Companies in the United States have been dealing with an influx of employees seeking out better opportunities and retiring over the past year. Just between April and August 2021, around 20 million workers left their jobs as they contemplated their careers. In the last quarter of the year, around 50.3% of adult workers aged 55 and older have decided to retire. Due to this, openings are plentiful and companies are increasing their salary and benefit offers as they compete for talent and fill in their hiring gaps.

Employee retention becomes more important than ever and businesses are looking into more ways to engage their workers into staying. A recent survey by Glassdoor, shows that 89% of younger employees prefer to receive ample benefits over a heftier paycheck. And among the popular choices for most companies across all sizes is to provide a pension for their employees.

In the US, a 401(K) plan is among the benefits offered to workers. It is a retirement savings plan where employees choose an investment opportunity for the money they contribute to the program. Employers are then given the option to participate in the program as additional support for their workers.

What then is a 401k plan and matching? Do rules vary depending on company size? And how does this become an investment for employees in the long run?

401k Plan: A General Definition

The 401k plan is an employer-sponsored retirement savings plan where employees give a portion of their salary into an investment account. Contributions made to the plan will be placed in each of the employee’s 401(k) accounts and will be invested and diversified in the stocks, bonds, or mutual funds that they have chosen. The investment choices will be set by the plan sponsor or the employer.

The maximum contribution that an employee can give in a year for this plan is $ 20,500.

These savings will be protected by the Employee Retirement Income Security Act of 1974. Additionally, it is considered a qualified retirement plan and is subject to tax benefits under the Internal Revenue Service (IRS).

What is 401k Matching?

The 401(k) Matching is not compulsory for employers and may be done later in the program. But an additional contribution will be a great way for employees to see how the company invests in its people. In fact, 51% of companies offering 401K provide matching for their employees.

Employers can offer to match dollar for dollar or 50 cents to a dollar, depending on the limit they set for their employees’ plans. For example, if an employee makes $50,000 a year and has allotted 6% of it for their 401(k), you can match their contribution for every dollar at $3,000 per year. In the same way, if you agreed to match 50 cents to a dollar, your matched amount will be $1,500 per year.

However, the amount that the employees will own upon the termination of their 401k will depend on the vesting schedule that the employers have set. The vesting period may be graded or cliff:

Graded vesting period: Entitles the employee to receive a gradual percentage of the matched amount depending on the years of service with the company,

Cliffed vesting period: Entitles the employee to receive the full amount after serving the required years of service with the company.

Different Types of 401k Plans

There are currently five different types of 401k plans for employees. Below are a summary of the rules governing each plan:

- Traditional 401k – This is an employer-sponsored plan whereby employees contribute a portion of their wages pre-tax and will be deferred until the savings are withdrawn. Employers may match a portion of their employees’ contributions and its income taxes will also be deferred.

- Roth 401k – This type of plan is similar to the traditional type, except it is not tax-deferred. It is after-tax dollars, meaning the taxes have already been paid during the contribution. Upon withdrawal, the income earned through the savings is tax-free. This plan is ideal for employees belonging to the high-income bracket.

- Solo 401(K)/Self Employed 401(K) – This plan is designed for businesses with no full-time employees. As the name suggests, it is ideal for sole proprietors and small business owners and consultants and contractors. This plan covers the owner, its partners, and spouses to pay contributions to their 401k both as an employee and employer. Contributions made as an employer will be tax-deductible (according to the guidelines by IRS) and contributions made as an employee will be deferred until its withdrawal.

- Safe Harbor 401(k) – This plan provides all employees participating in the plan to receive employer contributions. It is designed to ensure that all employees receive equal benefits base on their salary rate.It is a special type of plan for employers to avoid the non-discrimination testing set annually by the IRS.

- Simple 401(K) – This plan is similar to the traditional 401k, except it is designed specifically for small businesses with less than 100 employees. Taxation will still be pre-tax and employers will be required to either have a 3% contribution match or a non-elective 2% match for each employees’ pay.

401k Plan Based on Company Size

While 401(K) becomes a promising motivation for employees and appealing addition to the job postings to attract more talent, businesses must consider the best strategies to reap the benefits of this benefit. Below are some of the best practices and the types of 401(k) plan that is ideal whether you are operating for a small, medium, or large enterprise:

Small to Medium Enterprise (10 to 249 employees)

Small to mid-sized businesses, aiming to expand their operations and company size will benefit from offering 401(k) to their employees and business partners. But to better manage your organizations’ 401(k), the Department of Labor has given the following steps when establishing this retirement plan:

Adopt a written plan document

This documents a day-to-day plan for your business’ 401(K) plan. You may seek help from financial institutions or retirement plan professionals to draft a plan that best works for you.

Arrange a trust for the plan’s assets

Setting up a trust ensures that the plan’s assets will be allocated solely for this benefit. It must have at least one trustee to handle the contributions, investments, and distributions on the plan.

