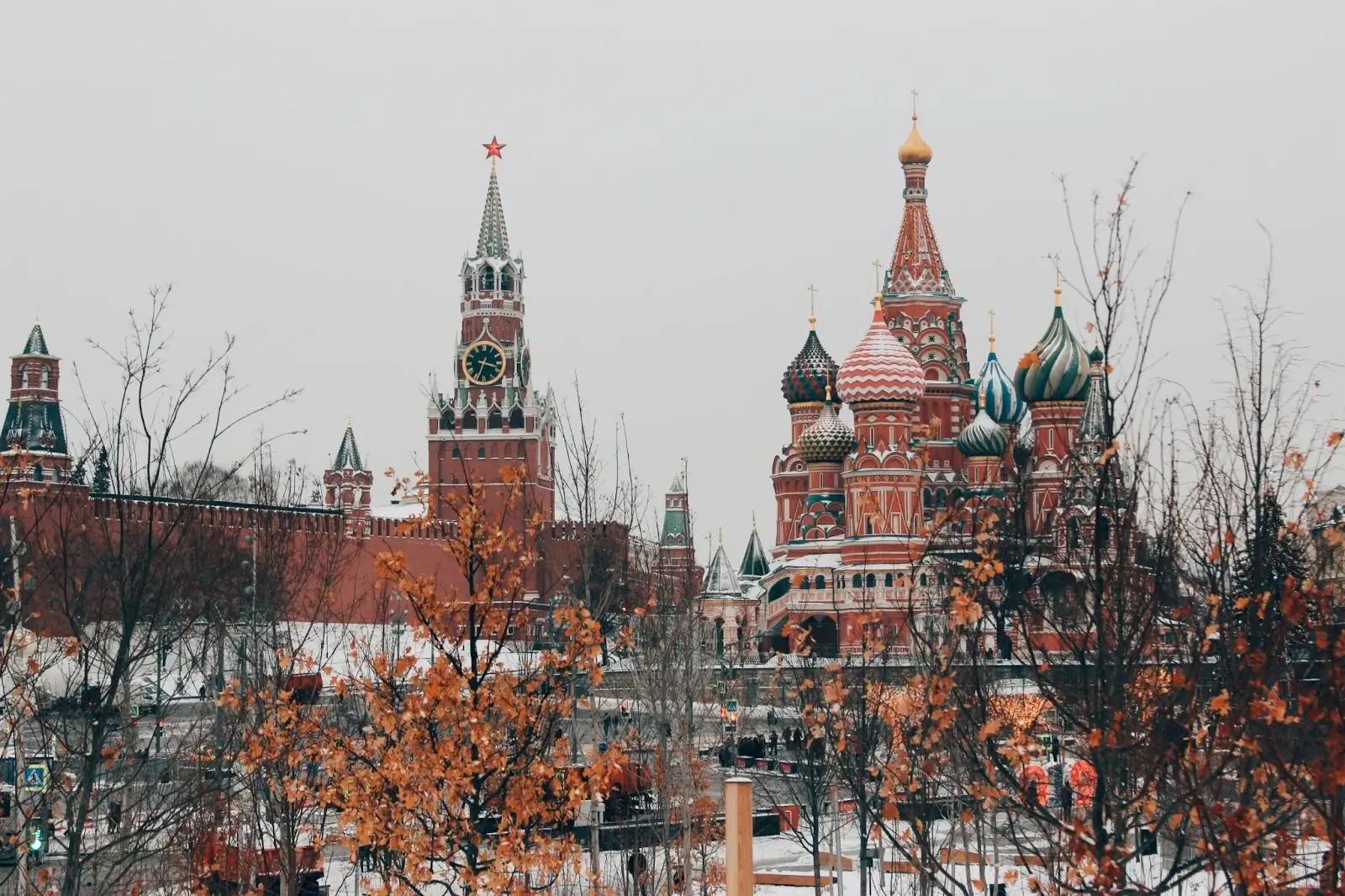

One of the benefits of hiring a remote team is the access to global talent. Gone are the days where your staffing options were limited to your physical location. Technology has enabled us to keep in touch with the entire world, therefore giving us the ability to access a global talent pool. As one of the top 10 countries with the largest populations in the world, you can definitely consider Russia as a country to tap for your future talent.

If you’ve already been looking at Russia as your next source of talent but are unfamiliar about the hiring process, local labor law requirements, and more, we’ve got you covered. We listed down some FAQs that cover almost everything you need to know about the topic.

