Think of Egypt as your launchpad to Africa and the Middle East—without the complexity

Egypt’s strategic position bridging Africa and the Middle East, coupled with its Free Zones and tax incentives, make it a compelling choice for business expansion. With the Suez Canal driving global trade and cost-effective operations supporting scalable growth, Egypt offers businesses an unparalleled mix of opportunity and infrastructure. Whether you’re leveraging its investor-friendly policies or tapping into its regional trade networks, Egypt provides a solid foundation for sustainable success.

The business benefits of registering your company in Egypt

Egypt is emerging as a top destination for global businesses, offering key advantages for managing compliance, operations, and payroll.

Here’s why Egypt is an ideal choice for your business expansion:

- Access a growing market of over 100 million consumers, with a rising middle class driving demand.

- Leverage Egypt’s Free Zones (such as Suez Canal Economic Zone) for tax incentives, duty exemptions, and streamlined customs procedures.

- Benefit from cost-effective labor and competitive operating expenses, particularly in sectors like manufacturing and IT.

- Establish operations quickly with clear regulatory guidelines and simplified processes through entities like the General Authority for Investment.

- Enjoy a strategic location that connects Africa, the Middle East, and Europe, offering a gateway for regional trade and global logistics.

- Take advantage of government incentives in key sectors such as manufacturing, IT, and logistics under the Investment Law.

Egypt offers a stable, dynamic business environment perfect for companies seeking growth in a strategically important region.

Next, we’ll look at your options for company registration, including standard registration, free zone setups, and Employer of Record (EOR), so you can choose the right approach for your business.

What is the difference between standard company registration and EOR in Egypt?

Egypt offers two primary options for establishing a business, each tailored to different needs:

Aspect | Standard Registration | Employer of Record (EOR) |

Purpose | Establishes a legal entity, granting full control over operations and finances. | Allows hiring in Egypt without setting up a legal entity; the EOR manages compliance and employment. |

Control | Provides complete operational and financial control. | Operational control over employees; EOR handles administrative and legal tasks. |

Compliance | Full responsibility for adhering to Egyptian labor laws, tax regulations, and reporting. | EOR ensures compliance with labor laws, taxes, and reporting on your behalf. |

Setup Time | Longer, due to documentation, legal procedures, and potential government approvals. | Quick, enabling immediate hiring and operations. |

Cost | Includes entity setup costs, licensing fees, and ongoing operational expenses. | Service fees to the EOR, which are often more cost-effective than establishing an entity. |

Scalability | Best for long-term, substantial physical operations. | Highly flexible for workforce scaling without the need for an entity. |

While standard registration provides full operational control, it can be time-intensive and costly. An Employer of Record (EOR) simplifies workforce expansion by managing compliance, payroll, and administrative tasks, making it an efficient solution for businesses looking for a fast and flexible entry into Egypt.

Let’s explore how EOR streamlines your company registration and employee onboarding in more detail.

How EOR simplifies Egypt company registration

Expanding into Egypt doesn’t have to involve long waits or unnecessary complexities. With an EOR, you can jumpstart your operations in 2025, hire local talent, and stay compliant without the headache of setting up a local entity.

Here’s how an EOR accelerates your entry into Egypt:

- Skip the lengthy entity setup process. An EOR becomes your legal employer, so you can focus on scaling from day one.

- Say goodbye to payroll and tax management. The EOR takes care of all administrative tasks, ensuring your operations run smoothly.

- Stay fully compliant with Egypt’s labor laws and tax regulations, avoiding legal risks and penalties.

- Save on setup and operational costs by bypassing the need for local entity registration, allowing you to reallocate resources to growth.

- Scale your workforce quickly and flexibly, adapting to market demands without committing to long-term legal complexities.

- Tap into Egypt’s skilled talent pool without the hurdles of navigating local hiring regulations or complex recruitment processes.

- Offer competitive, locally compliant benefits, all administered by the EOR, so your team is taken care of from day one.

- Minimize compliance risks with an EOR’s local expertise, ensuring your business stays on track while expanding.

An EOR makes entering Egypt easier, faster, and more cost-effective—giving you the freedom to focus on growing your business while EOR handles the legal and operational details.

Your guide to registering a company in Egypt

Setting up a business in Egypt is a straightforward process when you have the right strategy in place. Here’s a quick, efficient guide to help you get started and expand with ease:

Step 1: Choose Your Business Structure

Setting up a legal entity setup in Egypt can be strenuous given the paperwork and procedures. An Employer of Record (EOR) helps you bypass the process by acting as your legal employer, managing payroll, compliance, and onboarding. This allows you to focus on scaling your business efficiently—without the need for a local entity.

However, if a local entity suits your business goals better, the next step is choosing the right business structure.

