Unlike independent contractors, employees are entitled to many benefits such as worker’s compensation funds, unemployment insurance, anti-discriminatory laws, protection against wage deductions, annual paid leaves, and the right to be a part of labor unions.

Such benefits and perks come at a substantial cost to the employer. Thus, employers often avoid such costs by hiring independent contractors or misclassifying employees as freelancers. However, misclassifying employees or freelancers might lead to legal troubles for organizations.

Hence, employers must understand the rules for employee classification. After all, classifying an individual as an independent contractor or employee is one of the most contested topics in employment law.

The IRS 20-Factor Test is a popular check system used by the IRS (Internal Revenue System) for assessing employee misclassification by companies. Let us look at this in detail.

Understanding the IRS Independent Contractor Test

The employer must withhold income taxes of their employees, pay taxes for their social security and medicare, and unemployment taxes levied on their salaries. This is an obligation only for an organization’s employees and not for independent contractors or freelancers.

Sometimes employers wrongly classify their employees as independent contractors to avoid the burden of payroll and taxes. Such misclassification of employees is considered a deliberate attempt to avoid taxes and withhold the law-mandated protection and benefits from employees.

The IRS has developed a checklist to determine workers’ status. It’s the “Right-to-control” test. It evaluates employees’ independence and control in their workspace and the employer-employee relationship. The IRS 20-factor test seeks to identify a presence of control in the employee-employer relationship.

An organization dictates its employees’ job responsibilities, time, and workplace. However, they have minimal control over the time and place of work for individual contractors or freelancers.

Thus, the IRS 20-factor test or the IRS independent contractor test helps assess if a company has correctly classified their employees and freelancers/independent contractors and has not falsely misclassified them to avoid taxes. Although employers may save money in the short run by misclassifying their employees, they might face hefty penalties or fines in the long haul.

Who is an Independent Contractor?

A professional providing their services to employers on a need or project basis is an independent contractor or freelancer. They outline the basis of the services, service charges, availability, etc., based on the employer’s requirements. Essentially, hiring companies do not have direct control over an independent contractor’s performance, place of work, or working hours. However, when compared to employees, independent contractors hold significant control of their work.

They receive payments (hourly or fixed charges) as agreed upon under the work contract with the employer/client. While independent contractors do not receive perks like employees (social security, medicare, pensions, etc.), employers can offer them adequate bonuses if they exceed expectations.

Since independent contractors fall under self-employed personnel, they must file their self-employment taxes. Their clients/employers cannot withhold independent contractors’ federal, state, or local taxes.

Determination of Workers’ Status by the IRS

The IRS uses common-law principles for determining if a professional is an employee or an independent contractor. Common laws derive from previous decisions taken by the court. They are generally used when making a decision based on the current law or regulations. The IRS uses common laws to determine a worker’s status for federal employment tax purposes.

The IRS-20 factor test is also beneficial in evaluating a professional’s status. We now have the IRS 20-point checklist for independent contractors to make this evaluation easy, broken down into behavioral, financial, and the relationship between two parties.

Note: IRS considers a professional an employee by default unless proven otherwise. This is why it is vital to classify employees correctly.

IRS 20-Point Factor Test – A Checklist for Independent Contractors

The IRS 20-point checklist for independent contractors helps determine the relationship between the worker and the hiring party. However, you must regard these factors as guidelines – you must remember that all factors do not apply to every situation. Sometimes, even one factor is sufficient to establish the relationship between the employer and employee.

The parameters of the employee vs. independent contractor 20-factor test of IRS are –

- Instructions provided to professionals about when, where, and how they must perform their work establish the employer’s control over their hires. These instructions could be in a written manual. If the employer controls how they must accomplish the desired results, the individual must be classified as an employee.

- An organization generally trains its employees to perform certain tasks and duties. On the other hand, independent contractors receive no such training.

- A professional’s tasks and responsibilities determine the success or failure of the company’s operations. Thus, integrating the worker’s services into the company operation policy indicates the presence of control, thus making them an employee.

- If an individual must render their services personally for achieving desired results for the company without any substitutes, they are classified as employees.

- A professional is considered an organization’s employee if it has the right to control the hiring decisions of the employee’s assistant. On the other hand, if the person controls who they hire for assisting in their tasks, they are classified as independent contractors.

- An employee generally has a continuing relationship with the organization. On the other hand, independent contractors ate hired by companies on a project-to-project basis, which may be temporary or of continuing nature.

