Malta has one of the fastest-growing economies among all the European Union countries. Besides being known for its landscape and warm climate, Malta attracts entrepreneurs and investors for its business-friendly environment. From immigration opportunities to a stable economic system and fiscal benefits, the country has everything you need to start a business in Malta.

Although small, the island nation’s diversified economy can help you gather the right target audience for your business. Since the 1950s, Malta’s government has welcomed startups and investors to expand their economy and create more job opportunities. With a population of more than 400,000 and more than 1.2 million tourists visiting the country every year, you can expect to promote your business amidst a large target audience.

Besides, the tax system of Malta promotes a refundable tax credit scheme and double taxation agreements. The country also has an imputation tax system. Moreover, the World Bank Ease of Doing Business rankings in 2020 gave Malta a high score of 88.2 regarding starting a business in the country. Thus, plenty of reasons exist to set up an offshore company in Malta.

However, starting a company in a foreign land requires proper knowledge of its rules and regulations. Read on to learn more from this detailed guide to starting a business in Malta.

Benefits of Starting a Business in Malta

The advantages of doing business in Malta are as follows:

Stable financial sector

Malta offers a robust banking system and has developed itself into a beneficial European financial service center. Some of its innovative fund structures that help businesses and startups include Professional Investor Funds, Alternative Investment Funds, Private funds, and the UCITS.

Foreign investors with businesses of any stature can avail of supportive schemes like Business Advisory Services, Micro Invest, Business START, Development and Research Grant Schemes, etc., for their business growth.

The country’s GDP growth has also been impressive, with a 10.3% annual growth rate resulting in a total GDP of $17.36 billion for 2021. Malta has always weathered severe economic problems with minimum losses, maintaining an above ‘A’ credit rating in recent years.

Dynamic tax and legal system

Malta has adopted a tax imputation system that extends to shareholders regardless of residency status and is among the few countries to do so. Under this system, the corporate tax rate is equivalent to the highest tax bracket, and any difference is credited to the individual taxpayer through imputation. In cases where the imputation credits exceed the actual tax liability on the grossed-up income, the revenue office refunds the excess amount.

Regarding tax refunds, there are four different types in Malta. The standard corporate tax in Malta is 35%, the same as the personal income tax rate. The 6/7th and the 5/7th refunds amount to 5, and 10% of the taxes paid, respectively. In contrast, the 2/3rd refund is only offered to companies, not shareholders. However, the 100% refund applies only to participating holdings in Malta.

Educated workforce

The workforce of Malta is well-educated, especially in the 15 to 24 age group. This aids companies due to the availability of young, skilled employees.

In a UNESCO survey conducted in 2011, the country has a 98.9 literacy rate for the 15 to 24 age group. This percentage has been almost stable for more than a decade now. World Bank data shows Malta’s current adult literacy rate as 95%.

Besides, English is the official language of Malta. Therefore, communication does not stand as a barrier to your business growth. Apart from English, the people in Malta have a good grasp of Italian, German, French, and Spanish. Being a multilingual nation, you can communicate seamlessly with the government and the clients.

Easy transportation

Although Malta is an island, you can reach here both by air and sea. The island is connected to subsidiary airports in North Africa, Europe, UAE, and Turkey. There are also flights to and from Malta to prime locations like Berlin, Istanbul, Warsaw, Dubai, etc. This easy and seamless transportation makes it easy for entrepreneurs to enter Malta.

Advanced IT infrastructure

When it comes to IT infrastructure, Malta has an advanced, efficient, reliable, and secured IT system. Besides, the government provides funds for Fintech and IT businesses. So, entrepreneurs planning to start an IT startup can get aid from the Maltese government.

Requirements for Starting a Business in Malta

These are the requirements to do business in Malta:

Work permit and visa

Foreign investors can start a business in Malta only with the required visa. The government of Malta offers business visas, tourist visas, and visas for medical purposes. For foreign entrepreneurs, one of the primary requirements to do business in Malta is either a short-stay visa (C-visa) or a long-stay visa (D-visa).

Along with the work visa, foreign investors or entrepreneurs also require a work permit, better known as the employment license in Malta.

Company name

Your business or company should have a valid name that has no similarity to that of an existing company in Malta. The company name should be devoid of offensive words.

Furthermore, the name of the business or company should reflect the nature of the business. In short, it should be authentic and original without being misleading. The Registrar of Companies takes care of the business name registration in Malta.

Taxation

Malta’s corporate tax rate is 35%. Among all the European Union members, Malta has the lowest effective tax rate. The country has a Taxation Refund System through which the shareholders can get back a portion of their tax after distributing the dividends. Refunds range from 5% to 100% of the tax paid, depending on the type of business and tax.

Business capital

The business capital required for Malta’s new company incorporation depends on the type of business structure you organize. The minimum capital for starting a private company in Malta is EUR 1,164.69. On the other hand, for a private company, the minimum capital is EUR 46,587.47.