Options include:

- Limited Liability Company (LLC): Ideal for small to medium-sized businesses, with limited liability and flexible ownership.

- Joint Stock Company (JSC): Suitable for larger businesses, requiring three or more shareholders and higher capital.

- Branch Office: For foreign companies wanting a local presence while retaining control.

- Representative Office: For non-revenue-generating activities like marketing and research.

Each structure has different legal and financial implications, so choose based on your goals.

Step 2: Submit essential documents

After choosing your structure, submit the following documents to the General Authority for Investment and Free Zones (GAFI) for approval:

- Memorandum of Association (MoA)

- Articles of Association (AoA)

- Proof of business address

These are necessary to complete the registration process.

Step 3: Open a corporate bank account

You’ll need a corporate bank account to manage your finances. Banks typically require:

- Company registration documents

- Proof of tax compliance

- Identification documents for company directors

Managing payroll in Egypt doesn’t have to involve the hassle of setting up a local bank account. Multiplier’s global payroll solution offers a smarter alternative, enabling seamless payroll processing across multiple currencies while ensuring compliance with Egyptian tax regulations. By reducing risks and eliminating complexity, Multiplier lets you launch and run operations—without a bank account.

Step 4: Ensure tax compliance

To operate legally, register for a Tax Identification Number (TIN) and VAT if needed. Manage payroll taxes, social insurance, and employee contributions to ensure compliance.

Working with a global payroll provider like Multiplier gives you access to local expertise and simplifies these tasks, helping you stay on track with Egyptian regulations.

Understanding the costs associated with setting up in Egypt is the next step. Let’s break down the expenses to help you plan.

The real cost of registering a business in Egypt

For businesses planning to set up operations in Egypt, here’s a detailed breakdown of the costs to help you prepare:

1. Registration costs

- State fee: Registering a company with the General Authority for Investment and Free Zones (GAFI) typically costs between $100 and $300, depending on the entity type.

- Initial capital: While certain business types may have no minimum capital requirement, others (e.g., LLCs) often require starting capital of $1,000 or more.

- Legal services: Engaging a local attorney or consultant for registration can cost between $500 and $1,500.

- Business license fees: Industry-specific licenses may range from $100 to $500 annually.

2. Annual maintenance costs

- Accounting services: Professional accounting fees start at around $50 per month, depending on the size and complexity of your business.

- Tax filings: Filing taxes, including VAT and corporate income tax, incurs costs ranging from $200 to $500 per year.

- License renewals: Renewing business or operating licenses costs between $100 and $300 annually.

- Corporate bank account fees: Egyptian banks typically charge $10 to $30 per month for account maintenance.

3. Additional considerations

- Work permits: For expatriate employees, permits range from $500 to $1,000 annually.

- Office space: Leasing office space can cost anywhere from $300 to $1,500 monthly, depending on location and size.

An EOR eliminates many of these expenses by managing payroll, compliance, and legal requirements under a single, predictable fee. It’s an efficient alternative to traditional entity setup, saving you time and reducing overhead.

Let’s compare the costs of standard registration versus an EOR to determine the best fit for your business.