1. Why do people hire remote talent from Russia?

As the largest country in the world by area and one of the top 10 countries with the largest population in the world, Russia is a top choice for remote talent because of the quantity of available talent. Besides the sheer number of potential employees, Russia also has quite a number of skilled talent who have finished tertiary education. It is common for most Russians to obtain a college degree, with the top 3 most popular degrees being Education, IT, and Medicine.

An article in the Financial Time states, “A legacy of the Soviet Union, most Russian cities boast universities, technical colleges or other educational institutions for students after high school. The majority of places are free of charge, according to government data. The OECD estimated in 2016 that 54% of Russian adults have tertiary education, the second highest level among the OECD’s members and partner countries.”

Besides this, the cost of living and generally low wages in Russia also make it ideal for employers. The average monthly minimum wage in Russia ranges from RUB 12,792 (USD 172) to RUB 20,589 (USD 277), depending on the employee’s location. The cost of living in Russia is also roughly 77% lower than the United States and roughly 61% cheaper than Singapore.

2. Where do I look for remote talent in Russia?

When looking for the best places in Russia to hire remote talent, you typically want to hire talent from the following regions:

- Moscow

- St. Petersburg

- Novosibirsk

- Nizhny Novgorod

- Kazan

These regions have a higher economic activity compared to the rest of Russia, and have larger business and tech hubs with more available English talent. Getting graduates from the following top universities in the country is also a plus:

- Lomonosov Moscow State University

- Saint Petersburg State Polytechnic University

- Moscow Institute of Physics and Technology

- Novosibirsk State University

- Tomsk State University

Another way to hire talent is to post listings on popular job sites and portals or hire through a trusted recruitment agency. In Russia, the most popular jobs portals are:

3. What is the average salary of a Russian remote employee?

As of 2021, the minimum monthly wage in Russia is RUB 12,792. However, different areas, regions, or cities in Russia may have a higher minimum wage. For example, in Moscow, the minimum wage is RUB 20,589.

Here’s an approximation of the average monthly salary for seven different positions:

| Job Title | Average Salary Range (RUB) | Average Salary Range (USD) |

| Customer Service Representative | 37,100 – 56,700 | 493 – 754 |

| Software Engineer | 95,700 – 144,000 | 1,272 – 1,915 |

| Software Developer | 98,200 – 156,000 | 1,306 – 2,074 |

| Data Scientist | 162,000 – 249,000 | 2,154 – 3,311 |

| UX Designer | 70,700 – 112,000 | 3,500 – 7,000 |

| Project Manager | 129,000 – 198,000 | 1,715 – 2,633 |

| Sales Representative | 63,400 – 101,000 | 843 – 1,343 |

4. What are the computations for income tax in Russia?

| Net Taxable Income (RUB) | Contribution (%) |

| Annual income is less than or equal to 5 million | 13% |

| Annual income is more than 5 million | 15% |

| Non-residents | 30% (flat rate) |

Due to COVID-19, the Russian freelance market has exploded. An article in the Financial Times states, “The pandemic’s enforced shift to remote working has unlocked the opportunity for many recruiters to tap far more of the country’s 145m strong population, the majority of whom are based thousands of miles from businesses in Moscow or St Petersburg, across a vast country spanning 11 time zones.”

While this positive consequence of the pandemic is projected to reshape the landscape of work in Russia, it does come with some drawbacks. One big issue with freelancers is payment of taxes. Without a local registered company withholding income tax for them, freelancers can fail to pay their income tax or simply state that their income is below taxable income. You can help your Russian employee comply with local taxation laws by using Professional Employer Organizations (PEOs) like Multiplier who will take care of payroll and taxes for you.

5. What are the working hours in Russia?

Russian employees usually work an average of 8 hours a day, across 5 days a week. Russians are also required to have at least a 30 minute rest break each day by law. This is normally extended to an hour by most companies. Should you require your employee to do overtime, here is how you can calculate overtime pay:

| Period of Overtime | Hourly Salary Paid (%) |

| First 2 hours | 150% |

| Next 2 hours | 200% |

According to Russian law, overtime working hours should also not exceed 4 hours in 2 successive days and 120 hours per year.

6. What benefits am I required by law to provide a Russian employee?

Vacation Leaves

After six months of service, employees in Russia are entitled to 28 calendar days of vacation each year. Employees may be entitled to additional paid leave if they work in harmful and dangerous working conditions, have irregular working hours, work in the far North regions and in some other cases stipulated by the law.

