Payroll outsourcing is when an organization pays a third-party solution to manage payroll calculations, tax compliance, and other related functions.

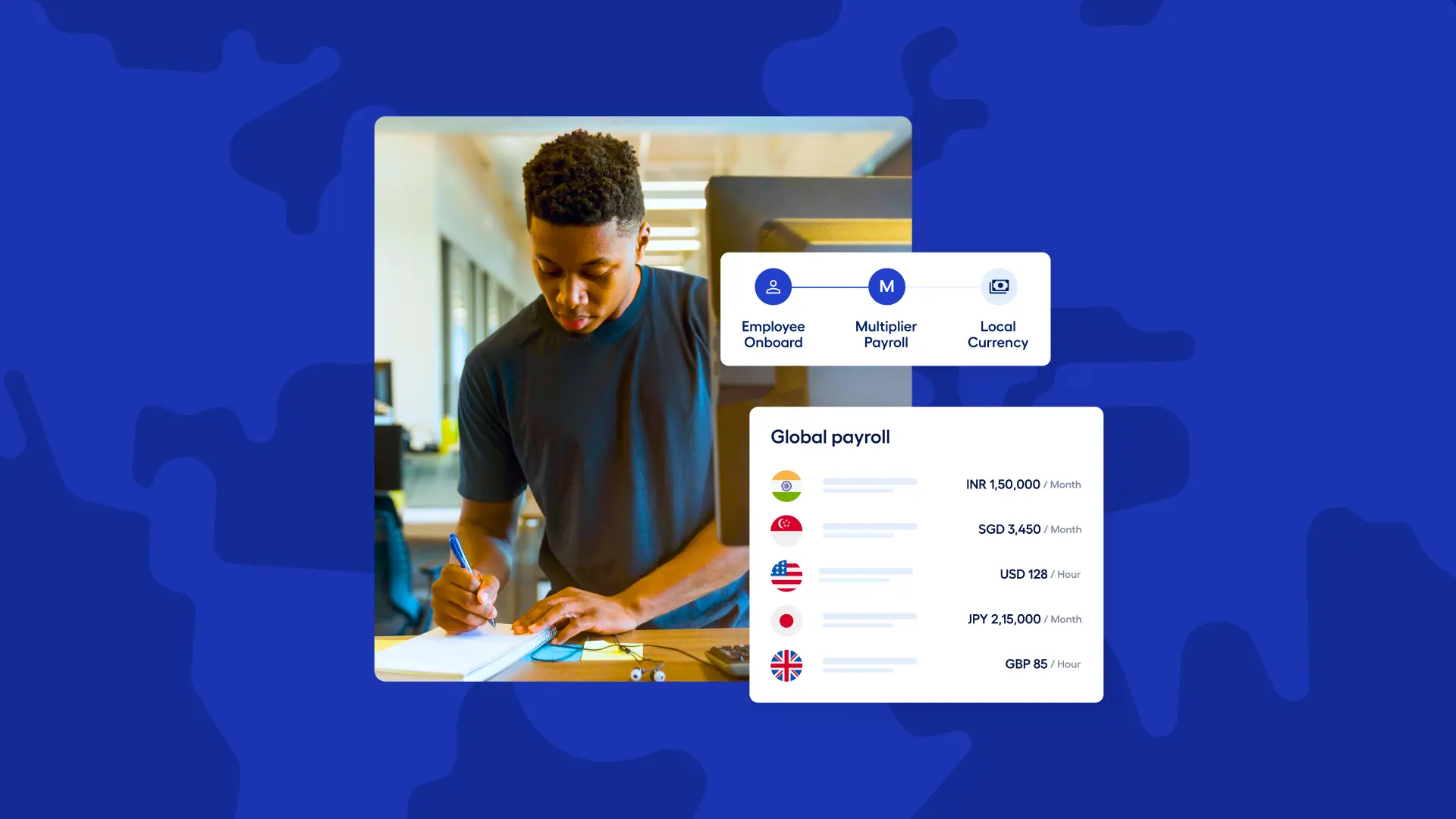

Global payroll outsourcing takes this to a whole new level; providers handle payroll activities for employees located in various geographic locations, each with its unique tax laws, employment regulations, and currency considerations.

In this article, we explore everything you need to know about these two types of payroll outsourcing, including looking at how the processes work. You’ll find recommendations on which questions to ask to find a service that directly supports your needs.

When And Why Should A Small Business Outsource Payroll?