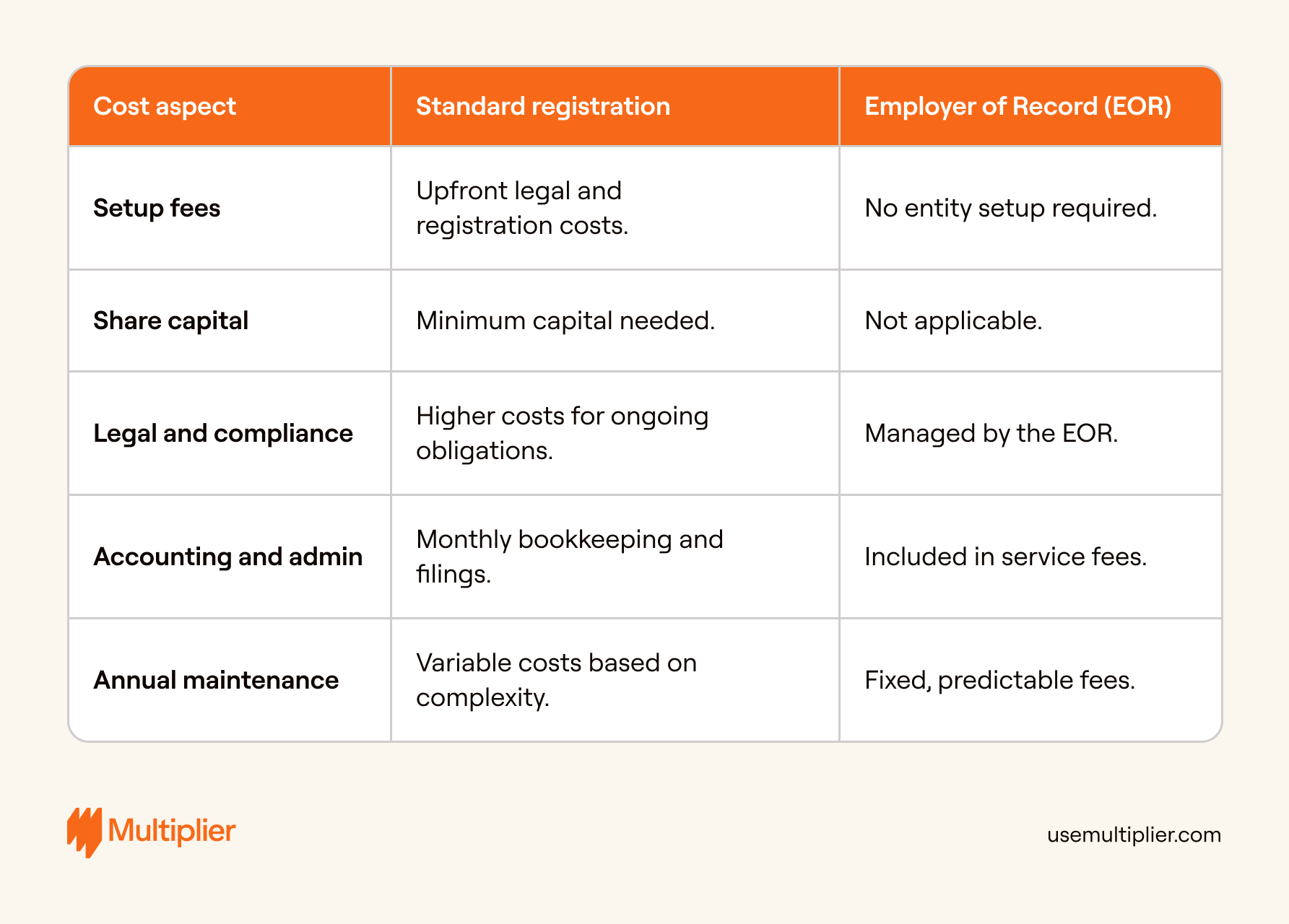

Cost Comparison: Standard Registration vs. EOR

Here’s a quick look at the cost differences between standard company registration and using an employer of record (EOR):

While traditional company registration involves significant upfront and ongoing costs—such as securing capital, handling legal compliance, and maintaining complex administrative systems—an EOR simplifies the process. With fixed, predictable monthly fees, an EOR manages most compliance, payroll, and operational responsibilities, allowing you to focus on growing your business.

By partnering with an EOR like Multiplier, you can accelerate your entry into Egypt, bypass the traditional setup delays, and avoid the complexities of managing local compliance, freeing you to scale quickly and efficiently.

Simplify your expansion into Egypt with Multiplier

Entering the Egyptian market doesn’t have to be complicated. With Multiplier’s Employer of Record (EOR), you can bypass the usual hurdles and focus on scaling your business while we manage the critical tasks.

Why Multiplier is the right choice for your Egypt expansion:

- Tap into Egypt’s talent pool, scale globally: Easily access Egypt’s diverse workforce with the help of our local HR team. We handle everything from contracts to onboarding, so you can expand with confidence and speed.

- Effortless payroll management: Let us take care of your payroll needs—accurately and transparently. Multiplier ensures full compliance with Egypt’s tax and labor regulations, so your business runs smoothly without interruptions.

- Centralized HR operations: With Multiplier’s platform, managing everything from onboarding and expenses to approvals and time-off requests is simple. Get full visibility and control over your teams in Egypt—all in one place.

- Compliance made easy: Stay on top of Egypt’s labor laws and tax regulations with our dedicated compliance expertise. Whether it’s meeting tax requirements or ensuring employee protections, we handle the details to keep your operations legally sound.

- Attractive benefits packages: Stand out in Egypt’s competitive job market with benefits tailored to local expectations. We manage all benefit-related administration, ensuring your team gets the support they deserve.

- Always available support: With our 24/5 customer support, Multiplier ensures that both you and your employees receive the assistance you need at every step. Your operations are secure with GDPR compliance, SOC 2 certification, and AWS-backed security.

Multiplier transforms your expansion into Egypt into a seamless experience. We handle everything—from managing payroll and benefits to scaling your workforce and ensuring compliance with local laws.

By taking care of the operational complexities, Multiplier enables you to focus on strategic growth, giving you the flexibility to scale rapidly and efficiently in a dynamic market.

Book a Demo with Multiplier EOR.