Sick Leaves

Employees can take sick leave in the event of illness or injury. Sick leave can also be granted to an employee taking care of a sick child or sick relative. In Russia, employees don’t receive their regular salary during sick leave; instead, they receive a temporary incapacity allowance paid from the Social Insurance Fund of the Russian Federation from insurance payments made by the employer (except for the first three days of each temporary disability period of an employee, which should be compensated by an employer). This amount depends on length of service and varies from 60%, 80%, or 100% of an employee’s average salary for the past two years, but may not exceed RUB 2,301 per day.

| Days of Sick Leave | Contributor |

| First 3 days of sick leave | Employer |

| 4th day onwards | Social Insurance Fund |

Parental/Childcare Leaves

These leaves are granted to mothers or fathers, grandmothers, grandfathers, and other relatives or guardians of a child. Note: Only one parent/person can take parental leave. During parental leave, the employee can work part-time or from home, and is entitled to receive a monthly allowance until the child reaches 18 months old. The allowance is equivalent to 40% of the person’s average salary over the previous two years, with a cap at RUB 27,984.66 in 2020.

Maternity Leaves

Female employees are entitled to 140 days of paid maternity leave – 70 days before birth and 70 days after birth. If the employee has complications during birth, this may be extended to 86 days, and in the case of multiple births 110 days.

Other benefits expectant mothers can get are the following:

- Can work part-time as per their request

- Cannot be dismissed by the employer except in the case of the employer’s liquidation, a gross violation of the employee’s job function, disclosure of protected, confidential information, etc.

- Cannot be sent on business trips

- Cannot be instructed to work overtime

- Cannot be instructed to work during nights

- Cannot be instructed to work weekends

- Cannot be instructed to work during public holidays

During maternity leave, women receive an allowance from the Social Insurance Fund out of insurance payments made by the employer. The allowance corresponds to 100% of the employee’s average salary over the previous two years. A maximum amount is determined every year (RUB 2,301.37 per day in 2020).

Insurance and social security

The Russian Federation has a system of obligatory social insurance. Employers pay insurance premiums in amounts set by law from the moment the employment contract commences. The amount of social security contributions is calculated based on an employee’s monthly salary. Generally, the employer must pay:

| Benefit | Contribution (%) |

| Pension Fund | 22.0% (capped at RUB 1,465,000/year), with 10% for any amount exceeding this |

| Social Insurance Fund | 2.9% (capped at RUB 966,000/year) |

| Medical Insurance Fund | 5.1% |

| Accident Insurance | 0.2% to 8.5% of the wage fund, depending on the type of work |

7. What other benefits or allowances can Russian remote employees be given?

While not mandated by law, it is quite common to provide non-taxable allowances for your remote employees, and it’s expected by the employees. These can include stipends for business and equipment expenses, internet and telecom allowances, and even transportation allowance – if your remote employee works from a co-working space.

Here are a couple of popular employee perks and fringe benefits for Russian employees, according to Asinta:

- Mobile phones – Around 97% of multinational companies provide mobile phones to all employees for business and private use.

- Meal vouchers – More than 70% of multinational companies provide meal allowances for employees. The typical monthly meal allowance and/or voucher amount is RUB 5,000 – 6,000 in Moscow and RUB 3,000 – 4,000 in other regions.

- Supplemental sick pay – In accordance with current Labor Law, days 1-3 of sick leave are paid by an employer based on an average salary and seniority of an employee. From day 4 payments are made from the Social Security System based on a minimum wage. To top-up statutory sickness benefits employers provide additional sick pay (at company expense or by extending Life insurance policies with this option). In this case salary continues at 100% up to a 14-day maximum. Approximately 50% of companies provide such supplemental sick pay.

- Gym memberships – These are popular with companies whose average employee age is under 30. Such companies sometimes prefer the benefits of a gym membership to group medical insurance.

- Bonus schemes – It is very common to pay bonuses at the end of a reporting period (usually once a year but some companies practice quarterly or semi-annual payments of bonuses) to those employees who achieved relevant KPI.

- Well-being programs – Some companies provide various activities for employees to maintain a healthy lifestyle.

- Additional days of annual leave – Employers may grant all their employees extra days off (on average – not more than 10 days) or offer such a benefit to employees who achieved significant success in a reporting period.

- Additional pay during maternity leaves – This can be in the form of cash or a top up of the salary but can also be material aid.

8. What are the regulations on working during the holidays in Russia?

As of 2021, Russia currently has a total of 14 public holidays. If you require your Russian employee to work on weekends and/or a public holiday, you must pay them 200% of their regular daily pay rate. For an updated list of Russian holidays, click here.

