What are Employee Benefits?

Employee benefits are the extra perks that companies offer their staff or employees depending on their internal policies and compensation plans. These benefits may be monetary or non-monetary, based on the employees’ demands and the organization’s financial capacity.

Along with theIncluding employee benefits in the compensation, the structure has its advantages. Companies can increase employee satisfaction and lower staff turnover by providing additional employee benefits. Employers may attract top talent to their companies by giving various added benefits to the employees.

All employees in Israel are eligible for a variety of employee benefits. Each employee is paid a salary equivalent to the Israeli government’s minimum wage. Additionally, Israelian employees are allowed to take a variety of leaves according to their needs. The employees receive optional benefits like a corporate car, supplemental health insurance, and mandatory benefits. Before choosing employee benefits for your employees in Israel, you must conduct a thorough market analysis.

You can design and draft a compensation and benefits plan for Israel with the help of this guide that will keep your employees motivated.

Compensation Laws in Israel

There are several compensation laws in Israel that you must adhere to while creating a benefits plan for your employees. Some of these compensation laws include:

- According to Section 9 of the Employment of Women Law, employers can not terminate a pregnant employee. Also, terminating the employment contract within a few weeks of childbirth is illegal.

- If an employee resigns willfully, they are not entitled to any severance pay from the company.

- Section 12 of the Minimum Wage Law states that all employees are entitled to a salary equivalent to, or more than, the minimum wage decided by the Government.

- As per Section 12 of the Work and Rest Law, employees can only work on a rest day if they have authorization from the Ministry of Labor. Such cases are approved only if the service is deemed in the general public’s interest, considering the security, safety, and economic situations.

- Section 20 of the labor law allows employees to take a short prayer break and a 45-minute lunch break during working hours.

- The Minister of Labor can prohibit women’s employment in hazardous working conditions that might pose a health risk.

All companies must factor in these compensation laws while drafting employee compensation and benefits in Israel. Violating these compensation laws can attract heavy penalties from the Government of Israel.

How to Design an Employee Benefits Program for Employees in Israel?

A benefits plan must consider qualitative and quantitative factors, so it takes time to design. You need to decide on an appropriate budget, consider various benefits, and draft a compensation plan.

In Israel, creating a compensation package entails carefully curating the benefits plan and assessing its sustainability at the corporate level. Before starting the process, you must also finalize a budget with a threshold in mind. When establishing an employee benefit program, you must consider employees’ needs.

Let’s look at some basic steps to develop a benefits plan for your business.

Step 1: Finalize a budget and your goals

You must fix a budget and determine the objectives of creating a benefits plan before you start curating a compensation package. Consider the size of the company and the industry it belongs to finalize the goals. Also, decide on a fixed budget, so you have a threshold for accommodating all the benefits you plan to provide to your employees.

You should craft your benefits plan to stay relevant even if the business goes through some changes. Some goals that you can consider while creating a benefits policy are:

- Energizing and inspiring the current workforce while attracting fresh talent

- Maintaining financial discipline while creating employee benefits in Israel

- Adhering to all the relevant labor laws

Step 2: Know the industry standards and the employee expectations

While adhering to the budget is essential, creating a benefits plan works only if the employees are happy with your benefits. Hence, you must try to understand the employees’ expectations from a compensation and benefits policy in Israel. To create a good benefits plan, research what your peers and competitors offer in the industry. Once you have information on the type of benefits your competitors offer, you can benchmark your benefits.

In addition, you must conduct an internal survey to understand what employees expect from a benefits plan. The survey results help to understand the kind of benefits the employees seek from their place of work. You can use these results to make some necessary changes to the benefits plan.

Step 3: Craft a flexible compensation structure

Now that you have the internal survey results, you can draft the worker’s compensation in Israel based on the findings and research data.

As employees have different expectations, you must design a flexible benefits package. You must provide guidance and clarify how to take advantage of any relevant advantages employees choose.

Step 4: Communicate and ask for feedback

Once you have a benefits plan, inform all parties involved and your employees about it. You can let them read the first draft and ask for their input. After that, include relevant feedback that helps improve the benefits program’s quality.

Additionally, suppose the feedback indicates that a specific benefit will be underutilized; you may either try to make the necessary adjustments to make it lucrative or completely delete that particular benefit.

Step 5: Analyze and publish the compensation plan

It is essential to evaluate the compensation structure in Israel to ensure that it can sustain itself in the dynamic business environment. You must curate a plan that stays relevant through the years. You should also have some scope for amendments so that you can comply with the prevailing labor laws at any point in time.

Before releasing the employee compensation policy in Israel, you must also ensure there are no potential mistakes. Also, before starting the implementation phase, evaluate every aspect of the benefits plan. You must also create a few metrics to evaluate the plan’s effectiveness and the entire activity.

