As a business, you ought to know how the independent contractor tax deductions work.

In the case of employees and freelancers, tax deductions are different. Unlike employees whose taxes are deducted automatically from their monthly compensations, employers do not handle independent contractor deductions.

1099 employee tax deductions are self-handled. We mean that the independent contractors manage their taxes.

In this blog, we’ll walk you through independent contractor tax deductions in detail.

So, read on to update yourself on independent contractor deductions if you plan to hire one soon!

How do Tax Deductions Work when You’re Self-employed?

Independent contractors are self-employed, nothing less than a small business. So, the IRS considers independent contractors as a business. This means that independent contractors can deduct the most appropriate and relevant 1099 business expenses on their tax returns.

Later in the article, we have listed the top tax breaks for self-employed that you can’t miss out on. But before that, let’s have a look at the differences between tax deductions and tax credits.

Difference between Tax Deductions vs. Tax Credits

There are several differences between tax credits and tax deductions. Let’s see what they are.

Definition

A tax deduction reduces the amount of income taxes payable. In other words, tax deductions result in the lesser amount payable as income taxes. Independent contractors minus the independent contractor tax deductions from their income before calculating the taxes owed. For example, if the independent contractor is in the 10% tax bracket and the tax deduction is $4000, the deduction would reduce the taxes by $400. The higher the tax amount, the more the benefits of tax deductions.

Coming to a tax credit, it is a dollar-for-dollar reduction in the tax amount that is owed. For example, an independent contractor qualifies for a $1000 tax credit and owes $6000 as a tax amount. Then, the tax burden will be reduced to $5000.

How does each work?

Tax deductions are calculated as percentages of the income taxes owed, which reduces the amount of taxes payable. On the other hand, tax credits are directly reduced from the amount of taxes owed.

In certain cases, like earned income tax credit, it might increase the refund or provide a refund even if no taxes are owed. These are refundable tax credits. Likewise, there are non-refundable tax credits as well.

Benefits

Tax deductions offset the amount of income on which independent contractors are to pay their taxes. This includes self-employed write-off expenses like healthcare, tuition, or any other capital gains losses faced.

The main benefit of tax credits is reducing the amount paid in taxes or increase a refund. Plus, tax credits can also be claimed even if the independent contractor has no tax liability.

Forms Required

For independent contractor tax deductions, they can claim the standard deduction on Form 1040. But if independent contractors want to itemize deductions, Form 1040 and Schedule A need to be filled out.

In the case of claiming tax credits, using Form 1040 is a must. If an independent contractor is claiming earned income tax credit, it will be mandatory to fill out Schedule EIC. This form will be applicable if an independent contractor plans to list out the qualifying dependents.

Tax deductions for independent contractors

As we have already mentioned that, unlike employees, 1099 employee tax deductions are self-managed. In other words, independent contractors are responsible for their freelancer tax deductions.

Fortunately, 1099 employees can claim several tax deductions.

So, here we have tried compiling a list of independent contractor tax deductions or self-employed write-offs, whatever you prefer to call them!

1. Educational expenses

For growing a business, pursuing courses and skill development sessions might be an essential factor. So, educational expenses are potentially suitable as a tax break for the self-employed or independent contractor tax deduction.

For example, virtual conferences, webinars, business-related books, subscriptions to professional publications are all eligible as deductibles when filing taxes.

2. Car expenses

If an independent contractor spends time making deliveries from office to office or performs other business-related tasks using a vehicle, it feels like a part of the business.

Fortunately, mileage and car expenses can be one of the most significant self-employed write-offs for independent contractors.

Parking expenses, tolls are also deductible. An independent contractor can include these out-of-pocket expenses for projects and meetings. However, it is essential/crucial to keep the receipts.

3. Home office

Independent contractors might have significant home office expenses. For example, they might use a part of their home as a teaching space, a yoga studio, or something else.

So, if the home space is a primary place of business for the contractor, they can have several options for calculating independent contractor deductions in this category.

