A sole proprietorship gives complete control to an individual owner. It is one of the simplest structures for business expansion in the Philippines. Freelancers and self-employed professionals are both included under sole proprietorship.

Foreigners can establish a sole proprietorship in the Philippines in industries not governed by ownership equity laws. Over 40% of firms are registered as sole proprietorships in the Philippines as per 2015 data. The process to register a sole proprietorship in the Philippines is also comparatively smoother.

Now let us see how to establish a sole proprietorship in the Philippines.

Who can be a Sole Proprietor in the Philippines?

Unlike the US and the UK, the Philippines does not have the legal concept of a Limited Liability Company (LLC) or Private Limited Company. Hence, many self-employed individuals and small businesses start as sole proprietorships and then transition to domestic corporations.

You must fulfill the following criteria to establish a sole proprietorship in the Philippines –

- Be a single owner of the business

- Have a Special Investor’s Resident Visa

- Be the sole beneficiary liable to responsibilities, profits, and losses.

Note: The sector you operate in should not have foreign equity restrictions.

Benefits of Sole Proprietorship in the Philippines

When choosing a business entity for your company, you must know the advantages of the structure you choose. A fair share of tax procedures and legalities are involved in registering a new business.

Here are some benefits of setting up a sole proprietorship in the Philippines:

- You remain the sole supervisor of all your business operations

- You have complete control over the decision-making process

- There is no separate taxation for the business

- The tax rate for self-employed individuals is 8%, provided their income is less than P3,000,000)

It is cheaper to set up a sole proprietorship in the Philippines than a corporation

Documents Required for Registering Your Business in the Philippines

Anyone looking to establish a sole proprietorship in the Philippines must fill out the mandatory documentation forms for registration. Moreover, they must register at these three different government agencies:

- The Department of Trade and Industry

- Local Government Unit

- Bureau of Internal Revenue

You must submit the following documents to register a sole proprietorship in the Philippines:

- Business Name application form

- Foreign Investor’s application form

- Passport size photos

- Biodata

- Valid visa

- Certificate of Authority to Engage in Business

- Government-issued ID such as passport, driver’s license, National ID

- Resident Agent Appointment form

- Proof of inward remittance of Foreign Currency with Peso Conversion

- Bank certificate of deposit

- Authority to verify bank account and bank certificate of deposit

Authorities might ask for additional documents depending on the nature of your business.

Other Criteria for Registering a Sole Proprietorship in the Philippines

Be mindful of these things when registering as self-employed in the Philippines:

- All businesses must secure a mayor’s permit or municipal license from the city (where the business is located) to ensure compliance with local regulations.

- After incorporating a sole proprietorship in the Philippines, if you plan to hire more employees in the future, you must register your business with:

- Social Security System

- Home Development Mutual Fund

- Philippine Health Insurance Corporation

- You must register with the appropriate regulatory bodies according to the nature of your business/product.

How to Register a Sole Proprietorship in the Philippines?

Multiple steps are involved in setting up a sole proprietorship in the Philippines. Here’s a step-by-step guide for the same:

Register a business name:

- Decide upon a business name, one that is not already registered or trademarked,

- You can keep your own name,

- Fill out the application form on the Department of Trade and Industry website,

- Check if the business name is available,

- Pay the registration fee,

- Obtain a DTI Certificate of Registration (COR) and make a printout of the same.

Register with Barangay Office: This acts as a legal requirement to operate your business.

- Go to the Barangay Hall of your business location,

- Submit the application form along with the DTI Certificate of Registration,

- Submit address proof,

- Two valid ID proofs,

- If successful, you will get the Certificate of Business Registration.

Register in the Mayor’s Office: This helps acquire permission to operate in the local municipality.

- Go to the municipal office where you plan to set up your business

- Fill out the necessary form(s)

- Submit residency proof/lease contract (for a rented office)

- Pay the Mayor’s permit fee

- Claim the business permit and licenses

Register with the Bureau of Internal Revenue: This is crucial for managing sole proprietorship taxes in the Philippines.

