Payroll errors can prove expensive. Early this year, Australia Post apologized to 3,600 workers who were underpaid by $5.6 million.

They carried out a payroll audit, which uncovered errors that went unnoticed for over a decade. A simple procedural anomaly marred the postal service’s public image and demoralized its employees.

A payroll audit is important because it reviews an organization’s entire payroll process and helps ensure accuracy in payments to employees, deductions, and reporting.

Regular reviews are a cost-saver as they help avert tiny errors, each of which can cost companies $291.

With a payroll accuracy rate of 80% across industries, conducting regular audits is critical for companies of all sizes in different industries. It can also boost your compliance record and bolster employee trust and morale.

What constitutes a payroll audit

A payroll audit covers several aspects of a company’s payroll process. It requires an exchange of data across HR and finance teams and coordination with company leaders, IT professionals, and legal experts.

Broadly, the process runs through:

1. Employee data

This includes employee information like demographics, tenure, roles and designations, and social security numbers. An audit may reveal ghost employees who are no longer with the company but are still visible on the payroll. A payroll process review is also necessary to provide accurate paychecks or payslips to employees.

2. Legal compliance

A review of payroll processes ensures adherence to regional and national labor and tax laws. This covers minimum wage regulations, time-off laws, social security policies, insurance norms, and overtime rules. A wage audit can also help strengthen your benefits administration.

3. Tax reporting

A payroll process review goes over tax slabs, deductions, formats, and deadlines in line with taxation regimes. It also reconciles tax data with employee classification and bank statements.

4. Data security

Auditors also need to check data security and privacy. They ensure workflows follow defined approval chains and access to data is provided to authorized personnel only. It means a review of safety protocols to handle breaches or cybersecurity attacks.

The benefits of regular wage reviews

The 2024 Company Payroll Complexity Report found that payroll errors are on the rise across companies, with implications on costs, reputation, and employee experience. Thus, payroll audits are essential.

Regular wage reviews ensure:

- Improved accuracy and risk management and Reduce the likelihood of errors, which may tarnish employee experience. Audits help avoid overpaying, or underpaying, employees and maintain accuracy in tax deductions and deposits. These save costs for correcting errors, processing compensations, or litigation.

For example, the IRS penalizes one in three businesses for payroll errors. In 2023, the mining company BHP admitted to wrongly deducting annual leave from staff entitlements for more than a decade. Its past and present employees are now receiving $280 million in back payments.

An audit helps prevent fraud or data manipulation. It also lets you strengthen workflows and protect data. - Legal compliance: Stay abreast of legal updates and configure payroll management in line with them. Payroll audits help you comply with labor and tax laws like those relating to minimum wage, insurance, social security and overtime payments.

- Positive employee experience: Payroll is part of benefits administration and audits help improve accuracy in payouts. This can boost employee morale and trust in your company. Robust payroll processes help you pay employees on time and simplify tax filing processes for them.

Wage audits also save the time and resources expended in grievance redressals. Payroll errors may leave your employees disgruntled. For instance, in the US, nearly half the workers seek new employment after just two payroll mistakes.

In fact, 59% of job applicants still believe salary is the leading factor contributing to work fulfillment. When applicants hear of payroll mishaps at your firm, your employer branding takes a hit, leaving candidates dissuaded.

Detailed steps to conduct a payroll audit

According to Herberg’s two-factor theory, salary is a hygiene factor that affects job satisfaction among employees. When salary expectations are unfulfilled or processes remain crippled, it may demoralize employees.

A payroll review can help maintain hygiene. And here’s a 7-step guide to conducting one:

1. Define scope, objectives, and timeline

Decide the audit’s purpose and intended outcome. Determine whether the exercise is routine or triggered by any anomaly. Chalk out a timeline including milestones, the areas you’d test, and in what order. You must also list resources and name the stakeholders needed. Also, consider roping in external auditors.

This step also includes gathering information using employee lists and paystubs, tax forms, timekeeping records, payroll reports, and bank statements.

According to an EY study, Around 32% of organizations consider inaccurate employee data being imported into the payroll system to be the topmost compliance challenge. But by using payroll software or an HRMS, you can gather data faster and more accurately.

2. Verify employee data and pay rates

Analyze data relating to employees listed on your payrolls. Check whether the listed have worked for you during the period under review. Check for data like demographic details or role descriptions.