Directors and company secretary

One of the primary steps to incorporate a company in Malta is to appoint directors and company secretaries. For a private company, at least one director and one company secretary are needed, while for a public company, the minimum requirement is two directors. However, the number of additional directors and company secretaries depends on the business structure you establish.

Types of Business Structures in Malta

Before starting a Malta business incorporation, it is necessary to look into the types of business structures workable in Malta.

Single-member company

- Can be formed either by incorporation or by acquiring company shares by one person

- Must comply with all the rules of a private exempt company

Partnership

- Has a separate legal entity

- Can possess property in its name

- Can be divided into general partnership and limited partnership

- General partnership

- Can be created through a partnership deed

- Unlimited personal liability of partners

- Limited partnership

- Shall have at least two partners

- Shall have a general partner with unlimited liability

- More than one partner has joint liability

- Contribution of limited partner required

- General partnership

- Must be registered with the Malta Business Registry

- Must be registered for value-added tax from the Department of Inland Revenue

Limited liability company

- Most popular business structure in Malta

- Cannot have more than 50 shareholders

- Must have one director and one secretary

- Must pay 20% of its share capital

- Can be divided into public limited liability and private limited liability

- Public limited liability

- Can offer shares to raise capital

- The minimum share capital required is EUR 46,587.47.

- At least two persons must subscribe to the share capital.

- Private limited liability

- Must possess two directors

- Must have 25% of its share capital paid

- The minimum share capital required is EUR 1,164.69

- At least two persons must also subscribe to the share capital.

- Public limited liability

Overseas company

- A company incorporated outside of Malta

- Has a branch in the country

- Have to be registered by the Registrar of Companies in Malta

- Registration within one month of office/branch establishment

Company Registration Process

The steps to incorporate a company in Malta are given below:

Step 1: Selecting a business structure

The first step includes selecting an appropriate business structure that suits your needs. You can register as a public LLC, a private LLC, a partnership, or an overseas company.

Step 2: Registering a company name

You have to choose a name of the company that has no connection to the existing enterprises of Malta. Once an appropriate name is chosen, register the company name with the Registrar of Companies.

Step 3: Determining authorized shared capital, company address, and duration

The share capital of a company will depend on the type of business structure you select. In the case of a private limited liability company, businesses need to pay 20% of their shared capital. On the other hand, for a public limited liability company, you need 25% of shared capital.

The company should have a registered business address in Malta. In establishing a company, it is the responsibility of the promoters to appoint the initial directors and shareholders. The first shareholders are also expected to provide the initial share capital required for the company.

Step 4: Preparing documents for incorporation

In the company registration process in Malta, you need to prepare some necessary documents. Some essential documents include a memorandum of association, articles of incorporation about the internal company regulations, a form BO1 to provide identities for the company’s beneficiaries, and evidence of paid share capital.

Generally, the memorandum of association (MoA) in Malta has the following details:

- The company type

- The share capital subscriber’s identity

- Company name

- Company’s registered office or branch address

- The company’s main trading point and objectives

- Details of the shares, including share subscribers and division of shares

- Details of the directors

- Details of the appointed company secretary

- Details of the legal representatives, shareholders, officers, and directors

- Company duration

You must register your company under the Malta Business Registry. The registration fee can range from EUR 245 to EUR 2250.

Step 5: Certification

In this step, you will receive the company registration certification. The Registrar’s Office will issue you the certificate only if your documents are in place. The whole process to receive the certification ranges between 5 to 10 working days.

Step 6: VAT registration

After receiving the company registration certification, register your company for VAT. If your firm is not registered as a holding entity, its VAT rate would be 18%.

How Much Does It Cost to Incorporate a Company in Malta?

The cost of incorporating a company in Malta primarily depends on the Authorised Share Capital value. The minimum cost is EUR 245. However, this can go up to EUR 2250. Besides, the kind of business entity you set up also plays a vital role in determining the cost of incorporating a company here.

Are Foreigners in Malta On Certain Passes Allowed to Start a Business in Malta?

Yes, foreign nationals can set up an offshore company in Malta, provided they have the necessary visa and work permit. For foreigners, there are two types of visas:

Short-stay visa or a C-visa

Having a short-stay visa means entering all countries under the Schengen region. With this visa, you can get accommodation for single, double, and multiple entries. With the short-stay visa, you can spend up to three months in Malta, irrespective of the number of entries.

Long-stay visa or D-visa

You need a long-stay visa to stay in Malta for over three months. To extend your period of stay, you need the D-visa. This visa is also applicable to students.

For setting up a company in Malta, these are the visa requirements for a foreigner:

- A filled-up visa application form

- Two recent passport photos

- A cover letter describing the trip’s purpose

- A valid passport having two blank pages

- An employment contract passed from a Malta-based company

- Proof of travel medical insurance coverage

- Proof of accommodation of stay

- Proof of enough financial means to support the stay

If foreign nationals need an employment license along with the visa, these are the additional documents required:

- A copy of the applicant’s resume

- A cover letter issued by the employer

- Proof of applicant’s qualifications with proper testimonials

- A medical certificate

- Proof of the company’s vacancy to show that the company searched for qualified Maltese talents for that position.

