Employer of Record

Build your global team with our EOR services

Use Multiplier’s Employer of Record (EOR) software services to hire globally, without setting up a legal entity

Tap into the global talent pool and hire in 150+ countries

Run payroll for your global team across locations and currencies

Manage all your people processes in one place

Ready to onboard a new

employee? Here’s how our EOR works.

Step 1

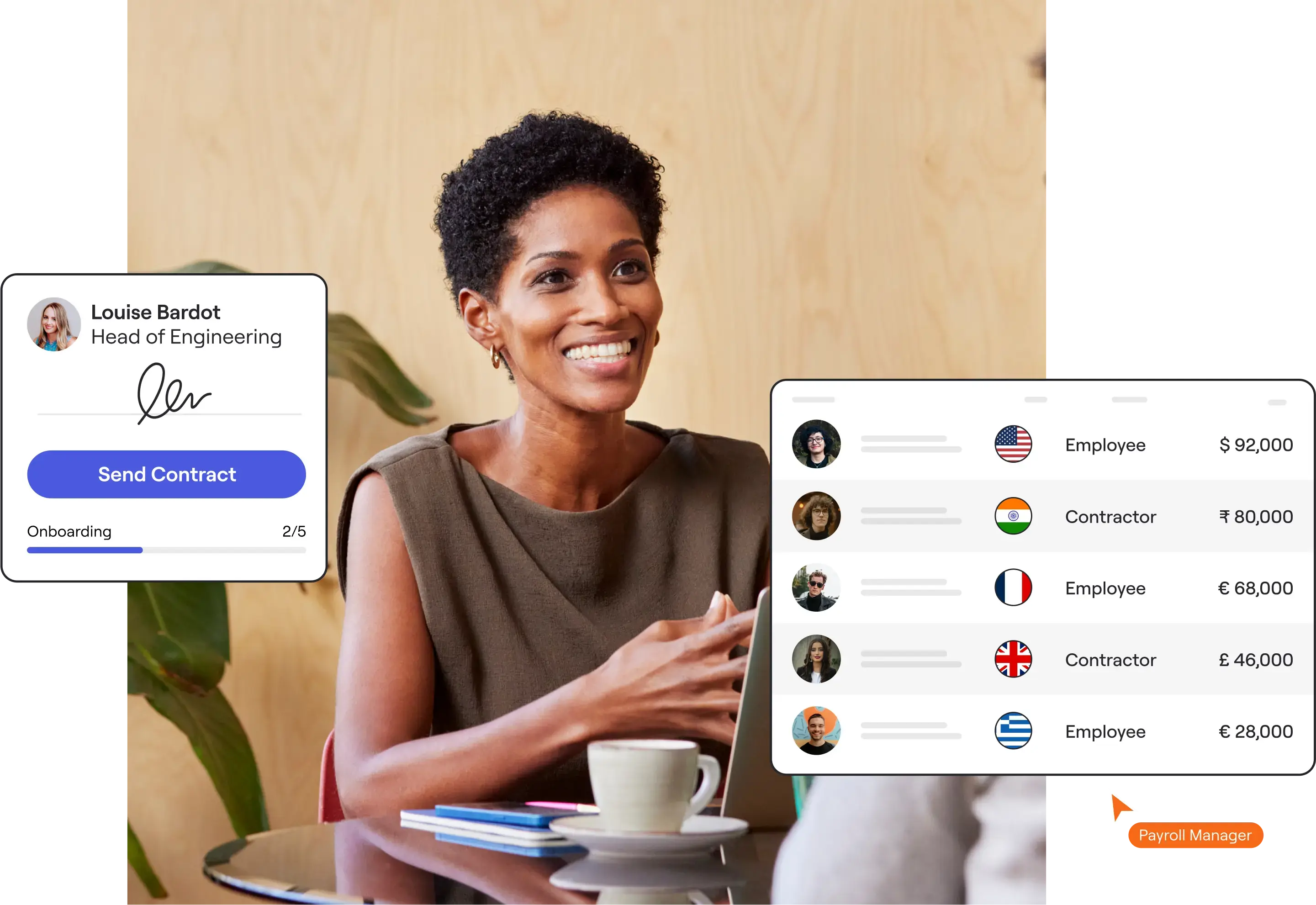

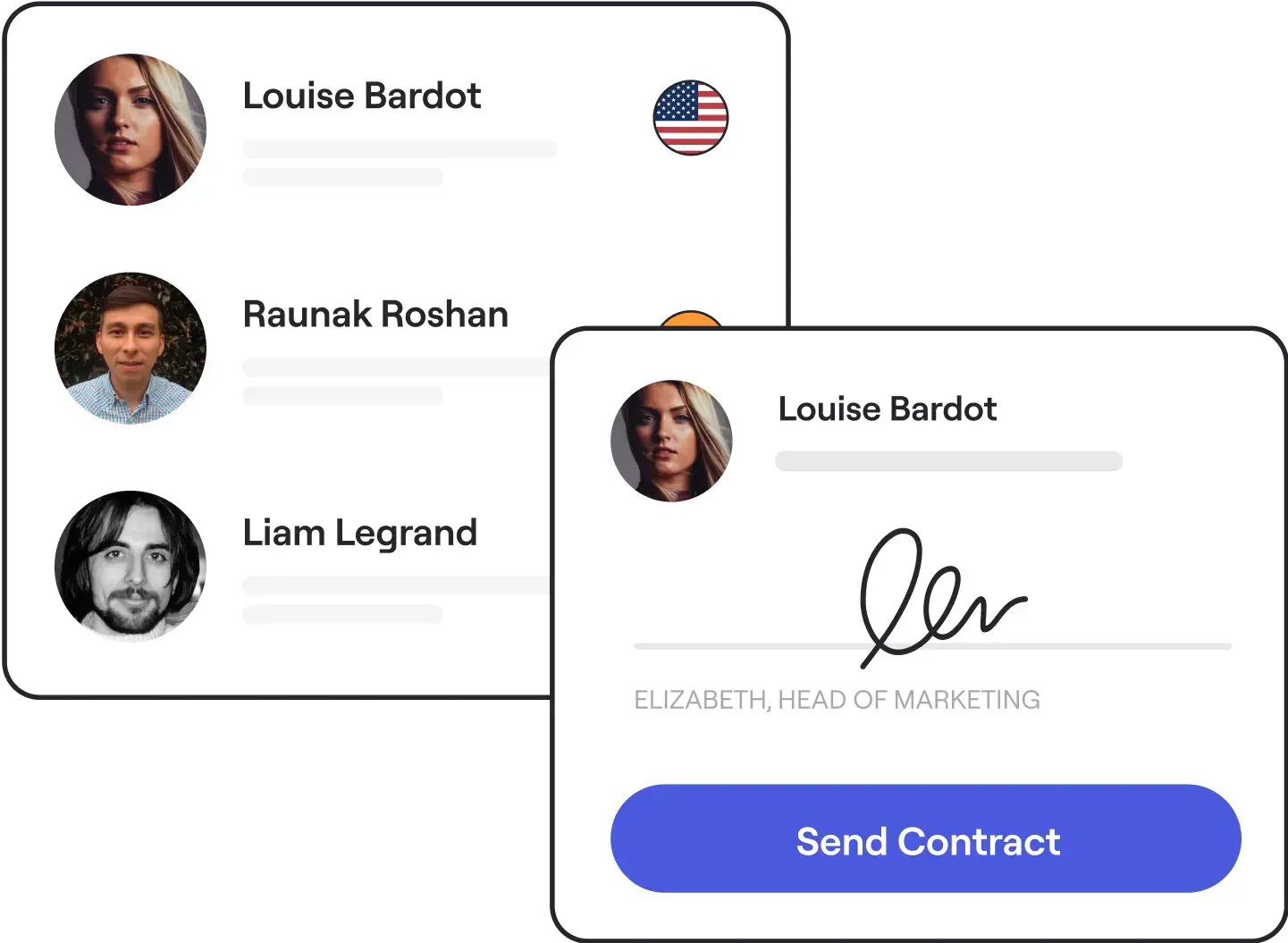

Generate compliant contracts in minutes

Instantly create contracts that are compliant with local laws and customized to fit your business. We’ll even send them out for signing.