Develop a recordkeeping system

This will ensure smooth tracking of the assets within the plan.

Provide plan information to employees eligible to participate

This step empowers your employees to have a better grasp of their benefits and the procedures of the plan. Employers must provide a summary plan description (SPD) to the participants to guide them on how the plan operates.

The ideal type of plans to provide: Traditional 401(k), Safe Harbor 401(k), Solo 401(k) for sole proprietors, SIMPLE 401(k) for businesses with 100 and below employees.

Large Enterprise (250+ employees)

Monitoring employee benefits in a large company becomes very tricky to monitor. While companies, nowadays, seek help from a PEO or an EOR, a better understanding on how 401(k) works will help you match contributions and hire the best talent in the country. While the steps as mentioned earlier for small and mid-size businesses apply to large businesses as well, below are additional steps large companies can take when handing their employees’ 401(k):

Set up a payroll withholding

The easiest way to ensure that contributions are made for the plan is by setting up an automatic deduction for your employee’s wages towards their 401(k) accounts. In the same way, employers matching their employees’ contributions must also set an automated credit to their workers’ plan to avoid any mishaps.

Pay attention to the 401(k) rules

Offering a 401(k) plan for your employees subjects your company to audits as a way to ensure that your business is following the regulations surrounding this employee benefit. Your HR should gain familiarity with the rules on matching and processing so they can keep a checklist of things that needs to be done for each employee. In this way, your business will be on top of things and won’t be dreading the audit notice when it reaches your office.

Keep track of your employee’s investments

Most companies see 401(k) processing as an annual event but it shouldn’t be the case. Employers must review their employee plans, their employee demographic, and economic trends all year round. For example, offering 401(k) plans to a majority of young employees will be different from offering them to middle-aged workers. Companies must always rethink their strategies on offering investments to different age groups.

In the same way, they must also monitor economic activities to gauge their employees’ investing behavior. This will be vital when ensuring your employee’s retirement security and guide them on creating the best decision for their savings.

Pros and Cons of Offering 401k

Before considering a 401(k) plan for each of your employees, businesses must consider a few pros and cons of this retirement plan.

Pros

- Employer matching can be used to reward your employees – Matching your employees contributions can be an incentive for your employees for their good performance and loyalty. It will be a way to get them motivated and promote employee retention.

- Matching allows employers to budget their contributions based on their fiscal performance – With matching being optional, employers have the freedom to match their employee contributions based on the business profitability. Additionally, this can also be motivating for employees because their additional contributions will be dependent on their performance.

- Tax deductions – Employer contributions from the matches are deductible from their annual federal income tax, provided that they have followed the contribution limitation. You may refer to the IRS’ publication here for more information.

Cons

- Setting up the plans will require a lot of time and money – Investing on your employees will always require a ton of effort – companies will need to provide the budget, outsource professionals to better monitor their employee plans and manage cumbersome documentation. Companies will need a solid process upon initial set-up in order to provide plans for its employees.

- 401(k) strict regulations -Complex regulations set by the Employee Retirement Income Security Act can be challenging, and is subject for annual review. Compliance will be vital to prevent any liabilities for your employees.

How Multiplier Helps With Offering Benefits?

401(k) plans are just one of the benefits that companies in the United States can offer their employees. Other benefits have their own set of rules and regulations that your HR department must manage on top of other administrative functions.

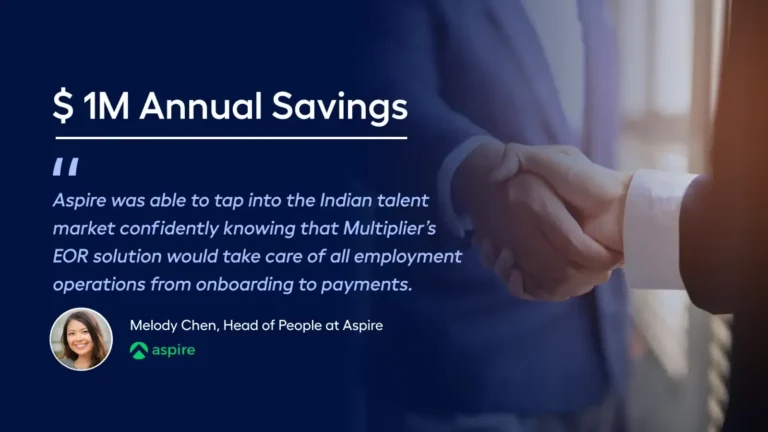

Multiplier is an all-in-one platform that can help your organization streamline HR functions, including setting up your payroll facility. Our global employment solution helps your businesses ensure that employees are paid on schedule and their contributions to the 401k are made on time.

Our team of experts is ready to help your company employ and retain the best talents, wherever they may be.

Book a demo and know more about our suite of solutions.