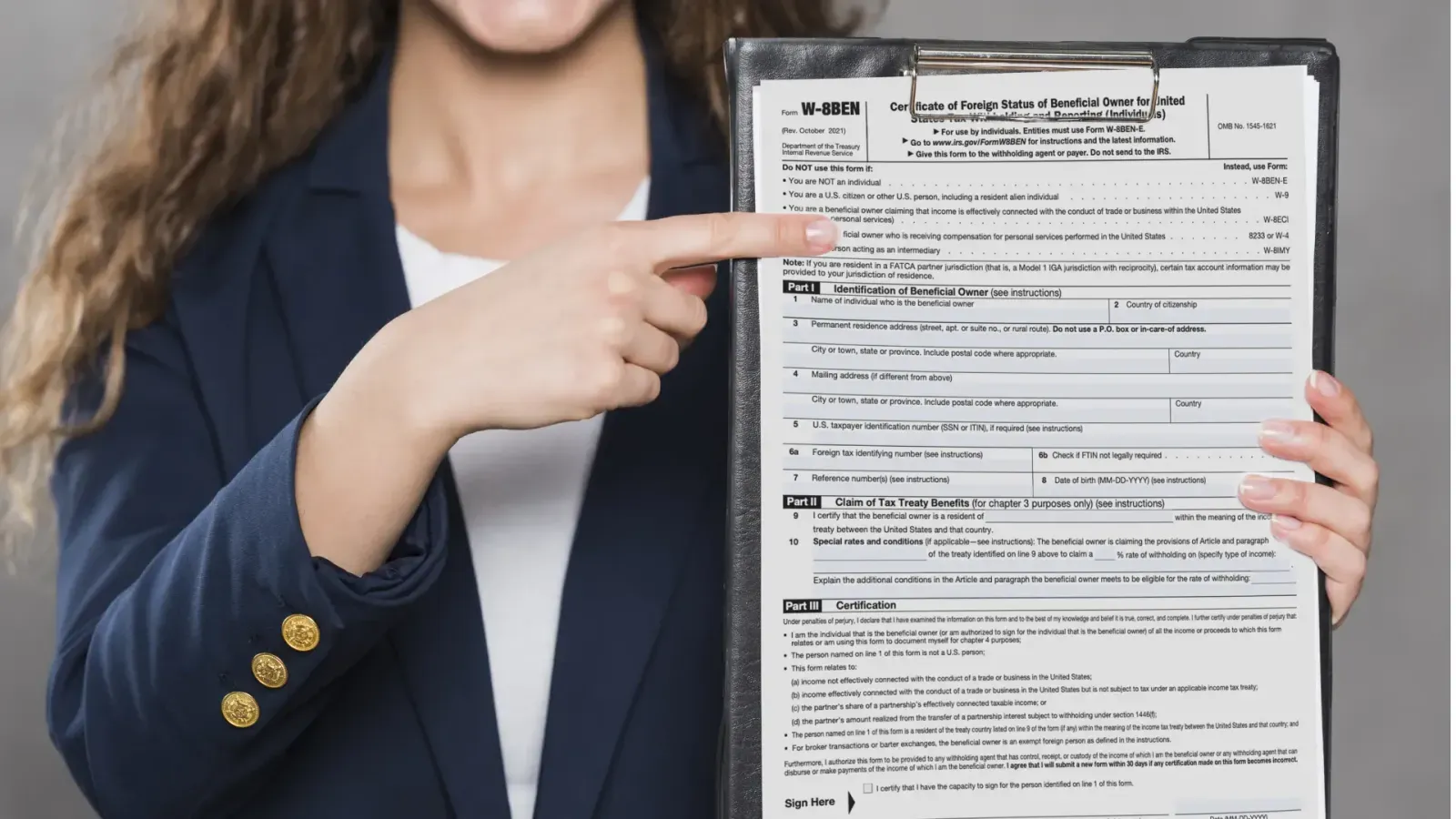

W-8 BEN – What is it?

The W-8 BEN form, also known as the ‘certificate of foreign status,’ determines the foreign status of NRAs (non-resident aliens; workers who are not US citizens or permanent residents) for tax purposes. The official name of this form is – Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals).

Where is the W-8 BEN used?

All payments made to businesses and individuals in the US are subject to taxes, irrespective of the beneficiary’s status of citizenship or residence. However, many countries have treaties with the US that benefit their citizens from lower tax rates. This income can be generated through one or more sources.

Once a non-resident alien (NRA) establishes their country of residence, the IRS runs a background check and determines if they are eligible for a lower tax rate. Once the checks are complete, employers can apply a lower tax withholding rate. Some examples of the sources of income that are covered in the W-8 BEN form are:

- Dividends

- Rental income

- Compensation for services/products

- Royalties

- Premiums

Who should fill out the W-8 BEN form?

