Is an independent contractor a sole proprietor?

Is there any difference between a sole proprietorship and a a self-employed?

It is often confusing for employers to distinguish between sole proprietor vs. independent contractor.

Both are popular modes of business for those who love to work on their terms. Sole proprietors and independent contractors plan their schedules and work the way they want.

However, they are responsible for paying their taxes, keeping records of their documents, etc., which is quite challenging.

So, now you know that sole proprietorship and independent contractor are not all rainbows and butterflies.

This article will walk you through the most crucial aspect- sole proprietorship vs. independent contractor and sole proprietorship vs. self-employed.

At the end of the article, you’ll come to know of both these entities, their differences, and everything else.

So, let’s start!

Who is a Sole Proprietor?

When it comes to sole proprietor vs. independent contractor, the first thing you must know is the definition of a sole proprietor.

Sole proprietors are people involved in running a business without registering the business as a separate entity, such as a corporation, an LLC, or a partnership business.

Thus, a sole proprietor’s business is the same as their finances. Simply stated, sole proprietors, are personally liable for their business expenses and losses. Also, they get to keep the profits for themselves.

Who is an Independent Contractor?

An independent contractor is an individual who provides services to multiple businesses but not as an employee.

Typically, an independent contractor is a freelance service provider like a creative professional, graphic designer, website developer, or IT professional.

Considering how independent contractors work, you can also call them self-employed sole proprietors.

Sole proprietor vs. Independent Contractor

Both sole proprietors and independent contractors are self-employed. Neither of the two receives a set salary for their work. Plus, their business and personal finances are the same.

Though the mode of work for both might seem similar, there are differences between an independent contractor and a sole proprietor.

Here’s an example to help you differentiate between sole proprietor vs. independent contractor.

To give you a clear picture of the differences, we have listed a few aspects to understand the differences in 1099 vs. sole proprietorship.

1. Taxes & tax forms

For independent contractors, here’s what taxation looks like.

- At year-end, the clients of independent contractors who paid them $600 or more during the tax year need to fill out Form 1099-NEC. Independent contractors return these forms and submit them to the IRS by January 31st of the following year.

- Independent contractors should also submit self-employment taxes (Social Security and Medicare taxes) on Form 1040-ES.

- Also, clients of independent contractors in the US must request the IRS Form W-9. For independent contractors outside the States, requesting for Form W-8BEN or W-8BEN-E is necessary.

Taxation of sole proprietors looks more straightforward as the business and personal finances are the same. Here’s a list of the tax forms they need.

- Schedule SE with Form 1040 to calculate the amount owed as self-employment taxes

- Schedule C Form to report business profits and losses

- Form 1040 to file annual income tax returns.

2. 1099-MISC forms for income

Considering Form 1099, reporting of sole proprietors’ and independent contractors’ income differs.

An individual gets a 1099-MISC form if they have worked as an independent contractor. An independent contractor receives a 1099-MISC that outlines the income earned during the previous year.

On the other hand, sole proprietors must track their incomes and expenses. However, a sole proprietor might also receive a 1099 form from their client, depending on the service type.

3. Insurance

Whether an individual is an independent contractor or a sole proprietor, it is necessary to have business insurance.

What’s common in sole proprietor vs. independent contractor is that both need the following two insurances:

General Liability Insurance

General liability insurance helps to cover claims by clients and third parties against the independent contractor or the business arising from reputational damage, personal injury, physical injury, and property damage.

Professional Liability Insurance

Similarly, independent contractors need professional liability insurance to help them cover claims of negligence and error against the contractor that resulted in the client’s financial losses.

This insurance might not be beneficial for all sole proprietors. However, considering professional liability insurance is a must depending on the services rendered.

The difference in insurance between sole proprietors and independent contractor is that sole proprietors might have employees working for them. In this case, workers’ compensation insurance will be necessary.

This insurance will cover the medical bills, missed wages, and ongoing care expenses for workers if they suffer an injury or are sick due to work.

Can a Worker/Small Business Owner Play the Roles of a Sole Proprietor and an Independent Contractor?

Suppose an individual is a content writer obliged to write four articles per week for ABC company. Here, the individual is an independent contractor.

