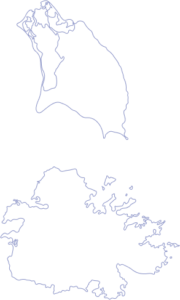

Your quick guide on talent and labor compliance norms in Antigua & Barbuda

Capital

St. John’s

Currency

East Caribbean Dollar (XCD)

Languages

English and Antiguan Creole

Payroll Frequency

Monthly

GDP per Capita

$16,786

Employer Tax

8%

Talent Overview

Antigua & Barbuda holds the 6th rank for GDP in Latin America and the Caribbean Sea. The country is well known for being one of the most prosperous nations in the Caribbean. Antigua and Barbuda’s GDP has majorly increased over the year. The country’s GDP majorly depends on tourism and industries such as clothing and construction. There has been significant growth in the GDP after 2019 in Antigua & Barbuda.

Major economic hubs:

St. John’s, All Saints, Liberta

Skills in demand:

Operations Manager, Marketing Manager, Marketing Analyst, Product Manager

Local Universities

The top local universities in Antigua & Barbuda are as follows:

Local: 1

World: 5685

Local: 2

World: 8810

Salary Data

Some of the job titles and average monthly salary of Antigua and Barbuda are;

| Job Title | Average Monthly Salary(XCD) | Average Monthly Salary(USD) |

| Financial Manager | 9,360 XCD | 3463.40 USD |

| General Manager | 8,490 XCD | 3141.48 USD |

| Business Development Manager | 7,280 XCD | 2693.75 USD |

| Business Analyst | 5,980 XCD | 2212.72 USD |

| Financial Analyst | 5,750 XCD | 2127.62 USD |

| Project Manager | 5,170 XCD | 1913.01 USD |

Talent Sourcing Tips

TotalJobs, Timesacsent, LinkedIn, Glassdoor

40,270

In order to onboard an individual from Antigua & Barbuda, the employer needs to have knowledge about the employment law, deductions, allowances, and bonuses to be provided.

Employment contracts in Antigua and Barbuda must be in the language that both the employees and employers understands – either English or Antiguan Creole.

The probation policy for new employees in Antigua and Barbuda is up to 1 month.

| Date | Name | Type |

| 1 Jan | New Year’s Day | Public Holiday |

| 2 Jan | Day off for New Year’s Day | Public Holiday |

| 7 Apr | Good Friday | Public Holiday |

| 10 Apr | Easter Monday | Public Holiday |

| 1 May | Labour Day | Public Holiday |

| 29 May | Whit Monday | Public Holiday |

| 7 Aug | Carnival Holiday | Public Holiday |

| 8 Aug | Carnival Holiday | Public Holiday |

| 1 Nov | Independence Day | Public Holiday |

| 9 Dec | V.C. Bird Day | Public Holiday |

| 25 Dec | Christmas Day | Public Holiday |

| 26 Dec | Boxing Day | Public Holiday |

| Type of Leave | Time Period | Mandatory |

| Annual/Earned Leave | 30 days | Yes |

| Sick Leave | 26 weeks | Yes |

| Maternity Leave | 13 weeks | Yes |

Payroll

Payroll Cycle

The payroll cycle in Antigua and Barbuda is Monthly.

Minimum Wage

The minimum wage is XCD 8.20 per hour in Antigua and Barbuda.

Overtime Pay

A minimum of 150% of the hourly wage has to be provided as overtime pay in Antigua and Barbuda.

Bonus

There is no statutory law for 13th-month pay in Antigua & Barbuda.

Taxes

| Funds | Contributions |

| Social Security | 8% |

| Funds | Contributions |

| Social Security | 6% |

There is no personal income tax in Antigua and Barbuda.

The standard VAT rate in Antigua & Barbuda is 15%.

Offboarding & Termination

The employer or the employee can terminate the employment contract with a notice or severance pay. However, the employer can terminate only based on the reason based on redundancy or illegal activities for termination.

The notice period in Antigua and Barbuda is one month.

After one year of service, one day of pay for each month worked. The severance pay is only applicable if the employee is terminated for the reason of redundancy.

Visa and Immigration

The individual has to provide personal documents along with the employee contract. The individual can stay in the country for six months and can be extended based on business requirements.

The individual has to provide personal documents along with the employee contract. The individual can stay in the country for six months and can be extended based on business requirements.