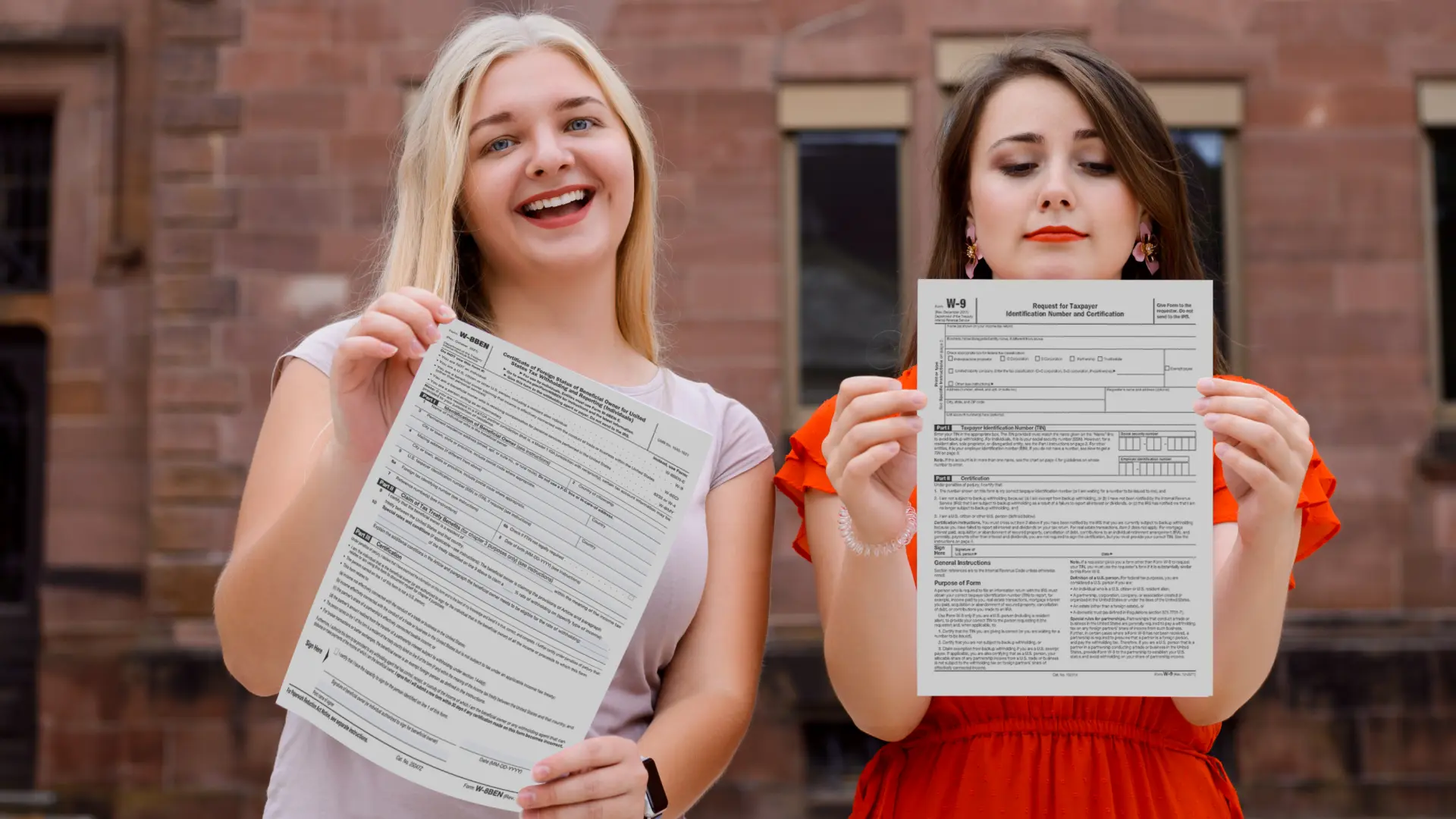

If you are a US-based business working with freelancers and independent contractors, it is important to understand the different types of tax forms. Two of the most common ones to know about are w8 or w9 tax forms.

