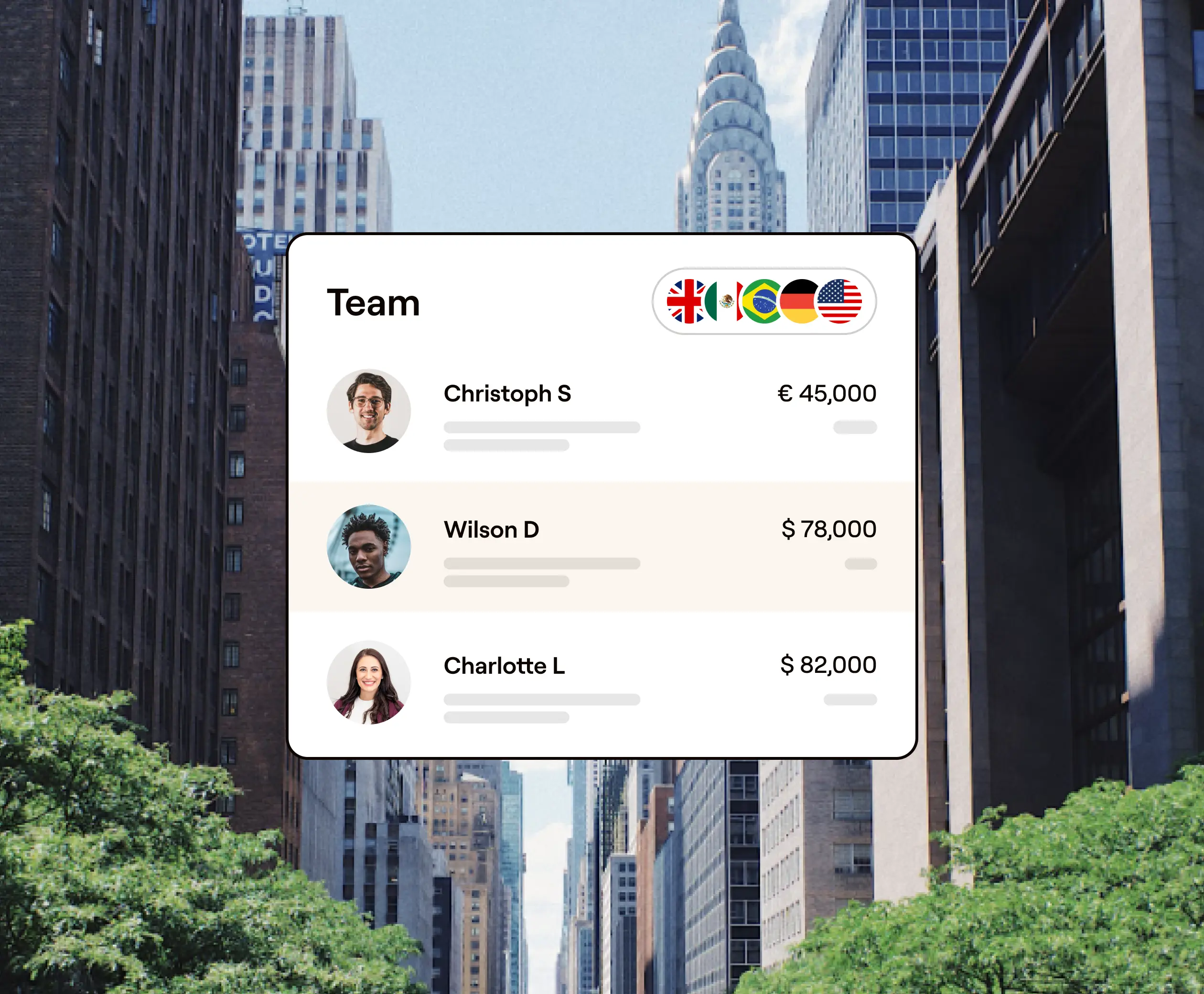

Employee cost calculator

Compare employee hiring costs across 120+ countries, so you can forecast your budgets with confidence. Try it out below!

Estimate costs

Calculate the total cost of hiring employees around the world, including base salary, insurance, and taxes. Get an answer in seconds.

Add an estimate

Want to compare the cost to hire for this role in another country?

Add an estimate

Want to compare the cost to hire for this role in another country?

All taxes and contributions are estimates. The total costs and employer contribution may change based on an employee’s personal data. For an exact quote for your new hire, please email us at support@usemultiplier.com. For transparency, the tables provide a detailed breakdown and estimates for in-country statutory social contributions, statutory benefits, and core benefits. Estimates do not take into account additional costs that may be incurred for relocation, visa applications, etc. This estimate is for guidance only, and may not constitute accurate financial advice. Information contained here is subject to change should any changes to taxation, compliance, etc. arise in this country.

Build your global dream team

No matter where your next employee is, Multiplier can help you hire, manage, and pay global teams effortlessly.

From Employer of Record (EOR) to Global Payroll, our unified platform streamlines the entire process so you can focus on your business.

Need help?

The employee cost calculator is built to help you estimate the overall costs of hiring an employee in a foreign country.

While hiring internationally, it is important to consider the total employment costs, including in-country employer contributions, taxes, insurance, and other mandatory payments that are often overlooked.

Employment costs are the total costs a company will incur to employ an individual in a particular geography.

In other words, these costs are a combination of the base salary of an employee and other mandatory employer costs such as insurance, contributions, pension, etc.

Statutory costs or employer contributions are the costs that are mandated by a statute, i.e, a legislative body. These costs can vary across countries as applicable by local labor laws.

Employment costs can vary across countries or states, and while our employee cost calculator is designed to help you estimate approximate costs, it is important to note that criteria such as the employee’s age, demography, etc., may also play a role in the tax brackets they fall into.

To know the exact cost of hiring an identified candidate, talk to our experts

To hire in a new country where you have not set up a legal business entity, use Multiplier’s Employer of Record solution.

Multiplier owns entities in countries all over the world and makes international employment, payroll, compliance and benefits easy and risk-free.

By hiring across countries, businesses can expand their operations in new potential markets. They can also tap into a global talent pool with niche skill sets that may not be available in their respective home country.

Mandatory employer costs

Grow your global team quickly and compliantly.