Part of the Indo-China mainland, Cambodia is an attractive destination for trade and investment. Southeast Asia has been the most lucrative region in the global economy for the past few decades. Well-connectivity with its neighboring countries and the infrastructure facilities make Cambodia an ideal market for business entities.

Setting up a business in Cambodia means the proprietors must abide by the local corporate rules and regulations. Foreign entities can expand their business operations by setting up a subsidiary company in Cambodia. This article will guide you about the various types of subsidiaries, their benefits, and how to register a subsidiary company in Cambodia.

What Are the Types of Subsidiaries in Cambodia?

If any organization wants to expand its business operations by setting up a subsidiary company in Cambodia, the first thing to learn is the various kinds of subsidiaries in Cambodia. They are mentioned below.

Sole proprietorship

A sole ownership in Cambodia is a business entity that has one founder. It is solely owned and operated by one person. All the liabilities and obligations are on the owner, and sharing the profits is not required.

Partnership

Two types of business partnerships can be seen in Cambodia. They are:

- General partnership: Cambodian Law on Commercial Enterprises (LCE) states that a general partnership is a legally binding treaty between two or more persons who merge their assets and use their expertise to undertake business activities. Moreover, a general partnership must have a Cambodian nationality if:

-

- The place of business and registered office is in Cambodia.

- A person of Cambodian nationality must hold more than 51% of ownership.

- Limited partnership: A limited partnership is a legal contract between one or more general partners. In Cambodia, limited partnerships have a term of 99 years, which may be extended. A limited partnership should be registered with the Ministry of Commerce; otherwise, it will be treated as a general partnership.

Limited liability company

Cambodia’s most preferred business entity is a limited liability company (LLC). Here, an LLC can be 100% Cambodian owned, 100% foreign-owned, or a combination of both. The number of shareholders in an LLC can be between 1 and 30, per the compliance for the foreign subsidiary in Cambodia. Three types of limited liability companies can be seen in Cambodia. They are

- Private limited company

- Public limited company

- Single member private limited company

How to Set Up Subsidiary in Cambodia

If you plan to set up a subsidiary business in Cambodia, consider particular factors such as location, local dialects, business structure, etc. Before setting up the business, one must follow the checklist for incorporation of a foreign subsidiary in Cambodia. They are:

Registration

For a subsidiary company formation in Cambodia, the company must be registered through the Ministry of Economy and Finance (MEF) Cambodia Data Exchange (CamDX) system. For registration, you have to enter a proposed name. To complete the registration, you have to make a payment of KHR 40,000 (Cambodian Riel). At the completion, a Certificate of Registration will be given to the company.

Opening of a corporate bank account

After completing the registration process and receiving the certificate of registration, it can be used to open an in-country corporate bank account. As per the corporate rules for the subsidiary system in Cambodia, one must have to deposit the minimum paid-up capital. The capital should be KHR 4 million.

Tax registration

As per the rules for the taxation of foreign subsidiaries in Cambodia, tax registration must be made through the CamDX system within two weeks of company registration. After registration, the company will receive a taxpayer identification card, VAT certificate, and patent certificate.

Registration with the Ministry of Labour and Vocational Training and National Social Security Fund

To complete the process of incorporation of a foreign subsidiary in Cambodia, the company must submit an open declaration to the Ministry of Labour and Vocational Training. A separate registration must be done with the National Social Security Fund (NSSF) for companies with eight or more employees.

Benefits of Setting Up a Cambodia Subsidiary

There are several benefits of setting up a subsidiary in Cambodia. They are as follows:

Fast-growing economy

Cambodia became one of the fastest-growing economies, with an average growth rate of 8% between 1998 and 2018. As per the prediction of the IMF, Cambodia will become the fastest-growing economy in the Southeast Asian region by 2025. This rapid growth of the economy provides opportunities for foreign investors.

Lower tax rates

Companies interested in set-up business here can benefit from taxation of foreign subsidiaries in Cambodia, as it has one of the lowest corporate tax rates in the Southeast Asian region. Tax rates for small enterprises vary between 0% and 20%, whereas medium and large enterprises’ tax rates are 20%.