Whether just managing employees with different working patterns or overseeing a global team, payroll is time-consuming. And this means that you need to hire dedicated staff to manage it in-house. However, with the average salary for a Payroll Manager being upwards of $80,000, internal payroll can be too large an expense for small businesses. Payroll outsourcing presents a solution as companies can avoid the expenses of hiring a whole payroll team, freeing up their time and saving money by:- Staying compliant with relevant payroll requirements and laws by using experts

- Streamlining administrative tasks such as payroll changes when hiring, filing reports to respective government authorities, etc.

- Ensuring tax penalties don’t arise

- Accessing the latest technology and data security processes for a lower cost

- Using a GEO service such as Multiplier process payroll in newer markets without having to establish a legal entity

How Does Payroll Outsourcing Work?

The process of outsourcing payroll typically begins with a comprehensive assessment of an organization’s needs. Payroll providers will usually ask questions about the number of employees, their compensation structures, and unique considerations such as varying types of employment contracts. We explore more questions you can consider in the next section. After you choose a payroll provider, you’ll need to give them all the necessary data, such as employee information, working hours, wages, deductions, and benefits. This usually means setting up an account on their platform to grant access to your current payroll information. The provider will then process the payroll based on the data provided, ensuring compliance with local tax regulations and, in the case of global payroll, international rules too. These are the steps they will follow:1. Choosing the right payroll frequency

Most employees across the globe are paid in the following approved payroll frequencies:- Weekly (52 times a year)

- Biweekly (26 times a year)

- Semimonthly (24 times a year)

- Monthly (12 times a year)

2. Classifying your employees correctly

When processing payroll, it is essential that your payroll outsourcing firm classifies your employees correctly. Classifying your employees correctly is a critical factor in deciding:- The business tax amount or VAT you would pay annually

- Amounts to withhold from an employee’s paycheck

- Tax documents that must be filed on their behalf

- Independent contractors or freelancers

- Part-time employees

- Full-time employees

- Executive

- Professional

- Administrative

3. Processing payroll and taxes for remote employees

Payroll outsourcing firms ensure that the responsibilities and complex challenges of processing paychecks in different regions and withholding necessary taxes are done efficiently. Employee payroll taxes are withheld depending on where the work is performed and apply to employees who commute between satellite offices. A payroll outsourcing firm ensures you are compliant with regulations including:- Registering with the relevant income tax department or the Department of Revenue

- Collecting and remitting the state/municipal/local income taxes where the work is being performed

4. Managing employees the right way

When working with employees who are required to work on a 24/7 shift (such as employees in the medical industry), payroll outsourcing partners ensure that:- You have the necessary policies in place

- You are documenting their work timings and other crucial aspects of employment

- Their paycheck is processed on time and all statutory benefits are catered to

5. Detecting and preventing payroll fraud

An outsourced payroll provider ensures that payroll system checks and payroll audits are conducted on a timely basis to ensure no anomalies with the existing payroll processes. This ensures that you do not run unnecessary payroll fraud complications and that prevention policies are in place.6. Executing wage garnishments

Wage garnishments are statutory deductions, such as income tax amounts and social security contributions, that must be deducted from an employee’s paycheck and credited to the respective authorities, such as the income tax departments. A payroll outsourcing company will ensure that the employee’s paychecks are credited on time, and the necessary deductions are credited to the respective government departments.Questions to Ask Before Outsourcing Payroll

In this section, we explore questions to ask your global payroll outsourcing partner before making a decision.- Can the payroll provider tailor their services to meet your organization’s unique needs, including complex payroll structures?

- How do they stay up-to-date with local and international payroll regulations?

- Can they make international payments and handle multiple currencies?

- What is in place to guarantee accurate and timely payroll processing?

- What payroll software does the outsourcing partner use? How user-friendly is it?

- Which other platforms do their solutions integrate with? How easily can their systems integrate with our existing HR and financial systems?

- How does the payroll provider guarantee data security?

- What channels of communication are available for addressing queries and concerns?

- What is the process for adding or removing employees from payroll?

- Can they provide references or case studies from other clients with similar needs?

- Does the outsourcing partner’s corporate culture align with your organization’s values?

- What will happen to costs when you scale your business?

- What is their minimum contract period and what does their termination contract look like?

- Time/attendance tracking to reduce the time it takes to compile timesheets for payroll

- EOR services to help you recruit global talent from different countries without having to establish local entities everywhere.

- PEO services to assist you in staying compliant with local labor laws and regulations