9. How do I hire a remote employee in Russia?

If your business is registered in another country, the easiest way to hire a Russian remote talent would be through a Professional Employer Organization. PEO platforms like Multiplier make it easy for you to hire remote talent, comply with local labor laws, and pay your employees in time. Instead of having to jump through the legal and financial hoops of setting up a business entity in another country, Multiplier will act as your representative and abide by all the necessary laws for you.

If you want more details on how to hire a remote team legally, you can check out our article here.

10. Are probation periods necessary?

While probation periods aren’t necessary when hiring Russians, it is quite standard for regular employees to have a 3 month probation period. If you’re looking to hire a top executive in the form of a chief account, branch head and/or representative, etc., the probation period may be extended to 6 months.

11. How do I pay a Russian remote employee?

Russia usually follows a bi-monthly payment cycle. Salaries must be paid to Russian employees at least once every half month. The date of compensation is usually predetermined in the employment contract. Should an employer neglect or delay payment for more than 15 days, Russian employees have the right to stop working, given that they give prior notice to their employer.

The easiest way to pay your Russian remote employees would be through PEO platforms like Multiplier. With a PEO platform, you won’t have to worry about payroll or compliance with local taxes and labor laws as they will be taking care of everything for you.

12. Can Russian remote employees be paid in foreign currencies?

As per the local law, Russian employees must be paid in Russian Rubles (RUB). Payment in other foreign currencies – whether in cash or through bank transfer – may be considered as a violation of the law by state authorities.

This can be quite troublesome for foreign nationals looking to hire Russian remote employees, which is why using PEO platforms like Multiplier can be extremely advantageous. Multiplier can help set up a contract, enable regular payment cycles in the local currency, and ensure labor law and taxation compliance for you.

By paying your Russian remote employees in their local currency, you’ll be able to avoid fluctuations in conversion rates, which will help make tax calculations and contributions to benefits such as healthcare and social security easier.

13. How do I terminate a Russian remote employee?

An employment contract can only be terminated in accordance with a strict list of general reasons, including:

- Mutual agreement

- On the employee’s/employer’s initiative

- Expiry of the contract

- Other specific grounds

Employment can only be terminated on the employer’s initiative for certain reasons, including:

- The employer’s liquidation

- Redundancy

- Numerous failures by the employee to fulfil official duties without good reason, provided a reprimand has been issued

- Gross misconduct

- Unauthorised disclosure of confidential information

- Other rarely used grounds

In general, under the current legislation, dismissal is not feasible without prior notice being served on the employee. The duration of the notice period depends on the grounds for termination. This ranges from 0 (if the employment contract is terminated for cause) to 2 months (in the case of liquidation of the employer organization).

The employee can terminate the employment on his/her own initiative by providing the employer with two weeks’ prior written notice (for directors, one month’s notice). The indicated notice periods cannot be extended in the individual employment contracts.

The severance payment rate depends on the reasons for the termination and generally amounts to an average month’s wage. Severance pay of two weeks’ average earnings is paid to employees in the event of cancellation of an employment contract for the following reasons:

- Failure to conform to the standards of the job held or work fulfilled as a result of the employee’s health precluding them from continuing to perform specific job duties.

- The employee is called up for military service or assigned to alternative civilian service in place of military service.

- Reinstatement at work of the employee that previously held the employee’s position.

- The employee’s refusal to relocate when the employer moves to another locality.

- Severance pay of one month’s average earnings is paid to employees in the event of termination due to redundancy or liquidation.

- In the event of termination due to mutual agreement, the amount of severance is usually established in the termination agreement.

To calculate severance pay, you can check out the data below:

Reason(s) for Termination

- Company liquidation

Severance Pay

1 month’s salary plus the average monthly salary during the period they are looking for a new job (but for no longer than two months from the date of termination)

Reason(s) for Termination

- Failure to conform to the standards of the job held or work fulfilled as a result of the employee’s health precluding them from continuing to perform specific job duties.

- The employee is called up for military service or assigned to alternative civilian service in place of military service.

- Reinstatement at work of the employee that previously held the employee’s position.

- The employee’s refusal to relocate when the employer moves to another locality.

- Severance pay of one month’s average earnings is paid to employees in the event of termination due to redundancy or liquidation.

- In the event of termination due to mutual agreement, the amount of severance is usually established in the termination agreement.

Severance Pay

2 weeks’ average earnings

Learn more about how you can easily hire remote talent from Russia with the help of Multiplier. You can visit our website or contact us today.

Binita Gajjar

Content Marketing Lead

Binita is a Content Marketing Lead at Multiplier