The independent contractor tax deductions can then include direct expenses like painting, repairs, and renovations. Plus, indirect expenses can also be included as a self-employed write-off like insurance, utilities, etc.

Further, office supplies also come under home office deductions. For instance, pen, paper, postage, shipping, printers, software, etc., all come under office supplies.

4. Business travel

Another tax break for self-employed is business-related travel. If an independent contractor has client meetings out of state or attending conferences is a part of their business, they can consider these expenses as self-employed write-offs.

Independent contractors can include hotel costs, airfare, taxis (Uber services) as business travel expenses. However, only 50% of self-employed meal deductions can be written off as business expenses.

Independent contractors can also include the trip expenses for independent contractor tax deduction if they extend their trip after completing business commitments. However, the number of days for the leisure trip must not exceed the total business days.

5. Business insurance

1099 business expenses can also include business insurance. Why?

Business insurance is for protecting the business against losses or unexpected costs like accidents or errors. For instance, if a client accuses an independent contractor of missing a deadline that resulted in costing them money, then a professional liability policy can provide coverage.

Often, even clients might ask for an insurance certificate before signing a contract with an independent contractor.

So, business insurance can be included in independent contractor tax deductions.

6. Health insurance

One of the many independent contractor deductions is health insurance. Independent contractors can include dental, medical, and vision premiums as deductibles.

Along with premiums, self-employed write-offs can also include expenses like glasses, visits, medications, etc. Also, there might be tax benefits for the spouse as well.

7. Start-up costs

If independent contractors have got their business up and running in the current year, they can claim independent contractor tax deductions. This deduction can be for several associated costs up to $5000. The costs might include travel, market research, registering a website, staff training, etc. For LLC or corporation, an additional $5000 can be included.

However, this tax break for self-employed does not include buying equipment or vehicle. As they depreciate, then you can deduct them.

8. Advertising

Spending money to promote a business does get included in the independent contractor tax deduction list. The advertising expenses include both physical or traditional advertising and digital advertising. For instance, flyers, business cards, posters. Plus, LinkedIn ads, TV commercials, website design, and maintenance, etc. All of these qualify as advertising expenses, and they can be included in the self-employed write-offs list.

9. Consultation fees

Business owners, at times, do need additional help from experts. For example, independent contractors might need a lawyer consultation to prepare a contract, an accountant for managing the books, or a financial advisor to guide them in setting long-term strategic goals.

These necessary expenses for 1099 business operations can be considered as 1099 business write off.

10. Retirement savings

If an independent contractor contributes towards a retirement account or IRA (Individual Retirement Account), they might get a tax break for freelancers for this expense.

However, if the independent contractors or their spouses contribute to an employee-sponsored retirement plan like 401(k) or 403(b), they might need to reduce the deduction or remove it altogether.

Plus, this deduction cannot be included in the independent contractor’s Modified Adjusted Gross Income (MAGI) exceeds the annual limit.

11. Self-employment tax

When filing a tax form as a self-employed worker, it might come as an unfair 1099 business expense.

Why?

Because that way, the independent contractor will be paying both employer and employee sides of the Social Security tax and Medicare taxes. This totals to around 15.3% of net earnings.

So, the IRS does understand this unjust expense. So, independent contractors are allowed to deduct 50% of their self-employment tax as independent contractor deductions.

While this won’t reduce the real amount of self-employment tax payable, it can reduce the income tax.

12. Tax advice

Several benefits are associated with being a self-employed contractor. Here, a tax consultant can help develop strategies related to 1099 employee tax deductions.

Getting help from a tax consultant might seem like a not-so-necessary expense, but then, they can help independent contractors save their time. They can help with independent contractor tax deductions, itemized deductions, identifying actual expenses, etc.

Hence, independent contractors can include the tax advice professional fees in the list of tax breaks for self-employed.

13. Depreciation

Depreciation of business-related equipment and property can be considered as an independent contractor tax deduction. For example, the contractor bought a printer four years ago. So, the printer is worth much less than when it was purchased. This is depreciation.