Understanding the difference between w8 and w9 is important as it helps in compliant payroll taxation for freelancers and independent contractors. Failing to submit the right tax forms can attract penalties due to non-compliance.

In this guide, we will cover everything you must know about w8 and w9 tax forms, their similarities, and differences, and how to fill them out. With the information in hand, you can maximize your freelancer workforce while being compliant.

What is a W-9 Tax Form?

A W-9 tax form, alternatively known as a ‘Request for Taxpayer Identification Number and Certification,’ is used by businesses to collect information from freelancers, independent contractors, and vendors. W-9 tax forms apply only to freelancers and vendors who are citizens of the United States.

Understanding when to use a W-9 tax form will be easier when explained through an example. For example, if you pay your freelancers $600 or more during a given tax year, you are required to report these payments to the IRS through a form known as 1099-NEC.

Unlike a full-time employee, you are not required to withhold income tax or pay statutory benefits such as medicare or social security contributions for freelancers. However, the IRS still wants to know how much your freelancers earn. This is to ensure they pay the correct income tax amounts as a part of self-employment taxes.

So, the W-9 form helps businesses gather all the required information for the 1099-NEC form and ensure the correct information is filled in. Such information includes:

- Name

- Address

- Social Security Number (SSN)

- Tax Identification Number (TIN)

An important point to note is that a Form W-9 can only be used by businesses to gather all necessary information to fill a 1099-NEC form. Neither the freelancers nor the business must submit the W-9 to the IRS.

What are W-8 series tax forms?

Compared to the W-9 tax forms, W-8 series tax ID forms can be trickier. This can be especially true if you work with:

- Non-payroll workers

- Non-US citizens and non-residents of the US

- US citizens and non-residents of the US

Therefore, it is essential to understand W-8 series tax forms for each of these categories.

Non-US tax residents use W-8 tax forms to prove their foreign status. With this, they can claim tax treaty benefits. The US has different tax treaties with different countries. So, employers must be very careful when withholding tax amounts for their freelancers. It should be in accordance with the country of residence.

After submitting a W-8 form from a non-resident freelancer, employers or withholding agents use W-8 forms to calculate the accurate tax amount to deduct.

Freelancers and independent contractors will be subjected to a 30% tax rate in case they fail to submit the W-8 form. This tax rate ordinarily applies to foreign entities.

Employers must note that, compared to a W-9 tax form, W-8 tax forms have five types. Each of these forms can be used by employers to manage tax requirements and declaration of foreign tax ID statuses.

All of these forms cater to freelancers and independent contractors, although not all five are required to be filled by foreign citizens. Therefore, filing the right one is key to complying with tax laws.

The next section covers the five types of W-8 series tax forms, which will help you determine the right form to fill based on

- The purpose

- The type of business

Similar to a W-9 tax form, a W-8 tax form should not be submitted to the IRS. Instead, W-8 forms must be submitted to the employers (the paying company) or withholding agents.

However, it should be noted that these forms are important to fill the 1024-s and 1099 NEC tax forms correctly. These two forms apply to all businesses working with freelancers and independent contractors.

What are the Types of W-8 Series Tax Forms?

One of the major differences between w8 and w9 forms is the different types of W-8 tax forms that an employer has to deal with. We will be discussing each of them below.

W-8 Ben

W-8 Ben is one of the most commonly used tax forms. It is alternatively known as the ‘Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting.’

The purpose of the W-8 Ben form is to establish that the individual filling out the form is

- A foreign resident

- Owner of the business

Foreign individuals are subject to a tax rate of 30% on income received from US payers. By filing a W-8 Ben form, foreigners can claim an exemption or a reduction from the US tax withholdings on the following conditions:

- The country they live in has a tax treaty with the US

- The income received is subject to the tax treaty

W-8 BEN-E

A W-8 BEN-E form is also known as ‘Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting.’

The purpose and the functions of a W-8 BEN-E form are the same as a W-8 BEN form; however, this form applies only to foreign entities receiving payments from US businesses.