There may still be names on the list of individuals who no longer work at your company. Some users may also commit fraud by including fake names on the roster. For instance, Uganda’s Auditor General found over 10,000 government workers illegally on payroll. They were either retired or dead or had absconded.

Next, verify whether pay rates prescribed for an employee in their contract match with payroll entries. Cover overtime pay rates, too. In case of recent salary modifications, ensure new pay rates become applicable on the defined dates.

You must match the time period worked and the applicable pay. For this, correlate data from your time and attendance management system or timesheet with payroll data. The rates may differ for contractors, freelancers, or permanent employees.

3. Monitor variable payments

Make sure you account for variable payments separately from regular wages. These may include bonuses, overtime hours, incentives, commissions, profit-sharing payments, or shift differentials.

Run reports from your performance management system to compare data. A payroll software that automatically generates reports by sourcing data from HR systems can come in handy. You must also match variable component descriptions in employee contracts with entries in the payroll sheet.

4. Ensure legal compliance

Ensure compliance with regional and national laws, especially tax regulations, to avoid penalties. Organizations must review investments and declarations made with tax authorities.

You must verify whether you’re withholding accurate taxes from your employees’ wages for deposit to authorities. Besides, you must look at the taxes your business pays as an entity.

5. Review bank statements

Reconcile the payroll system data with your bank statements and general ledger accounts. A general ledger records all company transactions. You must match the amount debited from the ledger with salary payout calculations.

Auditors must also verify bank account details of employees to which payouts are transferred. Although payroll reconciliations may be time-consuming, firms must undertake them before running payrolls every month.

The verifications may speed up if you use automated payroll platforms that are integrated with your HRMS.

6. Capture off-cycle transactions

Record atypical or off-cycle transactions in your wage disbursement. This may include corrective payments for previous underpayments or overpayments or even severance or back pay.

7. Report findings

Document the findings, and analyze and visualize them before presenting the report to the management. Highlight identified issues and suggest remedial measures. The recommendations could include policy updates, employee training, or potential infrastructural changes.

Implement corrective measures along a timeline. Monitor the effectiveness of the measures and fine-tune them to strengthen payroll management.

Best practices for payroll management

As we discussed previously, a properly managed, efficient, and error-free payroll process adds immensely to a company’s reputation and employer brand while saving enormous costs that could have been incurred due to non-compliance.

So your company needs a robust payroll management process. You can facilitate that now by:

- Holding regular audits: Conduct payroll reviews annually or quarterly, in most cases before you run the payroll. The frequency of such assessments may depend on the size of your business, the industry you operate in, and legal requirements.

- Keeping a tab on timelines: Chalk out timelines for payroll management and make the dates visible to stakeholders. Use a system to notify payroll managers and employees about upcoming deadlines. These notifications must cover dates relating to wage releases, tax filings, withholding submissions, and bank holidays.

- Classifying workers correctly: Classify employees along various employment factors, such as roles, designations, and departments. You must also differentiate between part-time or contractors and full-time employees. This ensures accurate disbursal of payouts.

- Drafting a payroll policy: Develop a global payroll strategy in line with the world’s leading organizations. This will guide payroll administration on workflows and best practices. Organize a representative team to draft the policy including C-suite leaders; finance, HR, IT and security, legal teams; and employees

Your payroll policy must spell out

- Payment methods

- Pay cycles

- Deadlines

- Formats for record keeping and filings

- Definitions

- Data protection practices

- Responsibilities

- Legal compliances

- Grievance redressal mechanism

- Planning for contingencies: Have a plan in place to handle unexpected situations like lockdowns, power outages, bank strikes, and cyber attacks. Create alternative and secure routes to manage payroll unhindered in crises. Appoint contingency agents internally, create protocols, and clarify the roles of agents in handling unexpected scenarios.

- Linking payroll management to business goals: Manage payrolls in line with your business strategy and goals. Employee classification, wage rates, variable components, and pay schedules must reflect your business priorities and future growth plans.

You must regularly use payroll data to influence business decision-making. For this, ensure easy access to data with visuals, such as charts and graphs, and predict future trends. An automated payroll solution like Multiplier can prove helpful here.