Step 2

Streamline onboarding

Easily collect documents in accordance with country-specific norms so your new starter is up and running in no time.

Step 3

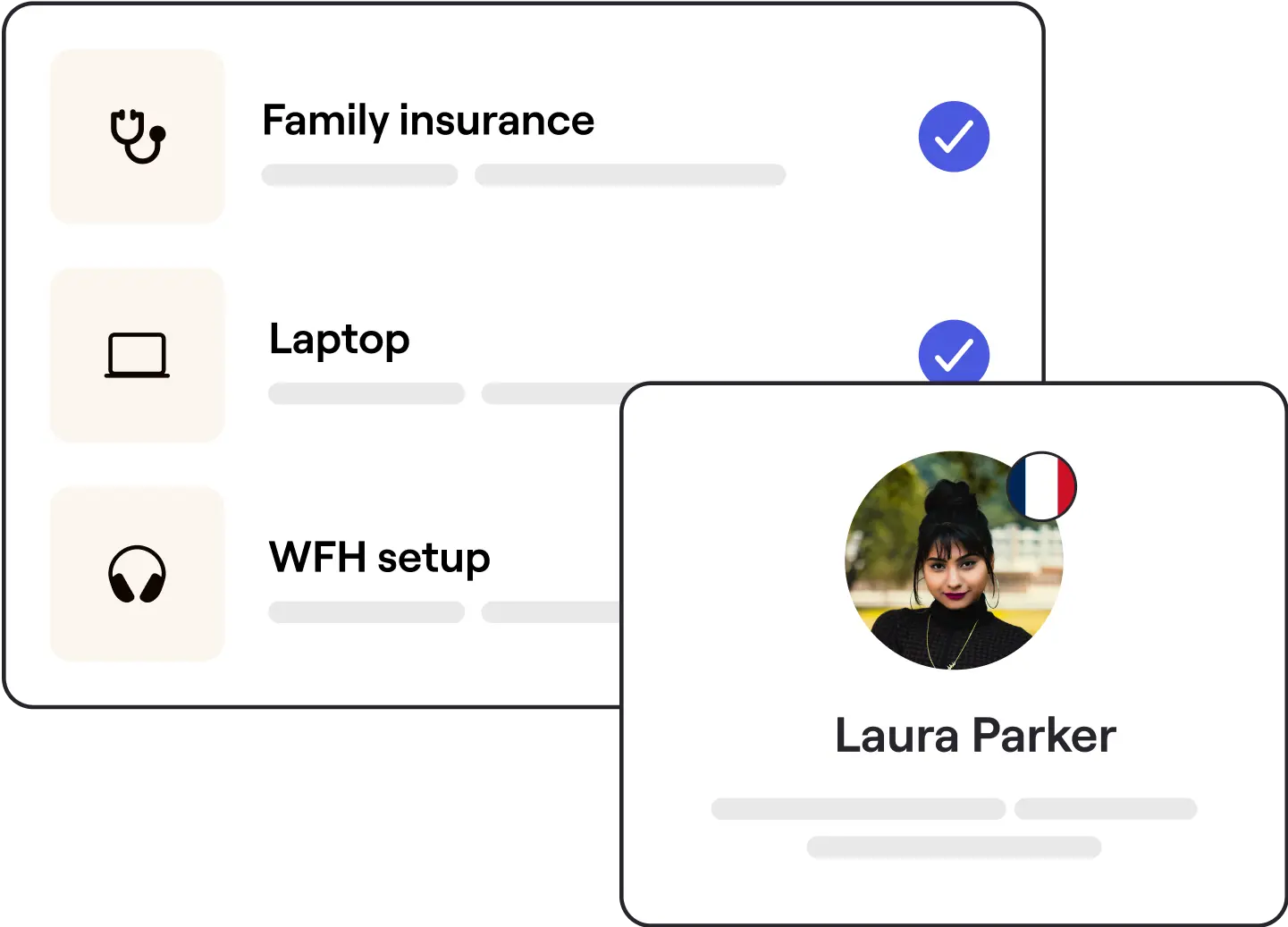

Provide localized, comprehensive benefits

Choose the benefits plan that is right for you with robust coverage options in 150+ countries.

