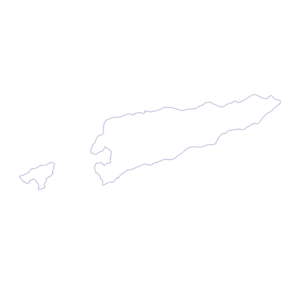

Your quick guide on talent and labor compliance norms in Timor Leste

Capital

Dili

Currency

United States Dollar

Languages

Portuguese, Tetun

Payroll Frequency

Monthly

GDP per Capita

$1,674.72

Employer Tax

6%

Talent Overview

Timor-Leste, or East Timor, is a Southeast Asian country with a GDP (Gross Domestic Product) of USD 1.9 million and a GDP growth rate of 4.4%. The country has a mixed economy, which implies that the government primarily controls the economy and offers limited private freedom. The country stands 181 in the Ease of Doing Business Index conducted by the World Bank.

Major economic hubs:

Dili, Maliana, Suai

Local Universities

The top local universities in Timor Leste are as follows:

Local: 1

World : 10996

Local: 2

World : 13052

Local: 3

World : 13053

Local: 4

World : 13103

Local: 5

World : 13379

Salary Data

Some common jobs in Timor Leste with average monthly salary are:

| Job Title | Average Monthly Salary (in USD) |

| Financial Manager | 4,220 USD |

| Country Manager | 3,930 USD |

| Financial Analyst | 2,640 USD |

| Business Analyst | 2,620 USD |

| Project Manager | 2,340 USD |

Talent Sourcing Tips

27,000

The Labour Code of 2002 regulates the employer-employee relationship in Timor-Leste. All working relationships in the country must align with the Code or face hefty penalties. The following sections cover various aspects of the Code in depth.

The Labour Code in Timor-Leste mandates written employment contracts to substantiate a relationship between an employer and an employee. In the event of a dispute regarding an oral employment contract, the employer will have to prove the absence of a contract and relevant terms.

The probationary period in Timor-Leste lasts a maximum of one month.

| Date | Name | Type |

| 1 Jan | New Year’s Day | Public Holiday |

| 3 Mar | Veteran’s Day | Public Holiday |

| 7 Apr | Good Friday | Public Holiday |

| 22 Apr | Eid ul Fitr (Tentative Date) | Public Holiday |

| 1 May | Labor Day / May Day | Public Holiday |

| 20 May | Restoration of Independence Day | Public Holiday |

| 8 Jun | Corpus Christi | Public Holiday |

| 29 Jun | Eid al-Adha | Public Holiday |

| 30 Aug | Popular Consultation Day | Public Holiday |

| 1 Nov | All Saints’ Day | Public Holiday |

| 2 Nov | All Souls’ Day | Public Holiday |

| 12 Nov | Youth National Day | Public Holiday |

| 28 Nov | Proclamation of Independence Day | Public Holiday |

| 7 Dec | Day of Remembrance | Public Holiday |

| 8 Dec | Day of Our Lady of Immaculate Conception | Public Holiday |

| 25 Dec | Christmas Day | Public Holiday |

| 31 Dec | National Heroes Day | Public Holiday |

| Type of Leave | Time Period | Mandatory |

| Annual leaves | 12 days | Yes |

| Sick leaves | 6 days | Yes |

| Maternity leaves | 12 weeks (6 weeks before birth and 6 weeks after birth) | Yes |

Payroll

Payroll Cycle

Timor-Leste follows a monthly payroll cycle.

Minimum Wage

The minimum wage in Timor-Leste is USD 115 per month.

Overtime Pay

The standard working hours in Timor-Leste are 8 hours per day and 44 hours per week. If an employer requires their staff to work overtime, they must compensate the employees at 150% of their regular hourly wage.

Bonus

The Labour Code of Timor-Leste does not mandate employers to pay 13th-month pay to their employees.

Taxes

| Contribution | Tax rate |

| Social security | 6% |

| Contribution | Tax rate |

| Social security | 4% |

| Taxable income from | Tax rate | |

| Wages (for residents) | Up to USD 500 per month | 0% |

| More than USD 500 per month | 10% | |

| Wages (for non-residents) | 10% | |

| Other than wages (for residents) | Up to USD 6,000 per year | 0% |

| More than USD 6,000 per year | 10% | |

| Other than wages (for non-residents) | 10% | |

Timor-Leste does not have any standard Value-Added Tax policy.

Offboarding & Termination

An employer in Timor-Leste needs a valid reason to terminate an employment contract legally. In case of misconduct at the workplace, the employee can be terminated without compensation. Furthermore, termination due to unsatisfactory performance requires the employer to give at least 3 warnings (in both written and verbal forms). The employer must provide a written notice of termination to the employee.

The notice period in Timor-Leste varies as per the following table:

| Length of service | Notice period |

| 3 – 6 months | 10 days |

| 6 – 12 months | 15 days |

| 1 year or more | 30 days |

Visa and Immigration

Any foreigner who wants to work at Timor-Leste must get a valid work permit before their first day of work. The permit is valid for a maximum of one year and employees can request multiple entries. The employee must visit an Embassy or Consulate of Timor-Leste in their home country, or ask their employer to contact the Department of Consular Affairs of the Ministry of Foreign Affairs in Dili, Timor-Leste.

The standard working hours in Timor-Leste are 8 hours per day and 44 hours per week. If an employer requires their staff to work overtime, they must compensate the employees at 150% of their regular hourly wage. Working on a public holiday or a rest day requires the employer to compensate at 200% of the employee’s regular hourly wage. In any case, the combined total of normal and overtime duration must not exceed 12 hours.