- Go to the Regional District Office and fill out the BIR Form 1901

- Submit the Certificate of Registration from DTI, Barangay clearance, and Mayor’s Business Permit

- Give an address proof and Valid IDs,

- Pay the registration fees,

- Register your book of accounts,

- You will get your final Certificate of Registration.

Once you have acquired all four certificates, you can start working on the business operations.

Conclusion

Setting up a sole proprietorship in the Philippines can be long and time-consuming. After all, it may take months to get the relevant permits from concerned authorities. Plus, you must be well-versed with the local rules and regulations for self-employed people.

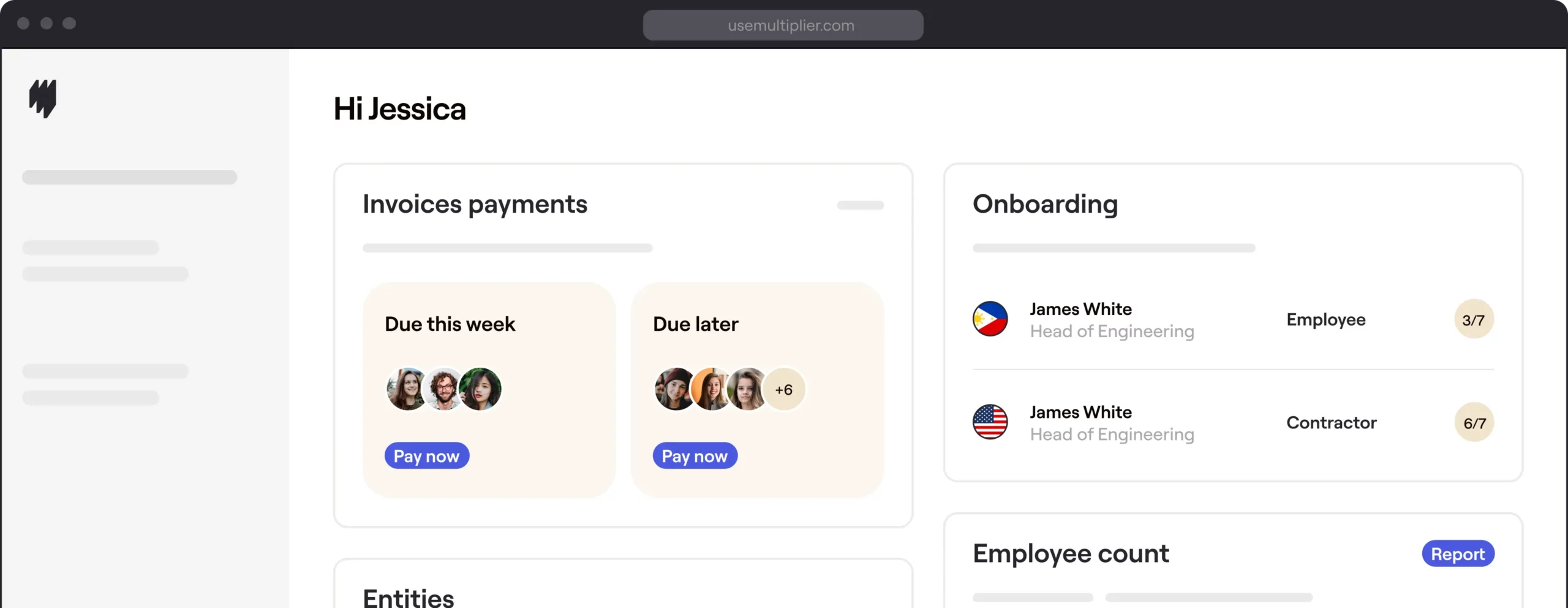

If you don’t wish to bear the burden alone, we recommend you partner with a global EOR firm like Multiplier.

With local entities in over 150+ nations, our experts can help set up your sole proprietorship in a foreign country. We can also help you onboard freelancers and manage their payroll. Our one-click payroll services will save you the hassles of taxation in foreign countries.