- The employer sets the working hours for their employees. Contrarily, employers have no control over the working hours of independent contractors.

- An employee works full-time for one organization. However, independent contractors choose which company or employers they will work with.

- An employee usually works at the employer’s chosen location, but independent contractors can choose their place of work.

- Employees must perform their duties according to a particular sequence of steps.

- An employee must submit project reports for their daily tasks. This establishes the organization’s control over the employee’s daily activities.

- An employee receives their salary according to a set payment cycle and method. Independent contractors are generally paid after the completion of a project.

- Employers bear the business travel expenses for their employees. However, independent contractors have to cover business travel expenses in their project fees – there’s no extra reimbursement for such costs.

- Independent contractors use their tools/equipment to complete a project, while employees use the employer’s resources to complete their tasks.

- The employer offers work facilities to the employee, but an independent contractor must pay for their work facilities.

- An employee’s earnings are predetermined and are not subject to profits or losses. Unlike this, an independent contractor’s earnings might be subject to profits and losses as self-employed individuals.

- Independent contractors can provide their services to multiple companies/clients simultaneously.

- An independent contractor can provide their services to the general public.

- An employee can be fired by their employers. However, organizations cannot fire independent contractors if their work meets the contractual requirements.

- The independent contractor is obligated to complete a specific job or be responsible for their failure to complete the project. Contrarily, employees can quit their job after serving the notice period without any liability.

The Difference Between IRS 20-Factor Test and Other Tests

Apart from the IRS 20-factor test, there are many other tests for determining employee classification, such as Economic Realities Test and ABC Test.

In the ABC test, professionals are classified as independent contractors only if they are free from the direction and control of the hiring partner, they are engaged in other work beyond the hiring organization’s standard business, and they generally engage in a trade/occupation that is similar to the work they perform for the hiring party.

The Economic Realities Test determines a professional’s dependence on the hiring company. It evaluates five factors:

- Hiring party’s control of the professional regarding the work

- The opportunity for profit and loss for the professional

- The skills needed for the task at hand

- If the work offered to the professional is the hiring entity’s core business operation

- The relationship between the hiring company and the professional – whether it’s permanent or temporary

The IRS 20-factor test establishes the control and independence a professional exercises in the work offered by the hiring party. Thus, the IRS 20-point checklist for independent contractors aims to determine the scope of control to declare an individual as an employee or an independent contractor.

Conclusion

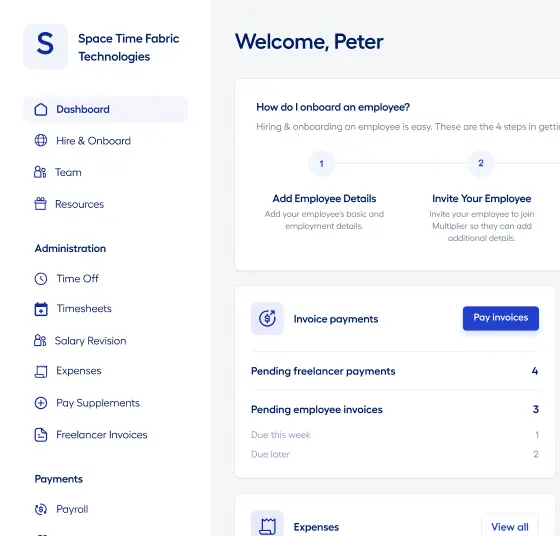

Businesses must be extra cautious when classifying their recruits because incorrect classification may attract hefty penalties and fines. This becomes even more crucial for foreign companies expanding overseas and hiring foreign employees. Hence, hiring a global employer of record (EOR) service provider like Multiplier would be wise.

Multiplier assists global companies in establishing their brand in a foreign land. Multiplier provides other services like employee onboarding, payroll management, drafting employment contracts, etc. Services provided by Multiplier help the companies in ensuring compliance with the labor laws of the foreign countries and ease in creating global teams.

FAQs

Q. What would happen if the company is found deliberately misclassifying the workers?

If a company is found guilty of misclassifying the workers for avoiding withholding taxes, it would be penalized by a court of law.

Q. How can international companies avoid the misclassification of the penalties?

Companies that do not have much knowledge about the international hiring systems should hire EOR service providers who can handle compliance issues and guide them on how to classify workers correctly.

Q. What does the IRS 20-factor checklist check?

The IRS 20-factor checklist determines the control of the hiring company on a professional’s work performance, working hours, job location, etc.