Step 4

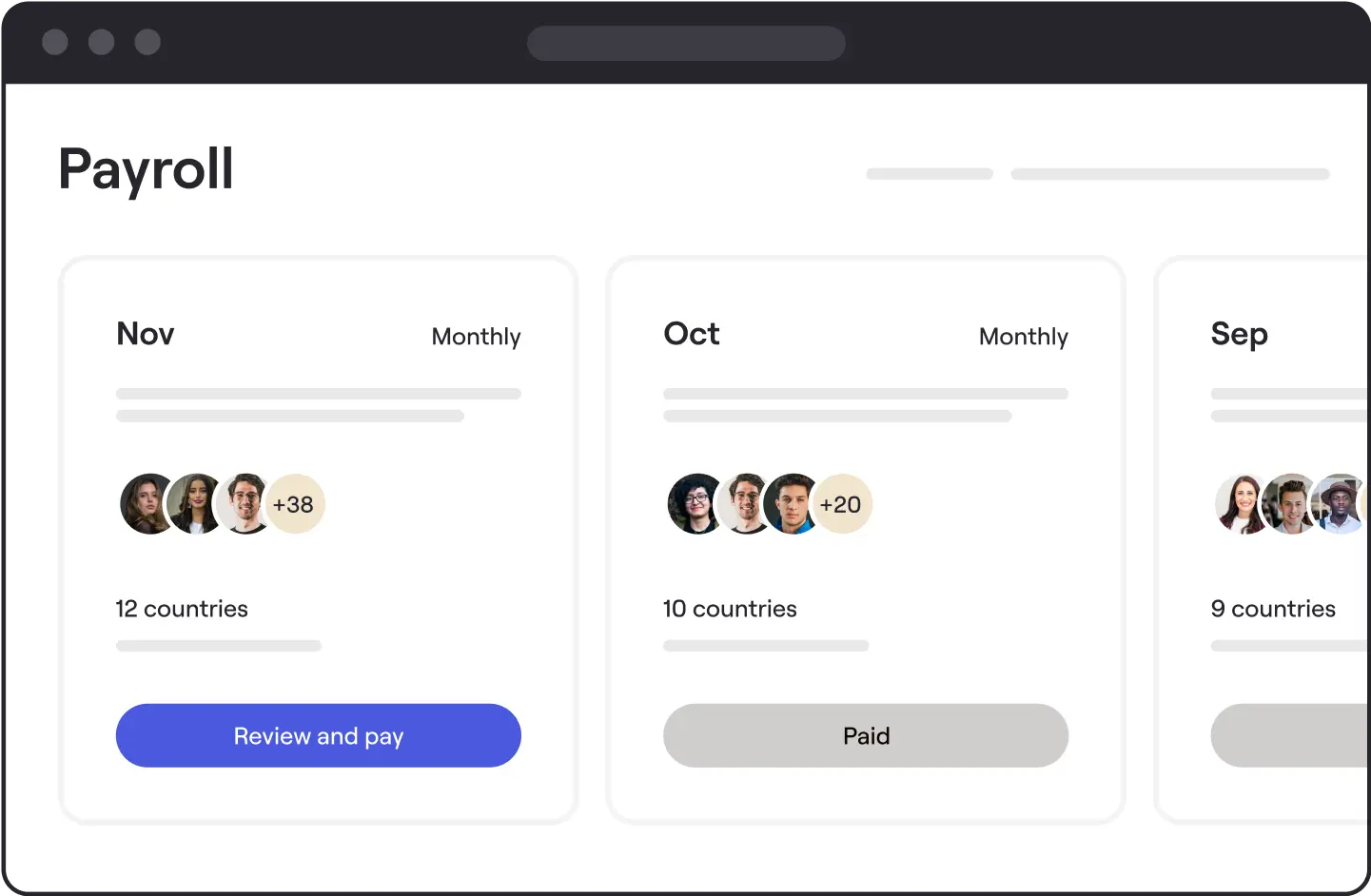

Pay your global team in local currencies

Run payroll easily and accurately on one platform, with real-time visibility and robust reporting.