- Protecting data and privacy: Ensure employee payroll data is safe, with limited access to authorized persons only. Follow data handling hygiene to avoid leakage and misuse of data. Adhere to data protection regimes, including local laws and the General Data Protection Regulation (GDPR). Win the trust of employees by reiterating the safety of their data.

- Using automation tools: Payroll software can let you automate calculations, deductions, and tax filings. This saves time and reduces the chances of errors that are rampant in manual processing.

You may integrate your payroll platform with attendance management, performance management, and core HR systems to reconcile data easily. Integrations can ensure the smooth flow of information across systems saving you time and costs.

Payroll software also creates audit trails to help you see who took a certain step, when, how, and at what time. This helps bolster transparency and accountability while ensuring legal compliance.

How payroll management software can help

For large modern organizations, managing the complexities of multi-jurisdictional payroll, inefficient processes, and compliance concerns represent the biggest pain points of releasing payroll. A payroll software can help resolve most of these concerns.

Improved accuracy and efficiency

Payroll software can automatically calculate salaries and tax deductions based on employee data, minimizing the risk of human errors. Every second organization that uses next-generation technologies indicates they use it for automating manual processes. This boosts their compliance and efficiency.

It also creates an audit trail to track actions taken and ensure accountability. Using a payroll tool, you can set up approval chains and limit access.

Integration with HR systems such as timesheets, performance data, and rosters ensures consistency across sources. The customizable nature of payroll software lets you modify its features based on your business priorities. Post an audit, you may easily implement corrective actions on the platform, while reducing the time for it to take effect.

Enhanced compliance

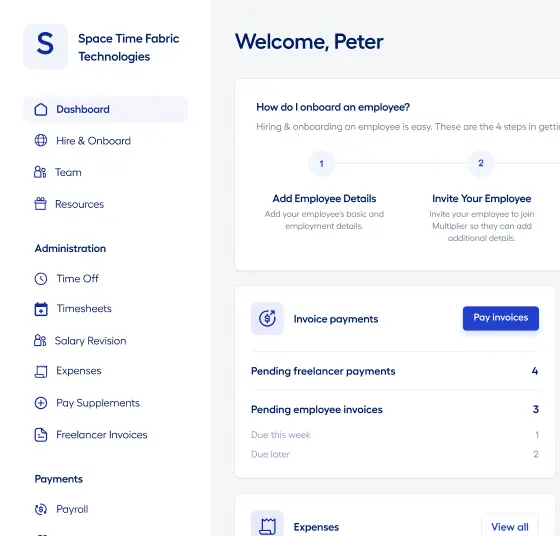

Modern payroll platforms like Multiplier feature updated tax slabs and deductions based on recent laws, removing the need to manually track changes to laws. Your payout calculations are done automatically, reducing litigation risks.

You may also use such platforms to generate forms and file taxes directly with authorities. They also notify you about upcoming submission or filing deadlines.

Some agile payroll platforms are sensitive to laws across regions and countries. And this can let you manage a workforce across regions and countries worry-free.

Better reporting

Payroll management software offers customizable infographics such as tables, charts, and graphs. You may use different combinations of variables to generate reports. The tools let you easily export data in bulk in your desired format.

Generate payroll summaries or tax reports, which facilitate easy review. With reduced paperwork, your auditors can work swiftly within the timeline.

Reliable software for payroll audits

Research suggests that organizations using six or more payroll providers are more than twice as likely to report payroll management difficulties. However, a unified payroll management solution like Multiplier can help you run global payrolls for different employee classifications from a single place.

- Automated record-keeping: Fetch employee payroll data in a few clicks at any time in any desired format. Integrations with HR systems ensure data from multiple sources are linked to payroll data for easy review.

- Audit trail: Trace steps taken to reach a decision, including people involved, timestamps, changes carried out, and approvals. This will help you identify weak links in your payroll management process for timely corrections.

- Compliance checks: Ensure legal compliance for your workforce in 150+ countries through Multiplier’s on-spot legal entities. You can review region-specific compliances on the platform, which means all-year adherence to local labor and tax laws.

- Customizable platform: Quickly redefine workflows, approval chains, and employee classifications on Multiplier post the audit. You can also implement employee cohort-specific corrective measures.

Slash risks and errors. Offload your payroll compliance tasks to Multiplier today.