Types of Guaranteed Benefits in Israel

Employees enjoy different employee benefits in Israel. Before designing a benefits program for your employees, you must know about these guaranteed benefits. These benefits include:

Minimum wage

- All employers must pay their employees a salary that is at least equivalent to the minimum pay decided by the Government.

- Currently, the minimum wage stands at ILS 5,400 per month for employees across sectors.

- The minimum wage for employees who are paid hourly is ILS 29 per hour.

- The monthly minimum wage will increase to ILS 6,000 by December 2025.

Working hours and overtime

- Employees can work up to 42 hours a week in Israel.

- The daily working hours may vary from 7 to 9 hours depending on the number of working days in a week.

- As per the Government mandate, the employees must get a rest period of 48 consecutive hours a week.

- Employees who work beyond the 42 hours limit are entitled to overtime pay.

- Collective agreements govern overtime payments, and the charges differ for additional hours.

- Employees who work two additional hours get an overtime payment at 125% of their regular pay.

- If an employee works beyond two additional hours, the overtime payment is 150% of the regular pay.

- Working beyond 12 hours a day or 16 additional hours as overtime is illegal in Israel.

Paid leaves

- For the first five years of employment, the employees are entitled to 16 days of yearly paid leave benefits in Israel.

- During the sixth year, the number of paid leaves goes up to 18 days and increases to 21 days during the seventh year of employment.

- If the employee remains in the company for more than seven years, an additional paid leave is credited for every different year up to a maximum limit of 28 days.

Public holidays

- The employees in Israel enjoy nine public holidays. These are common holidays across all companies operating in Israel, irrespective of their industry.

- These holidays are given during Rosh Hashana, Independence Day, Sukkot, Shavuot, Yom Kippur, and Passover.

Sick leaves

- For every month the employee works, they receive 1.5 days as sick leave. However, employees cannot accumulate these leaves beyond 90 days.

- The first day of sick leave is unpaid. However, the employees are paid 50% of their regular salary for the next two days.

- If the sickness goes beyond three days, the employee receives a 100% of their regular salary from the 4th day onwards.

Maternity leaves

- The female employees are entitled to a 26-week maternity benefit in Israel.

- Female employees are eligible for maternity leave only when they complete a year in the company.

- The female employees can take seven weeks’ maternity leave before the due date and avail of the remaining 19 weeks after the delivery.

- The employees are paid via the social security system during maternity leave. The 15 weeks are paid fully, and the remaining 11 weeks are unpaid.

- If a female employee has worked for a company for less than a year, they are eligible for a 15-week maternity leave.

- In case of a complicated birth or multiple births, the employee can extend the maternity leave period by three weeks. However, no payment will be made for these leaves.

Paternity leaves

- A father can take paid paternity leave of up to 5 days to post the child’s birth.

- The first three days of the paternity leaves are deducted from the annual paid leaves, and the remaining two days are considered sick leaves.

Annual bonus

- There are no provisions for an annual bonus in Israel. However, employees receive a recreation payment every year as a supplemental benefit.

Employee Benefits for Expatriates

The ex-pats who travel to Israel for work have access to the same benefits that the local Israel employees enjoy. Ex-pats get health insurance along with supplemental health coverage. Also, the employer covers the cost of travel for all ex-pat employees. Other expenses that the employers bear as part of the ex-pats’ benefits include:

- Relocation expenses

- Traveling expenses

- Accommodation expenses

These benefits might differ from employer to employer. However, the clauses of these benefits are mentioned in the employment contract.

How are Employee Benefits taxed in Israel?

Companies must factor in bonuses, leave payments, and other benefits when determining an employee’s take-home pay because most benefits are a part of the taxable income. The employer is responsible for withholding the proper amount for tax obligations from each employee’s paycheck.

Israel has a progressive taxation system in place. Hence, the tax rate increases with an increase in gross pay. Gross pay also includes the monetary value of the benefits given to the employees. The tax percentage ranges from 0% to 50%.

Restrictions for Benefits and Compensation in Israel

Like in other economies, most benefits are taxable in Israel. To determine how much tax an employee will owe, you must know the monetary value of these perks. The employer’s responsibility is to timely deliver all tax payments to the relevant tax agencies monthly.

Before creating a compensation structure in Israel, be sure that your company is legitimately incorporated in Israel and that you can conduct business there. The perks and pay package should also follow Israel’s labor rules.