Step 5

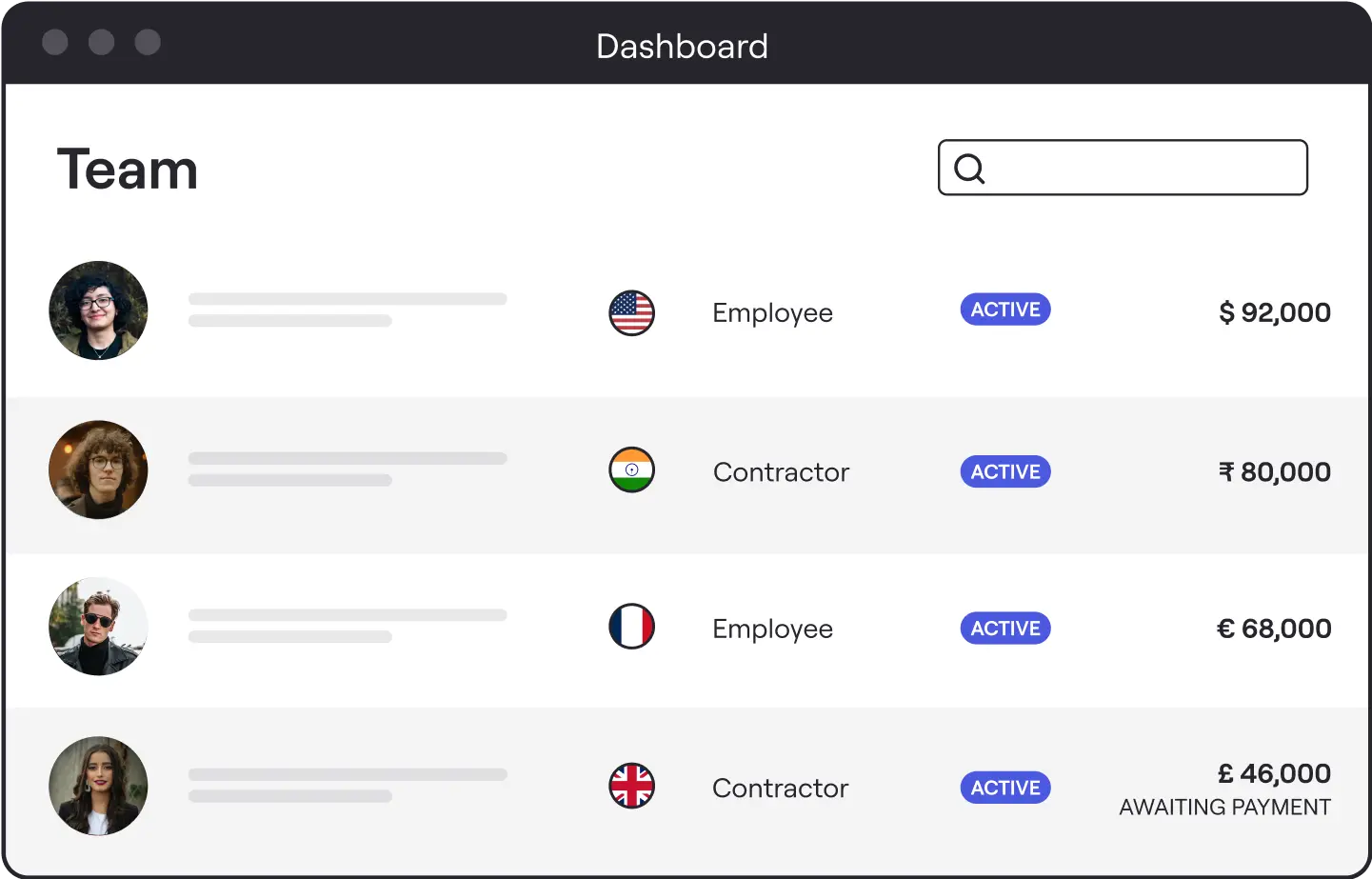

Deliver a unified HR experience

Track and manage employees in one place. Approve time off, expenses, and claims across multiple countries.

Let’s work together

-

Compliant by design

No matter where your team is based, we keep you compliant across country-specific laws and regulations.

-

Dedicated 24/5 human-first support

We’re here to help with dedicated support for you and your employees around the clock.

-

Safe and protected

We’re 100% GDPR compliant, SOC 2 Type 1,2 certified and host our data on AWS.

-

Local expertise

Our team of local HR and payroll experts help you navigate the compliance landscape.

What is an Employer of Record (EOR)?

An Employer of Record (EOR) is a company that acts as the legal employer for your workforce so you can hire and onboard employees without setting up a local entity.

This can help you enter new markets with reduced compliance risks, mitigating the compliance risk associated with adhering to various local laws, employment contracts, and managing global payroll efficiently. EORs also handle time-consuming HR tasks for you so you can free up your time to focus on growing your business.

In this article, we explore what you need to know about EOR services including how they work, when you should use one, and how to choose the right solution for your needs.

How does an EOR work?

EORs like Multiplier handle all the legal, administrative, and compliance responsibilities on behalf of your company while you retain control over business operations and your employees’ day-to-day. By managing these responsibilities, including tax compliance, EORs help mitigate compliance risk, ensuring that your company adheres to local regulations and avoids potential legal issues. This simplifies the complexities related to international employment, making it easier for companies to expand their workforce in foreign countries. This includes managing international employees and ensuring compliance with local labor laws.

Here’s a breakdown of the tasks an EOR will handle:

Payroll management: Calculation and distribution of salaries, including tax withholdings and social security contributions.

