An expatriate employee refers to executives assigned to work in a foreign country for a period of time. Also known as expat employees, the category of workers enables global companies to utilize human resources to efficiently support business activities abroad.

What operational difference do employers face if their employees work from their home country or a foreign land? Well, there lies the catch.

An expat employee working from abroad needs to be aligned with the taxes and regulations of that particular country and is not considered a regular home-country employee.

That is how expatriate payrolls come into play.

What is an expatriate payroll?

A foreign host country may have different labor laws than a home country. Due to the differences, an expat employee’s local taxes and social security amounts vary from the rest of the home country’s payroll. The employer must conform with regulations around expatriate employee’s taxes and benefits aligned as per the regulations.

Employers have different ways of handling the payroll processing of expat employees. It includes using:

- Host country payroll

- Split payroll

- Shadow payroll

While distributing salary via the host country payroll, the employer will follow the practices from the host country, such as tax, insurance, benefits, etc. When it comes to split payroll, just like the name suggests, a part of the salary will be sent through the home-country payroll and the other half via the host country payroll.

Moving to shadow payroll or expat payroll, the employee will be paid through the home-country payroll, and a shadow payroll will be established in the host country, from which taxes will be calculated and submitted to host country tax departments. It helps companies to comply with tax contributions in one territory while providing remuneration to employees through the payroll of the other country.

An expatriate or expat payroll is a mechanism by which employers manage the salaries, benefits, taxes, working hours, and other aspects of employees allotted to work from a foreign country. These are also known by the name shadow payroll.

In simple words, the employer has to report and pay the taxes in the host country (where the employee currently works), while technically, the person will be paid in another jurisdiction (the home country).

Advantages and disadvantages of expatriate payroll system

Like any other arrangement, expat payroll has its own ups and downs for employers and employees. Let’s have a quick glance at the top ones.

| Pros | Cons |

| Can have the trusted employees carry out the business on your behalf | Miss the chance to harness diverse exceptional talent around the world |

| Can maintain standardized operations beyond borders as the employees are familiar with the practices you follow | Chances of double taxation arise, in which you will have to pay taxes in both your home country and host country. |

| – | Cost of living might be high in the host country, making it difficult for employees to survive decently with the home-country income. |

| – | Even though working as an expat, the employee may need to pay taxes in their home country, which is a burden for them. |

| – | Complications with tax compliance – employers need to have extensive knowledge of the host country’s taxation, benefits, and social security regulations. |

| – | Threat of hefty fines for any violation of tax payment and other prevailing rules, which can also affect the brand reputation. |

| – | Have to deal with the complications of immigration laws |

Now you have seen the pros and cons of expatriate payroll; you would have already understood how the cons of expatriate payroll outweigh the benefits.

Factors that complicate expatriate payroll

Let us now move on to the most critical concerns that make expat payroll processing complex.

Payment of expatriate employees

The cost of living varies in different countries, and it is no secret these expat employees need to be paid way higher than their home-country salary to meet the expenses.

A few years back, the Guardian conducted a survey among local employees and expats, only to find out that the wage gap can be as high as 900%. Imagine how much an employer can save if a local employee was hired instead of sending one from the home country.

An expat employee’s salary may depend on various factors: housing rent, children’s schooling, education expenses, miscellaneous costs, benefits, and social security contributions. Paying a hefty amount as a salary can be a huge burden on employers.

Another instance is the form in which salary is paid. The payment currency has to be the host country’s accepted currency so that the employee does not have transaction trouble, which is again the employer’s responsibility.

Compliance with local labor laws

Taxes is a burning issue for every expat employer. The labor laws and taxation varies with countries, and so does the ease of compliance. Based on the labor laws of a host country, the cost of employing a person changes, which includes:

- Basic salary

- Health insurance

- Social security contributions

- Allowances (housing, transportation, etc.)

- Unemployment benefits

- Workers compensation fund and more.

As an employer, you will be responsible for providing the employment conditions the host country’s law requires you to abide by. In the case of having an expatriate payroll, there is a high chance you miss some contributions and get fined. It may affect your brand reputation and can attract undesirable legal situations.

Thinking about how to avoid these complications? Well, we have got some tips for you.

Tips for Global payroll for expatriate employers

With all the complications listed above, employers might feel confused about having expatriate employees, but there is a solution.

We can suggest some measures to manage your expatriate employees effectively and in a much simpler way.

- Audit payroll processes monthly to analyze liabilities

- Ensure exchange rates for payments are updated

- Monitor changes in the taxes and benefits in the host country

- Use global payroll providers to manage the expat employees smoothly

As an employer, try these tips to reduce the complexities of expatriate payrolls. As the business grows, expansion is unavoidable, and so are the possibilities of having expat employees, but the wise use of facilities can help you manage them efficiently.

Let Multiplier handle your expatriate employees

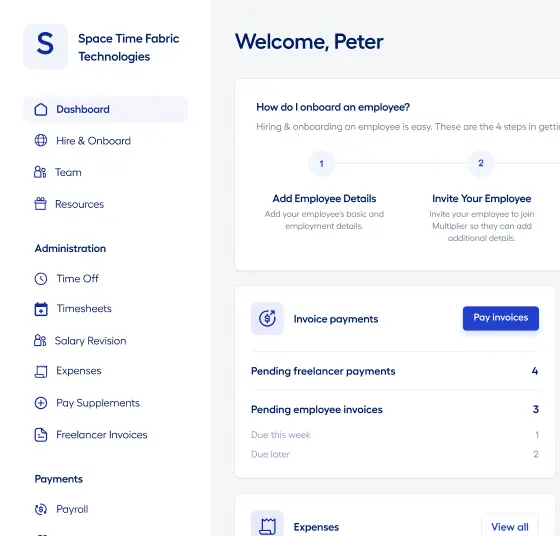

Do you still feel that managing expatriate employees is a mammoth task? We have a fix. Multiplier, a SaaS-based HR solutions platform, lets you securely manage your expatriate employees stress-free.

With Multiplier, you can:

- Easily pay your employees abroad in the desired local currency

- Compliantly onboard talents from the host country without any hidden charges

- Get regularly updated on tax liabilities and labor laws

- Affordably manage employees effectively

We value your time and business. Join hands with Multiplier, so you can focus on your business and not spend your precious time untangling the operational nuances.

Wish to know more? Click here for a quick demo.