 3

World : 8648

Local: 4

World : 16763

Local: 5

World : 17927

Salary Data

The monthly salary in Bhutan for some job title are:

| Job Title | Average Monthly Salary (BTN) | Average Monthly Salary (USD) |

| Developer / Programmer | 37,900 | 460 |

| Network Engineers | 33,500 | 407 |

| Lawyers | 72,100 | 876 |

| General Manager | 64,700 | 786 |

| Chief Executive Officer | 83,010 | 1,008 |

| Chief Financial Officer | 74,500 | 904 |

| Information Technology Manager | 62,500 | 759 |

Talent Sourcing Tips

JobNet.com.mm, JobsInYangong, Myjobs.com.mm

102,200

Hiring employees in Bhutan is a breeze when you are knowledgeable about its employment laws, benefits, payroll, and tax systems. Know how to employ and onboard talents from Bhutan with the information below.

Written employment contracts in Bhutan are required if the contract schedule is more than one year of service. When a written contract is not met, the employer must adhere to the Labor Law of Bhutan. Contracts are generally written in Choke but as a rule, they must be understood by both parties.

| Date | Name | Type |

| 3 Jan | Winter Solstice (Nyilo) | Public Holiday |

| 12 Jan | Traditional Day of Offerings | Public Holiday |

| 10 Feb | Losar (New Year) | Public Holiday |

| 11 Feb | Losar Holiday | Public Holiday |

| 21 Feb | King’s Birthday | Public Holiday |

| 22 Feb | King’s Birthday Holiday | Public Holiday |

| 23 Feb | King’s Birthday Holiday | Public Holiday |

| 18 Apr | Death Anniversary of Zhabdrung (Zhabdrung Kuchoe) | Public Holiday |

| 2 May | Birth Anniversary of Third Druk Gyalpo | Public Holiday |

| 23 May | Buddha’s Parinirvana | Public Holiday |

| 16 Jun | Birth Anniversary of Guru Rinpoche | Public Holiday |

| 10 Jul | Buddha’s First Sermon | Public Holiday |

| 9 Sep | Thimphu Drubchoe (Thimphu only) | Municipal Holiday |

| 13 Sep | Thimphu Tshechu (Thimphu only) | Municipal Holiday |

| 14 Sep | Thimphu Tshechu (Thimphu only) | Municipal Holiday |

| 15 Sep | Thimphu Tshechu (Thimphu only) | Municipal Holiday |

| 22 Sep | Blessed Rainy Day | Public Holiday |

| 12 Oct | Dashain | Public Holiday |

| 1 Nov | King Jigme Khesar Namgyel’s Coronation | Public Holiday |

| 11 Nov | Birth Anniversary of the Fourth Druk Gyalpo/Constitution Day | Public Holiday |

| 22 Nov | Descending Day of Lord Buddha | Public Holiday |

| 17 Dec | National Day | Public Holiday |

| Type of leave | Time Period | Mandatory |

| Annual leave/Earned Leave | Minimum 18 days | Yes |

| Sick Leave | Based on requirement | Yes |

| Maternity Leave | 3 to 6 months | Yes |

Payroll

Payroll Cycle

Compensations in Bhutan are paid monthly.

Minimum Wage

The minimum wage in Bhutan is BTN 3,750 per month.

Overtime Pay

Overtime hours should not exceed 2 hours per day or 12 hours per week. A worker is paid at a minimum of their normal rate of pay or may depend on the employee-employer contract. If the employee is needed to work from 10:00 p. m. – 8:00 a. m. then the rate is 50% in addition to their normal rate.

Bonus

The 13th-month salary is mandatory in Bhutan.

Taxes

The contribution taxes are dependent on which contributions the employee is available to provide.

| Type | Contribution Rate |

| Employer | Not lower than 5% |

| Type | Contribution Rate |

| Employee | Not lower than 5% |

Income tax is levied at a progressive rate on all annual income as follows:

| Income Group (in BTN) | Taxes |

| 0 – 300,000 | 0% |

| 300,001 – 400,000 | 10% |

| 400,001 – 650,000 | 15% |

| 650,001 – 1,000,000 | 20% |

| 1,000,001 – 1,500,000 | 25% |

| 1,500,001+ | 30% |

The GST (VAT) rate in Bhutan is 7%.

Offboarding & Termination

An employer must provide an employee with at least two weeks written notice of their intention to terminate the employment of an employee. Thereafter, the employer must pay the employee two weeks wages at a regular rate.

However, federally regulated employees do not have to give their employer notice if they choose to quit.

An employer is required to provide a minimum 30 days notice period in the employment contract.

On termination of contract, employees with a minimum service of 5 years with constant contribution will receive the provident fund contributions including interest from employee and employer contribution. With less than five years of constant contribution, employees are entitled to their provident fund contributions with interest but not the employer’s contribution.

It is not stipulated in the law that requires the employer to provide a severance pay package.

Visa and Immigration

Getting a Business Visa or Work Permit in Bhutan depend on the rules and regulations of the Ministry of Foreign Affairs (MFA).

For a Business Visa, you must have documentary evidence of the business existing in the country.

For a work permit, it depends on the relevant agencies for processing but generally, you must apply for a permit from the Department of Labour and must be over 18 years of age.