Government Assistance for Foreign-owned Businesses

The government provides grants for starting a business in Malta. The government has a series of support schemes and funds to aid companies in setting up their companies without financial restraints. Here are some of them:

- The Tax Credit Certification Extension scheme helps businesses by extending their taxation period up to three years.

- The Business Development 2021 scheme supports various activities, including the initial development phase for companies establishing an operational base in Malta, expanding projects, consolidating activities, and reengineering business processes. The incentive is available until the 31st of December, 2023, to promote the region’s long-term economic development. The government may offer this support through a tax credit or a cash grant.

- The Skills Development Scheme aims at training and building the skills and knowledge of the workforce employed by small and medium enterprises (SMEs).

- The Business Start Scheme 2021 aids startup companies with business ideas and stands by them during their growth and development phase. This initiative provides growth funding to start-up entities before they seek third-party capital. Companies may receive an initial grant of €10,000 to develop a business plan, and those with a viable plan may be eligible for additional grant support based on the employment effects of their project. The scheme will be available until the 31st of December, 2023, with applications being accepted until the 31st of October, 2023.

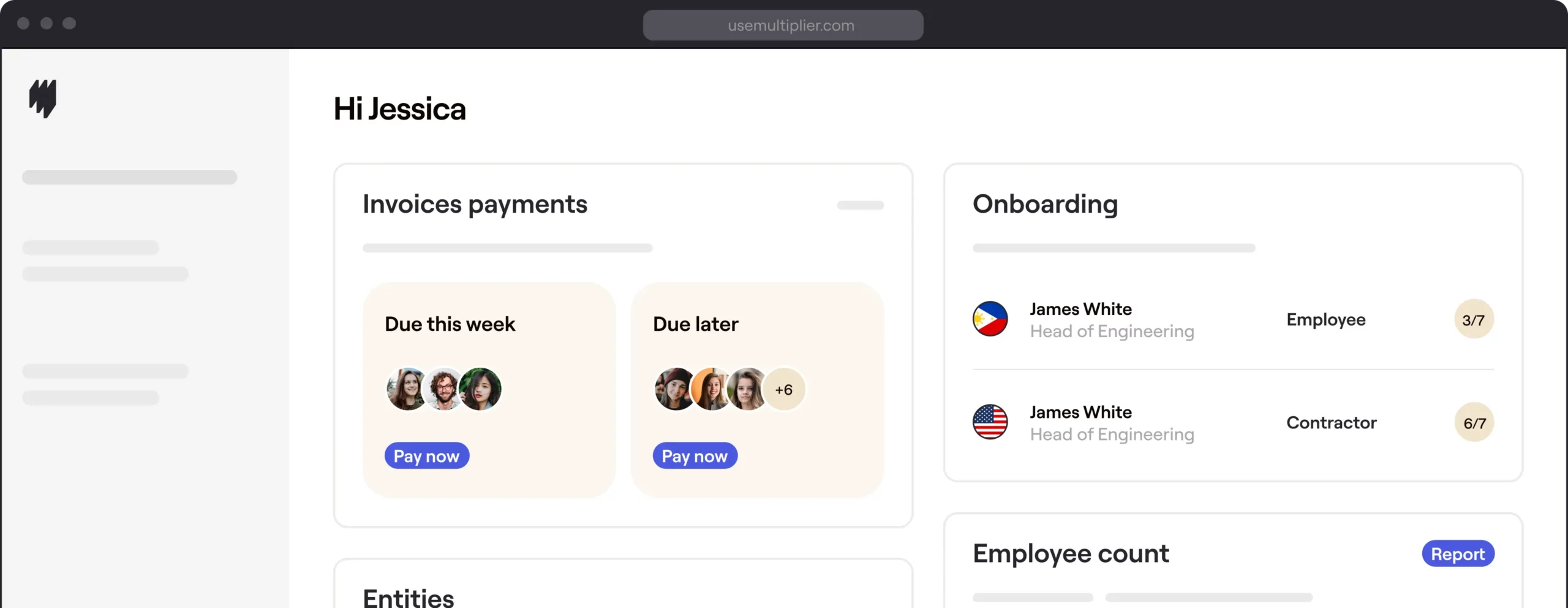

How Multiplier Can Help

Setting up a company in Malta can expand your business and take it to another level. However, this comes along with a series of rules and compliances. If you are wondering how to set up a business in Malta, Multiplier is here to help you.

As an EOR platform, Multiplier helps businesses expand and grow globally. The team here is supportive and responsible enough to provide suitable talents. Further, we provide SaaS-based solutions to get work permits and visas without much hassle. For setting up businesses overseas, consult Multiplier today.