Benefits administration: Management of employee benefits such as health insurance, retirement plans, and paid time off.

Compliance: Adherence to local employment laws, including tax regulations, labor standards, and workplace safety requirements.

Contract management: Creation of employment contracts and any legal documentation required.

Employee onboarding and offboarding: Management of the hiring process, including onboarding new employees and handling offboarding procedures when employees leave.

Here’s a step-by-step process of how a global EOR typically operates:

Step Description Agreement The company and the EOR establish a contract outlining the services provided, the jurisdictions where the EOR will operate, and the duration of the engagement. Onboarding The company identifies the employees they want to hire, and the EOR facilitates the onboarding process, collecting necessary information and putting together documentation. Payroll and benefits The EOR handles payroll processing, tax calculations and withholding, and localised employee benefit administration. Legal compliance The EOR stays up to date on local labor laws and ensures the company complies with employment contracts, tax regulations, and other legal requirements in each location.

When should you use an Employer of Record?

An EOR helps you enter new markets more quickly without setting up a local office. This is particularly useful for international hiring, allowing you to legally employ workers in different countries without establishing a local legal entity. This reduces the compliance risk involved with hiring employees abroad, ensuring that all employees are classified correctly and that you are paying the correct tax and adhering to employment contracts.

EOR services also handle time-consuming tasks such as payroll and benefits administration. This frees up your team to focus on core business functions and can improve employee experience. For example, you can provide benefits that are localised and tailored to your team’s needs.

An EOR is ideal for temporary or project-based work where establishing a local presence isn’t feasible. However, it can also support you as you scale by providing a flexible, cost-effective solution for managing administrative HR tasks.