If an individual writes a novel on the side and decides to publish it, company ABC has nothing to do with it. All the profit belongs to the writer alone. This means the individual is a sole proprietor.

Now, this example is sure to spark a question – can a sole proprietor be an independent contractor?

And the answer to the question is yes.

It is pretty common for small business owners to function as sole proprietors and independent contractors. It all depends on the nature of the business relationship and the tax structure.

In the above example of a content writer/ book writer, you can see that the same individual can be an independent contractor and a sole proprietor. Here, the individual pays both income taxes and payroll taxes.

Why?

Because the income includes earnings from the book publishing plus earnings from writing blogs for the company ABC.

Let us take another example to understand further.

A software developer starts a sole proprietorship business. Hence, it does not require setting up a separate corporation. Also, it allows the filing of personal and business taxes on Form 1040.

If the individual outsources services to corporate clients, they might establish an independent contractor relationship with the developer. It would mean:

- An employer is not liable for withholding taxes for paying the developer’s payroll taxes

- The developer must pay both payroll taxes and Medicare and Social Security taxes

- Using Form 1099-MISC, the employer must report the developer’s business payments to the federal government.

However, if the developer decides on creating and selling an app, they would no longer be independent contractors. It is because they would not earn anything from any business. But each time someone downloads the app, they would have an income.

Here, the developer will not receive Form 1099-MISC. Instead, using Schedule C (Form 1040), reporting the app-related revenue would be necessary.

FAQS on Independent Contractors and Self-employed vs. Sole Proprietor

Q. Can I hire independent contractors as sole proprietors?

Such questions can create utter confusions when you plan to start planning your hiring process.

This FAQ section is here to address your concerns relating to independent contractors and the difference between self-employed and sole proprietorship.

Q. What is the difference between self-employed and sole proprietors?

Being self-employed is a common aspect between independent contractors and sole proprietors. In other words, both independent contractors and sole proprietors are self-employed individuals.

However, while sole proprietors and independent contractors are self-employed, all self-employed people might not be sole proprietors. For example, freelance designers are self-employed but not necessarily sole proprietors. They are mostly independent contractors.

Q. Can I be a self-employed sole proprietor?

Yes. Being a self-employed sole proprietor is possible because they do not have an employer or work in a company as an employee. As individuals run their own businesses, you can classify them as self-employed business owners.

Q. Is an independent contractor a sole proprietor?

An independent contractor may be a sole proprietor, depending on their type of work and compensation.

Most independent contractors work for more than one client at the same time. They offer their services on a freelance basis. A few other independent contractors provide contracting services in addition to their full-time or part-time work as employees.

If an individual is the sole owner and operator of a business, they are a sole proprietor. So, if independent contractors consider themselves the sole owner of a company, they might use the term sole proprietor.

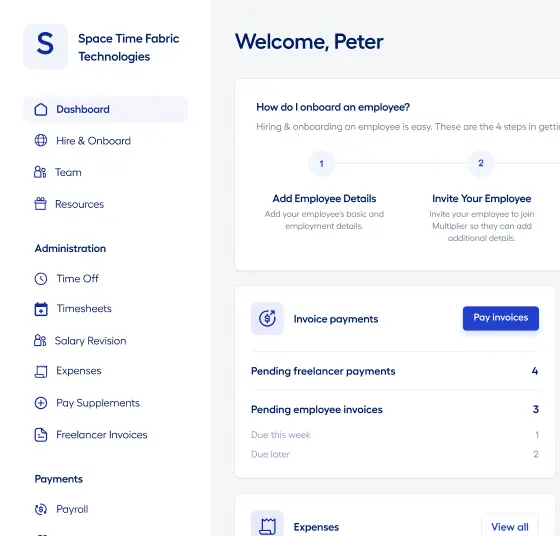

Clear your Doubts on Independent Contractor vs. Sole Proprietor with Multiplier

Do you know how to hire an independent contractor? Can you tell the difference between an independent contractor and a sole proprietor? These are essential things to know, and you must go to the depth.

The B2B SaaS onboarding platform that can help you here is – Multiplier.

Here’s how:

- It generates compliant independent contractor agreements

- It streamlines the payment of global contractors effortlessly

- It helps you figure out the necessary perks and benefits of an independent contractor

To know more, Book a demo now!