As per the IRS, if any business purchase lasts more than a year, an independent contractor can consider it as self-employed write-offs.

The depreciation value can be written off on the tax return. Plus, the independent contractors can deduct the cost of the repairs spent on business property or equipment.

14. Bank fees and interest payments

If an independent contractor takes a bank loan to fund a business, the interest can be deducted as an independent contractor tax deduction.

However, if the loan is used for both personal and business expenses, 1099 employee tax deductions will only include the interest of the business portion. Plus, business-related fees and other charges like service charges, replacement checks, etc., can also be considered as tax breaks for self-employed.

If 1099 business expenses include credit card expenses, the interest from credit cards and other associated costs can be included as tax breaks for self-employed.

15. Rent or lease payments

If an independent contractor rents vehicle, office space, and equipment for business purposes, all those expenses will be considered self-employed write-offs.

Plus, if self-employed contractors lease a vehicle for 30 days or more, they might have to reduce the deduction by an ‘inclusion amount’.

16. Employee benefits

Suppose an independent contractor has employees. And they are provided with health insurance and other benefits. Then the cost of benefits will come under the self-employment tax deductions list.

However, independent contractors cannot include their health insurance as a 1099 business expense.

17. Casualty and theft

If an independent contractor suffers losses from theft, natural disasters, or accidents, the amount of loss over $100 is an independent contractor deduction.

Unfortunately, if the contractor suffers more than one loss within a tax year, $100 from each loss amount can be deducted minus any funds received from insurance policies.

18. Charitable contributions

Independent contractors must keep a record of all small donations made throughout the year. These small amounts add up big as an independent contractor deduction.

Contributions of $250 and more require a receipt for tax documentation. Plus, the cost of gas or other expenses can be deducted.

19. Contract labor

If an independent contractor hires other independent contractors like graphic designers or website developers, their fees will be included as tax breaks for the self-employed. Such professional expenses of contractors are fully deductible.

20. Miscellaneous expenses

Independent contractors can include necessary or daily expenses as ‘other expenses’ if they cannot be categorized.

Few standard freelancer tax deductions include;

- Bad debt

- Dues and subscriptions

- Trademark related costs (acquiring or defending trademark)

- Bank fees (including maintenance and overdraft)

- Business gifts

- Training and education expenses

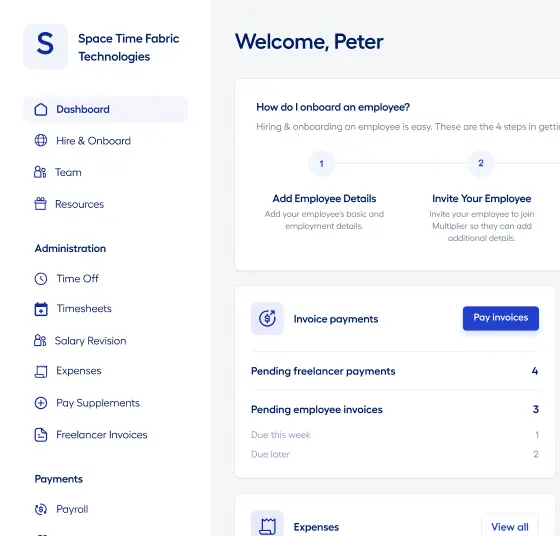

Hire Independent Contractors Seamlessly with Multiplier

It’s a waste of time to try to learn more about independent contractor tax deductions. Especially if you’re a new entrepreneur with a lot on your plate.

But who will be in charge of independent contractor tax deductions? The answer is Multiplier, a SaaS-based onboarding solution.

Multiplier is a self-service onboarding tool that can help you with the following:

- Creating acceptable contracts for smooth freelancer onboarding

- Making timely payments to the global freelancers

- Monitoring the global freelancers within a single dashboard

- Providing various perks and benefits to freelancers

Want to know more? Book your free demo!