W-8 BEN forms are typically filled out by non-resident aliens who do not hold valid US citizenship but earn an income through the US. This applies to foreign employees, contractors, and freelancers performing tasks for US-based clients. The most important details needed for the W-8 BEN form are a US Tax Identification Number (TIN) or a Social Security Number (SSN). Apart from this, the tax identification number of the domicile country and proof of residence is also required.

In the case of employees, contractors, and freelancers, it is the employer’s duty to provide the W-8 BEN form to their workers. Before doing so, employers must identify tax treaties between the US and said countries.

Individual statuses under which a W-8 BEN form is applicable:

- The individual is a non-resident of the US

- The individual is a non-citizen/does not hold a green card

- The individual has earned an income in the US

Foreign workers then fill out the form and submit it to the withholding agent and claim the tax exemptions or reduced rates. It is important to note that the W-8 BEN form is not submitted directly to the IRS. Instead, it is submitted to the withholding agent.

3 Easy steps that will help you fill out the W-8 BEN form

Once the employer/withholding agent provides you with a W-8 BEN form, an employee must follow the steps mentioned below.

- Carefully enter your personal information. Key details include:

-

- US Tax Identification Number/Social Security Number

- Domicile Tax Identification Number

- Name

- Date of birth

- Mailing address

- Name of the domicile country

- Reduced/exempted tax rates (if applicable)

- Close the form with a signature and mark the date.

- Check and return the form to the withholding agent.

Apart from this, some documents that should be kept handy are:

- Proof of foreign citizenship

- Proof of foreign address

- Proof of income generated in the US

For how long is your W-8 BEN form valid?

The W-8 BEN form is valid for three years from the filing date.

The W-8 BEN form is an important document that helps foreign individuals avail lower tax rates, and an employer must provide their foreign workers with this form.

What happens if you don’t submit a W-8 BEN?

There are two perspectives on the consequences of not submitting the W-8 BEN form.

If a foreign worker fails to submit this form, they will not be able to benefit from the lowered taxes or exemptions and will have to abide by the standard 30% deduction. This will result in them losing a good chunk of the money they have earned in the US.

The consequences can be severe if employers fail to provide their foreign workers with the W-8 BEN form. Without a W-8 BEN, employers will withhold the standard 30% of their workers’ income, and this will lead to a case of improper compensation. These cases can result in a breach of employment contracts and can also cause a lot of legal trouble.

Other types of W-8 forms

The W-8 BEN is one of five types of W-8 forms in the US. Individuals primarily use it to prove their foreign status and avail tax benefits. The other W-8 forms are also used to avail tax exemptions or deductions, but the status of the individual/entity differs with each form.

Other types of W-8 forms are:

Form W-8 BEN-E:

Officially known as the “Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting,” this form is very similar to the W-8 BEN. The only difference here is that this form is used for foreign businesses/entities to avail tax deductions instead of foreign individuals.

Form W-8 ECI:

This form is officially known as the “Certificate of Foreign Person’s Claim for Exemption From Withholding on Income Effectively Connected With the Conduct of a Trade or Business in the United States.” It is used to claim benefits on incomes that are not directly or regularly generated in the US, but the source still remains in the US. For example, investment/partnership in a business or trade being conducted in the US would be considered under the W-8 ECI form. Here, the lowest applicable taxes will be deducted from your income.

Form W-8 EXP:

This form is called the “Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting,” and it is used by foreign government organizations, foundations, or tax-exempt organizations to avail tax benefits on their incomes in the US.

Form W-8 IMY:

This form is the “Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting.” This essentially means that form W-8 IMY is used by parties who have received taxable payments through a third-party intermediary or on behalf of a foreigner. Here, the deductions cannot be availed by beneficiaries who are individuals or business owners generating income in the US.

W-8 is just one of the kinds of tax forms applicable in the US. There are multiple different forms for independent contractor taxes, employee taxes, etc. Employers often confuse these forms, an especially confusing one is the comparison between 1099 vs. W-2.

All these hassles can easily be avoided by using an EOR solution like Multiplier!

Let Multiplier take care of the compliance!

Multiplier is a sophisticated tech-based EOR solution that enables you to hire employees across the world. Right from onboarding-payroll-compliance-benefits-offboarding, Multiplier has got your back. The user-friendly dashboard enables you to seamlessly track crucial details about your workers, such as time-off schedule, total leaves taken, compensation, benefits, etc.

Multiplier has a robust legal team that consistently ensures that every penny you pay to your workers complies with their local labor laws, has the right deductions, and is in the right currency, every time.

We have entities in over 80 countries, are serviceable in over 150 countries, and can help you onboard employees, freelancers, and contractors from the massive global talent pool.

Book a demo here; go global now!