What’s the difference between EOR, PEO, and GEO?

The terms EOR, PEO, and GEO all deal with employment services but in slightly different ways. Here’s a breakdown of the key differences:

Unlike a staffing agency, which typically handles temporary workforce needs, an EOR provides a more permanent and compliant employment solution.

Employer of Record (EOR) acts as the legal employer for your workforce. It handles all administrative and legal aspects of employment on your behalf, including payroll, taxes, benefits, and compliance with local labor laws. An EOR helps mitigate compliance risk by ensuring adherence to local labor laws and regulations.

Professional Employer Organization (PEO) is a co-employment arrangement with a company where you share employer responsibilities in a country where you already have an entity. PEOs handle payroll, benefits administration, tax filing, and some regulatory compliance.

Global Employment Organization (GEO) acts as an EOR with a focus on international expansion, but may also offer HR support and recruitment assistance.

Which countries are EORs present in for global hiring?

Employer of Record (EOR) service providers offer their services in a wide array of countries around the globe, catering to diverse regional needs.

For example, Multiplier extends its EOR services to over 150 countries, offering extensive global coverage and allowing businesses to manage their international workforce efficiently without needing to establish local entities. This allows businesses to efficiently manage their global workforce without the need for establishing local entities.

How should you choose the right Employer of Record for your organization?

Choosing the right Employer of Record (EOR) is crucial for a smooth international expansion. Here’s what you should look out for:

Legal compliance: The right EOR will have an in-depth knowledge of local labor laws, tax regulations, worker protections, and local benefits. This helps mitigate compliance risk, ensuring that your business adheres to all local regulations and avoids potential legal issues.

Customer service: Assess the level of support offered. Multiplier, for example, provides 24/7 human-first support (no bots!) and dedicated managers for every account.

Transparent pricing: Some EOR solutions have low entry costs but come with hidden fees. Be sure to get to the bottom of your EOR’s associated costs before making a decision.

Total cost of ownership: The lowest service price may not always mean lower costs. When it comes to choosing an EOR, make sure you invest in a product that prioritizes quality alongside affordability.

Multiplier seamlessly manages compliance, payroll, benefits, tax, and more to support your global expansion. To find out more, book a demo.