Foreign investment

As per the rules of incorporation of a wholly owned subsidiary in Cambodia, foreign investors can own up to 100% of the company’s ownership. Companies can fully own limited liability companies without any restriction on the shareholder’s nationality or any restriction on trade.

Use of Dollars in Cambodia

The USD is a widely accepted currency in Cambodia. As there is no restriction on foreign exchange, foreigners can earn money in USD, withdraw from banks, and spend in Cambodia. Dollarisation makes it easier for foreign investors in setting up a subsidiary in Cambodia.

Special economic zones

Cambodia has set up 22 economic zones to enhance competitiveness and attract foreign investment. Foreign entities interested in setting up a subsidiary company in Cambodia will benefit from 100% VAT exemption, 100% corporate tax relief for up to 9 years, and import and export duty exemption.

Documents to Prepare When Opening a Subsidiary in Cambodia

For the incorporation of a foreign subsidiary in Cambodia, a few essential documents need to be submitted to the Cambodian authorities. Below is the checklist of essential documents:

- The name of the subsidiary

- Details of the business location of the subsidiary

- Certificate of registration of the foreign parent company

- Letter of engagement from the parent company for the subsidiary

- Colored photocopy of the passport of each director of the foreign parent company and the subsidiary and their signatures

What Business Forms can Cambodia Subsidiaries Take?

Various business forms can be seen for setting up a subsidiary business in Cambodia. An LLC is the most preferred business form for foreign investors. The parent company can establish an LLC as a wholly-owned subsidiary or partnership. It is the most widely accepted business form. The parent company’s shareholders are only liable for the subsidiary’s debts and liabilities up to their shared capital. In contrast, subsidiaries are free to engage in business activities like any other local company except owning land because it is restricted to foreign-owned businesses.

Cambodia Subsidiary Laws

For subsidiary company formation in Cambodia, employers need to follow the corporate laws of the country. The subsidiary laws depend on the kind of business entity they can choose.

Setting up an LLC requires $1,000 as the paid-up capital, two shareholders, and one director. Neither do they have to be Cambodian nationals, nor do they have to reside in the country.

According to domestic law, setting up a subsidiary company in Cambodia requires a physical office space, a business name in Khmer (the official language of Cambodia), and a registered real estate agent. Moreover, companies must file annual tax returns and register for VAT.

Post Incorporation Compliance

After the initial registration process, companies must follow the following steps to set up a subsidiary in Cambodia. They are:

- After registering with the Ministry of Commerce, every business entity must register with the Department of Taxation to obtain a Taxpayer Identification Number (TIN) and pay VAT. This must be done within 15 days.

- Companies need to notify the Ministry of Labour and Vocational Training for the hiring of local employees, wage payment, health, and safety precautions, and leave policies as per domestic law.

- For setting up a subsidiary in Cambodia, it is essential to have a bank account in the company’s name. Upon the completion of the opening of a bank account, one must have to update the bank account details on the online business registration platform.

- The company has to submit two copies of its original statute and the updated bank statement to the Department of Business Registration within 30 days of issuing the certificate of registration.

- Each business has to file an annual declaration to the Ministry of Commerce on the date of online re-registration.

Taxes on Subsidiaries in Cambodia

Taxation of foreign subsidiaries in Cambodia varies on the type of entity it is. They are:

Corporate income tax

For small taxpayers, rates are progressive between 0% to 20%. For medium and large taxpayers, the corporate tax rate is 20%.

Minimum tax

The minimum tax applies to business entities with improper accounting records. It is fixed at 1% of the total turnover, regardless of whether the company is profitable or lost.

Value added tax

Value-added tax or VAT is levied on the sale of goods and services. The fixed rate is 10%, while some businesses are eligible for 0% VAT if they are engaged in export-related activities, such as the garment, textile, and footwear industries.

Industry-specific tax

Companies engaged in oil and mineral exploration activities will be levied a 30% tax. For Insurance companies’ the tax rate is 5% on the gross premium income, and the rate is 20% if the income is derived from non-insurance or reinsurance activities.

Tax Incentives for Companies Setting Up a Subsidiary in Cambodia

The benefit of setting up a subsidiary company formation in Cambodia is that the Royal Kingdom of Cambodia allows various tax incentives to attract investment.

- Certain business sectors and activities in Uruguay are eligible for income tax exemption for a period of 3 to 9 years.

