Your quick guide on talent and labor compliance norms in Seychelles

Capital

Victoria

Currency

Seychellois Rupee (SCR)

Languages

English, French, Seychellois

Payroll Frequency

Monthly

GDP per Capita

$17,117.03

Employer Tax

22%

Talent Overview

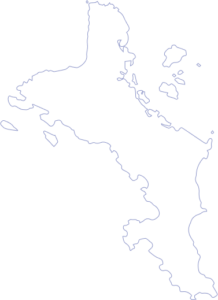

The Republic of Seychelles is an archipelago of 115 islands on the Indian Ocean. The country holds a freedom score of 61.1, thus ranking it the 79th freest country in 2022. Seychelles has moderately seen significant growth in the GDP per capita from 2021. The Republic of Seychelles ranks 5th out of 47 in the Sub-Saharan Region in economic development.

Major economic hubs:

Victoria, Anse Boileau, Beau Vallon, Takamaka

Skills in demand:

IT Professionals, Software engineers, and General managers

Local Universities

The top local universities in Seychelles are as follows:

Local: 1

World : 9524

Salary Data

The average monthly salary of some jobs available in Seychelles are as follows:

| Job Title | Average Monthly Salary (SCR) | Average Monthly Salary (USD) |

| Financial Manager | 37,300 SCR | 2917.43 USD |

| General Manager | 33,500 SCR | 2620.21 USD |

| Business Development Manager | 28,100 SCR | 2197.85 USD |

| Financial Analyst | 23,100 SCR | 1806.77 USD |

| Business Analyst | 22,400 SCR | 1752.02 USD |

| Project Manager | 20,900 SCR | 1634.70 USD |

Talent Sourcing Tips

Jobo, Jobisland, MillionMakers

36,930

RisingMoon

While onboarding any individual from Seychelles, it is essential to know about the Labor laws, employment terms, deductions, and benefits. This section contains all the necessary information that employers can use.

Employee Contracts in Seychelles have to be in any official language i,e, English, French, or Seychellois. Also, it can be in any other language that the employer and employee can understand.

The probation period is up to six months for newly hired employees.

| Date | Name | Type |

| 1 Jan | New Year | Public Holiday |

| 2 Jan | New Year holiday | Public Holiday |

| 3 Jan | Day off for New Year | Public Holiday |

| 7 Apr | Good Friday | Public Holiday |

| 8 Apr | Holy Saturday | Public Holiday |

| 10 Apr | Easter Monday | Public Holiday |

| 1 May | Labour Day | Public Holiday |

| 8 Jun | Corpus Christi | Public Holiday |

| 18 Jun | Constitution Day | Public Holiday |

| 19 Jun | Day off for Constitution Day | Public Holiday |

| 29 Jun | National Day | Public Holiday |

| 15 Aug | Assumption of Mary | Public Holiday |

| 1 Nov | All Saints’ Day | Public Holiday |

| 8 Dec | Immaculate Conception | Public Holiday |

| 25 Dec | Christmas Day | Public Holiday |

| Type of Leave | Time Period | Mandatory |

| Annual/Earned Leave | 21 days | Yes |

| Sick Leave | 21 days | Yes |

| Maternity Leave | 112 days | Yes |

Payroll

Payroll Cycle

The payroll cycle in Seychelles is Monthly.

Minimum Wage

The minimum wage in Seychelles is 44.10 SCR per hour for casual employees and 38.27 SCR for all other employees.

Overtime Pay

Overtime pay above 60 hours is 150% of the basic wage; however, work done on holidays or rest days will increase to 300%.

Bonus

The 13th-month pay is compulsory in Seychelles.

Taxes

| Fund | Contribution |

| Social Security Contribution | 20% |

| Pension Fund | 2% |

| Fund | Contribution |

| Social Security Contribution | 2.5% |

| Pension Fund | 2% |

For Seychelles residents

| Annual Taxable Income | Tax Rate |

| From 0 to 8,555.50 SCR | 0% |

| From 8,555.51 to 10,000 SCR | 15% |

| From 10,001 to 83,000 SCR | 20% |

| Above 83,001 SCR | 30% |

The standard rate of VAT in Seychelles is 15%.

Offboarding & Termination

Both employer and employee can terminate the employment letter. If the employee had a fixed contract from the employer, the individual must provide a notice period. However, the employer can terminate the employment contract for reasons of redundancy.

The notice period in Seychelles is 14 days.

The severance pay in Seychelles is mostly the compensation for the notice period provided.

Visa and Immigration

To work in Seychelles, an individual must have a Gainful Occupation Permit (GOP), which allows working within the country. Either the employer or the employee can apply for the GOP. However, for any individual, an approval certificate from the Ministry of Employment, Immigration and Civil Status (MEICS) is required initially.