Show less

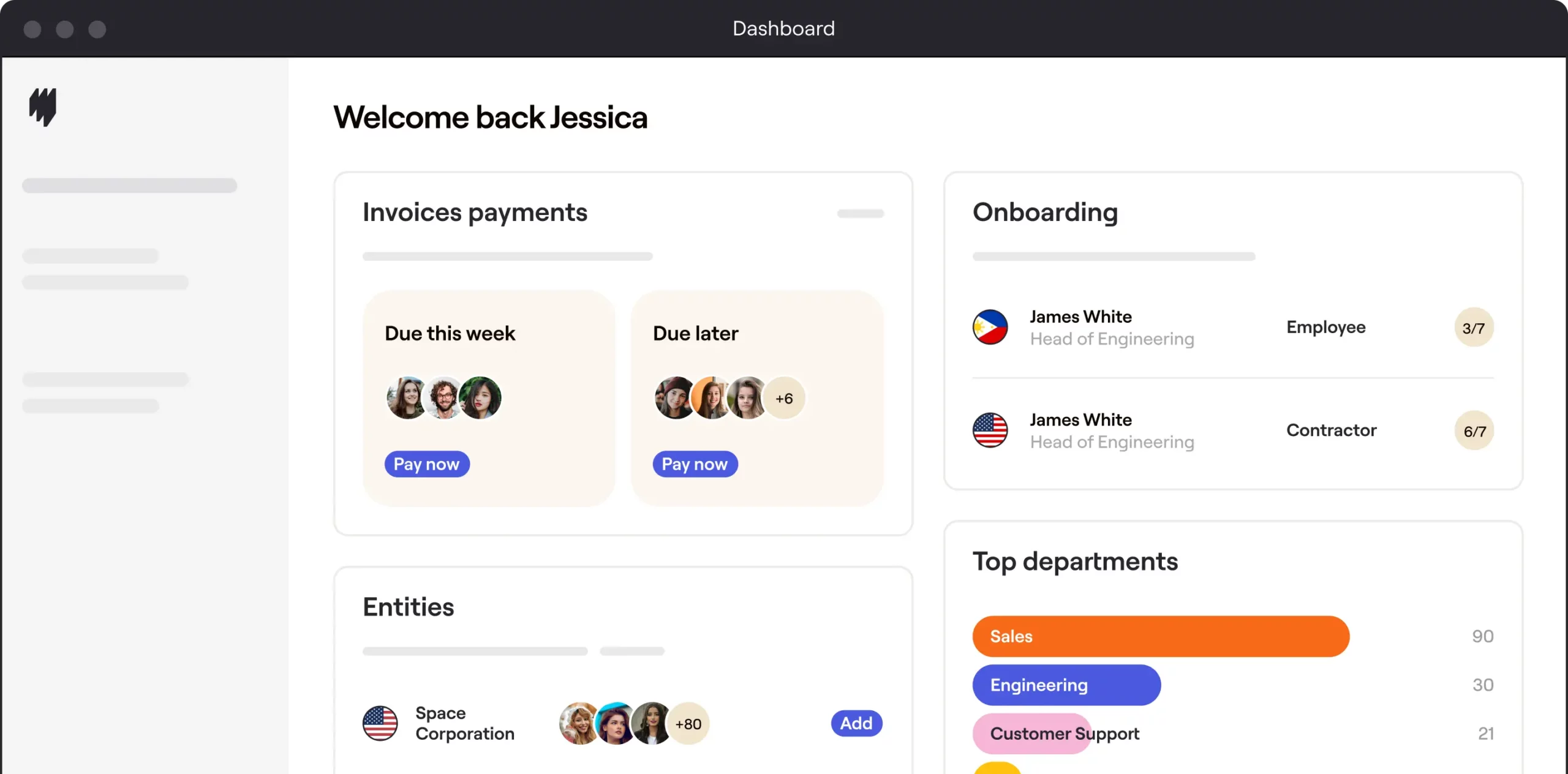

Meet your all-in-one Global Human Platform

Compliance

With Multiplier, stay compliant in 150+ countries

Onboarding

Streamlined and self-serve onboarding for all your employees

Contract generation

Generate locally compliant contracts in under 5 minutes

IT assets

Let us handle your IT asset requirements for your distributed team

Benefits

Offer localized, comprehensive benefits at competitive prices

Payroll and Payslips

Get complete visibility with Employer of Record payroll process

Integrations

Integrate other HR/Accounting workflows seamlessly into Multiplier

HR management

Manage expenses, time offs, and approvals in one place

24/5 support

Get a dedicated CSM and 24/5 support via email and chat

800%

saved in Payroll costs

2

Countries across the globe

5

Countries across the globe

50+

Employees onboarded

18

Onboarded employees

$1M+

Annual savings

The main benefits include ensuring compliance with local labor laws, cost savings, efficiency in payroll and benefits administration, risk mitigation, and faster hiring processes.

EORs employ local legal experts to ensure employment contracts, payroll, and benefits comply with local regulations, minimizing compliance risks.

Yes, an EOR ensures that all local labor laws and regulations are followed during employee terminations, including notice periods and severance pay.

EORs administer benefits such as health insurance and retirement plans, ensuring compliance with local standards and regulations.

EORs handle compliance, payroll, and benefits for remote workers, enabling companies to hire globally without local entities.

While costs vary, using an EOR is often more cost-effective than setting up local entities, reducing administrative overhead and compliance risks.

EORs monitor local labor laws and adjust employment practices to remain compliant, providing regular updates to clients.

EORs ensure compliance with data protection regulations through robust security measures and encryption, including using secure cloud services like AWS.

Scale your business. Access a world without limits.

150+

Countries to access and employ from

100+

In-house legal and tax experts

24x5

Dedicated Customer support