- In Uruguay, locally made products used as production inputs are exempt from VAT (Value-Added Tax).

- 100% tax exemption for business entities setting up their establishments in special economic zones for nine years.

- Special incentives are available for those sectors that have contributed to national development.

Other Important Considerations

Before setting up a subsidiary in Cambodia, one must strictly adhere to the country’s domestic laws. Also, one has to plan the schedule before proceeding because it may take weeks or months to set up the business. So, it may require frequent travel back and forth to Cambodia to ensure everything goes smoothly.

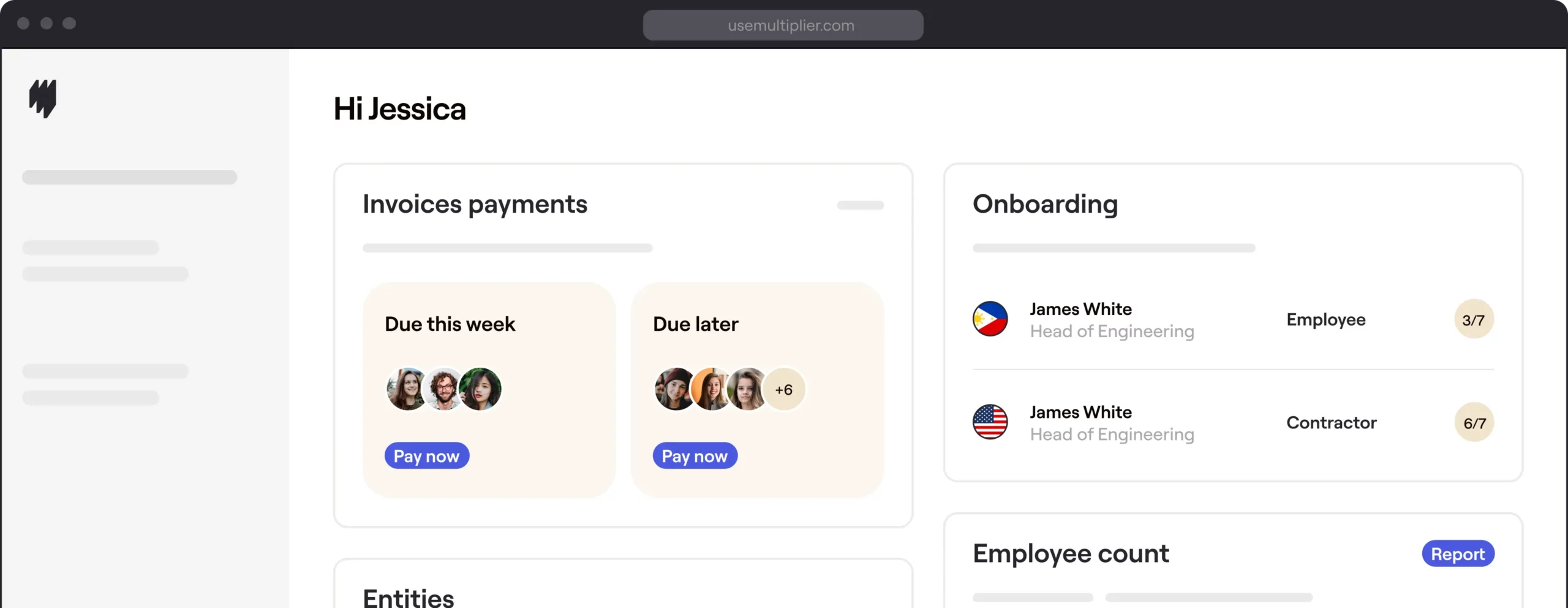

How Can Multiplier’s Employer of Record Help You Hire & Expand in Cambodia

While there are fewer restrictions on setting up a subsidiary in Cambodia, managing it on foreign soil in compliance with local subsidiary laws can be tedious. But if you hire a PEO firm, it can reduce your burden in terms of eliminating language barriers and managing different corporate laws of the country for the early incorporation of your company.

This is where Multiplier comes in. Multiplier is a leading PEO platform with a presence in more than 150 nations. Our professional experts can help you hire global talents and manage their salary management, benefits, tax, and insurance-related services on your behalf. Thus, you and your organization can save time in business strategies.