The rising costs of food, petrol, and other necessities are quickly eroding living standards. Hourly earnings are decreasing at the quickest rate in decades, even adjusted for inflation. If the U.S. consumers are struggling due to high inflation, Europe and other places have seen steep hikes in, interest rates. Does this mean we’re in a recession?

According to both United States’ President Joe Biden and Federal Reserve Chair Jerome Powell, the recession is not here yet as there are still strong labor market trends and rising wages. The National Bureau of Economic Research has not called it out as well, with most economists opining that it doesn’t meet the formal definition, which is based on a broader set of indicators, including measures of income, spending, and job growth.

But the fears of a recession would naturally make businesses anxious. After all, the last recessions were crippling for many companies.

When Do We Call a Recession?

Before we go into determining if the world is in a recession. Let us first define what a recession is.

According to the CEPR, the world economy has had four global recessions in the last seven decades: 1975, 1982, 1991, and 2009. During each of these events, annual real per capita global GDP declined, and this contraction was accompanied by a weakening of other key measures of global economic activity. Meaning, when GDP decreases for two consecutive quarters. This is frequently followed by other economic indicators such as growing unemployment rates, rising cost of goods, and dropping of stock prices.

However, in today’s current situation the world is slowly recovering from a pandemic. The “formal” definition of a recession may not apply.

The Conflicting Views: This Recession Will Not Be Similar to Your Grandfather’s Recession

Organizations are still wondering whether we are currently in a recession or possibly entering into a recession. This could possible be because reacting to recession or inflation pressures is often defined by playbooks..

But companies must keep in mind that the current environment is different. Almost none of today’s companies were around to navigate disruptions on the scale of what the world has faced these past few years. The pandemic, geo-politoical tensions, supply chain issues, and scarring labour shortages have already made the ecosystem a heady mix of challenges. Adding a dash of recession uncertainty makes this an entirely new ground for companies all over the world. But there are still silver linings…

Demand for labor is still high

In most recessions, both economic output and employment fall at the same time. Lower revenue forces businesses to reduce staff, resulting in higher unemployment. Higher unemployment eventually leads to lower consumer spending, creating a vicious cycle.

If we’re in a recession, how come the job market is still thriving?In the US, unemployment remains at a record low in 2022 and there have been multiple reports of talent shortages. In the US, July’s official unemployment rate was 3.5%, matching a 50-year low reached shortly before the pandemic. There have in fact been talent shortages in different industries which Goldman Sachs called it “historically unusual.”

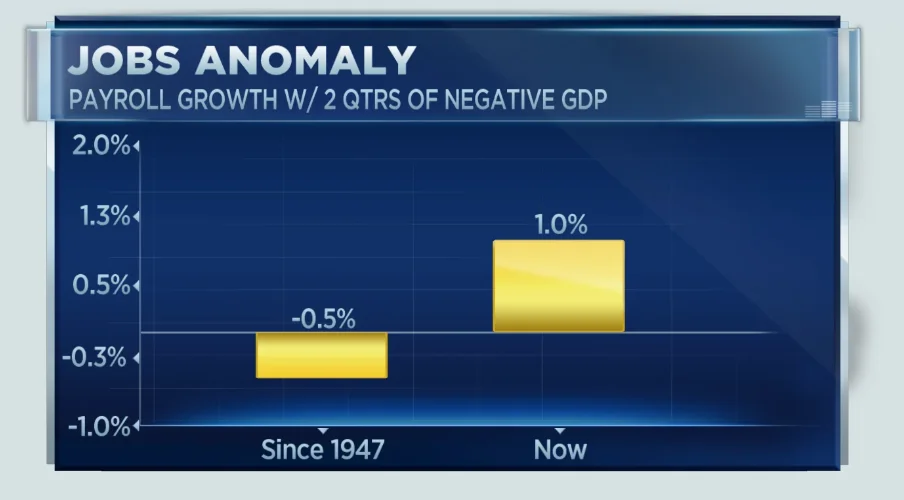

Moreover, a CNBC analysis indicated that when gross domestic product has been negative for six months, as has been the case for 2022, payrolls fall by an average of 0.5 percentage point. But this year, the job count actually has increased by 1%.

Source: CNBC

Furthermore, the Dallas Federal Reserve said that its analysis of multiple data points revealed that most indicators provide strong evidence that the U.S. economy did not enter a recession in the first quarter of the year.

Wages are still rising

Another key difference is the speed at which companies are able to raise wages. With the labor market being hot, wages are rising faster than at any time amid a pandemic

According to Willis Towers Watson’s July Salary Budget Planning Report, companies are budgeting an overall average increase of 4.1 percent for 2023, compared to the actual average increase of 4 percent in 2022.

Moreover, they concluded that 96% of firms globally have grown salaries — and salary budgets — at rates not seen in nearly two decades. In addition to increasing salaries, many businesses are utilizing non-monetary techniques to lure talent.

For example, in the same report, 69% of respondents have improved workplace flexibility and 19% plan to in the future.

Countries are opening up borders for skilled labors

If we’re in a recession, how come countries like New Zealand, Canada and Australia are opening their borders to skilled workers?

According to Y-axis, New Zealand opened its borders to skilled workers in July 2022, permitting cruise ships and skilled personnel to enter the country.

Canada is doing the same. Recently, Canada held two draws where in Ontario invited over 1,500 skilled trades individuals, and Saskatchewan gave over 1,700 invitations, higher than the past year’s draw.

As job openings continue to climb and an aging citizenry continues to make up a disproportionate share of the population, Canada has been desperate to capture and invite immigrants which will have a larger role to play in the labor market in the coming years.

So, are we in a recession? What’s clear?

What’s clear to everyone is the economy is slowing, prices are rising at their fastest pace in decades, and the housing market has started cooling as interest rates rise aggressively. But when you look at factors like jobs, companies are still creating jobs and hiring aggressively.

According to the Wall Street Journal, a recession is certainly possible. it may lead to a recession if countries and companies are not being cautious with their decisions. The way countries tackled the previous recession shouldn’t be the same way we’ll tackle the upcoming recession.

Companies could look at the current economic downturn to strengthen their talent bases. Making the best of the talent market could give companies the muscle needed to navigate the recession, should it occur. The drum beat for the recession may get louder, but companies should know that it’s not all doom and gloom yet.