The foreign entities must fill up the form and submit it to the IRS as a part of the compliance process.

W-8 ECI

A W-8 ECI form is officially known as the ‘Certificate of Foreign Person’s Claim for Exemption From Withholding on Income Effectively Connected With the Conduct of a Trade or Business in the United States.’

This form must be filled by foreign individuals

- Engaging in services or trade with US-based businesses

- Receive regular income from them

The IRS has coined such income as an ‘effectively connected income.’

An effectively connected income (or ECI) is not subject to the same 30% withholding rate, although such an income is subject to

- The tax rates applicable to US citizens

- Standard deductions

After subtracting the standard deduction, an ECI is taxed at a graduated rate that US citizens are subject to. If the residence country of the individual has a tax treaty with the US, they will be subject to the lowest tax rate.

W-8 EXP

A W-8 EXP form is officially known as the ‘Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting.’

The purpose of a W-8 EXP form is for entities such as foreign governments, tax-exempt organizations, and foundations to claim a reduction or an exemption on tax withholdings efficiently.

To qualify for a reduction, the entity must be eligible under the IRS codes below:

- Code 115(2)

- Code 501(c)

- Code 892

- Code 895, and/or

- Code 1443(b)

W-8IMY

A W-8IMY form is officially known as the ‘Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting.’

A W-8IMY form must be used by intermediaries to certify that they received tax-withholding income as a flow-through entity or on behalf of a foreigner.

W8 Vs. W9: The Difference

When dealing with independent contractor taxes, it is important to understand w8 vs. w9 tax forms to ensure you know which one to fill out. Below is a drilled-down difference between w8 and w9 tax forms:

| W-8 Tax Form | W-9 Tax Form | |

| Who are these forms applicable to? | Must be filled out by foreign individuals who are non-residents of the US, receiving income from US sources/employers | Must be filled out by US workers who have a Tax Identification Number (TIN) or Social Security Number (SSN) |

| Are there different types of forms? | Five types of forms that differ based on the type of income freelancers or vendors earn | One type of form for all freelancers, independent contractors, and vendors |

| Are the purpose of both forms different? |

|

To ensure self-employed individuals and entities in the US pay the correct tax amounts |

When and How to Collect These Tax Forms?

Although we have discussed the differences between w8 and w9 tax forms, the processes to file them can get confusing. Below is an overview of the processes for w-8 vs. w-9 forms:

Form W-8

Non-US independent contractors, vendors, and freelancers must submit an accurate W-8 tax form to their employers (or the paying company) before the first payment is made. If the submission is delayed, the employer or the withholding agent has to withhold the entire amount equaling 30%, normally withheld under US tax laws.

A best practice for employers is to guide foreign freelancers and independent contractors to submit the W-8 form applicable to them at the time of their onboarding. This will ensure you have all the relevant documentation before the first payment is issued.

Once the right W-8 form is submitted by the freelancers, the forms are effective for up to three calendar years from when they were signed. For example, a Form W-8 signed and submitted on January 1st, 2023, is valid through December 31st, 2026.

Form W-9

A Form W-9 should be collected from every new vendor or freelancer during the onboarding process. If the freelancer’s information changes (such as an address, business name, or Tax Identification Number), they should update it by submitting a new W-9 form.

Since it is important to submit a Form W-9 early on, employers won’t always know how much they will pay freelancers. This creates an ambiguity in submitting a 1099-NEC form. For example, if the freelancers are paid below $600 in a calendar year, employers are not required to submit a 1099-NEC form.

How can Multiplier help?

The different tax forms and their corresponding requirements might feel complex and overwhelming, especially when the confusion is w8 vs. w9. In such cases, having a dedicated team that will help you stay compliant with US tax laws is important. However, hiring a different team to help you handle the legal aspects can be expensive and time-consuming.

You can now partner with Multiplier to help you work with freelancers across the globe. Our team of professionals helps you pay your freelancers in their currency and manage their payroll.

You can now be better equipped to work with freelancers in the US and around the world.

Reach out to us to understand how you can stay compliant!