Supplemental Benefits for Employees in Israel

Israel offers supplemental and mandatory benefits to all its employees. These benefits add to the employees’ extrinsic motivation and help the company attract the best talent. Some supplemental benefits offered to employees in Israel are:

Supplementary insurance

A primary health cover does not include services like eye care, dental care, etc. Therefore, companies in Israel provide supplemental health insurance to their employees. The supplemental insurance includes services like dental services, long-term care, etc. It also allows you to expand your current health insurance by adding coverage for transplants, etc.

Transport cost

The employees in Israel get 22.6 NIS every day to manage their transportation charges. The amount can vary from employee to employee depending on the distance of the office from the employee’s home.

Payment for recreation

Unlike other countries, all employees in Israel are eligible for a recreation payment as soon as they finish a year in the organization. The payment is made anytime between July and September. The amount is decided based on the years of employment. During year 1, the employee gets 1,890 NIS; if the employee has worked in the organization for 2 to 3 years, the payment is 2,268 NIS.

Advance study fund

The employees who hold senior positions in the organization have access to advance study funds. The employers contribute 7.5% of the monthly salary to this fund, while the employees contribute 2.5%. The contributions made up to 15,712 NIS are free of taxes. However, the employee cannot use the fund for the first six years.

How Multiplier Can Help with the Benefits Management in Israel

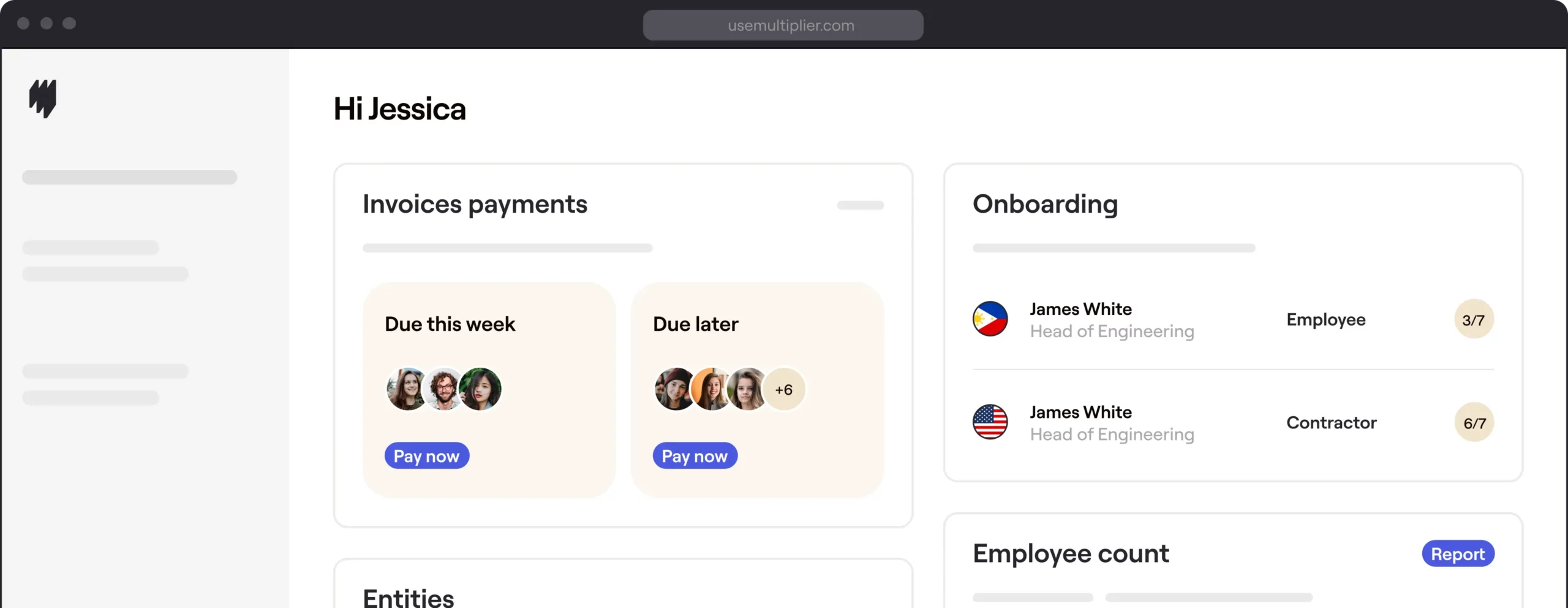

Starting a business in Israel comes with its own set of challenges. However, if you take a step-by-step approach and implement the local laws while designing the benefits package, you can navigate it quite easily. You can contact a Global PEO platform like Multiplier to help craft an effective benefits program.

Multiplier helps you understand all the labor laws in Israel and onboard skilled labor and educated personnel who can contribute to your company’s growth. You can start creating a workforce in Israel without establishing a subsidiary in the country with the help of Multiplier. The PEO will help you stick to your budget and manage employee costs arising from mandatory and supplementary benefits.